Bond market projections currently tend to fall along two general lines of thinking, neither of which paints a rosy picture for returns on fixedincome investments.

The first view holds that a bear market in bonds is unfolding, which could hand fixed-income investors a string of losses in the years ahead. The second view holds that we’re in an era of historically low bond yields and potentially skimpy future returns – and that won’t change even as the Federal Reserve ends its pandemic policy. With half of the Baby Boomer generation estimated to be retiring in the years ahead, a heavy reliance on bonds for retirement income may start them off on the wrong foot.

We think it’s better for financial planning if advisors prepare for years of low bond yields – a phenomenon that’s already visible in the U.S. Consider that the first time the yield on the 10-year Treasury note fell below 1.7% was over a decade ago, in the autumn of 2011. Since then, its yield has moved between 0.5% and 3.3%.

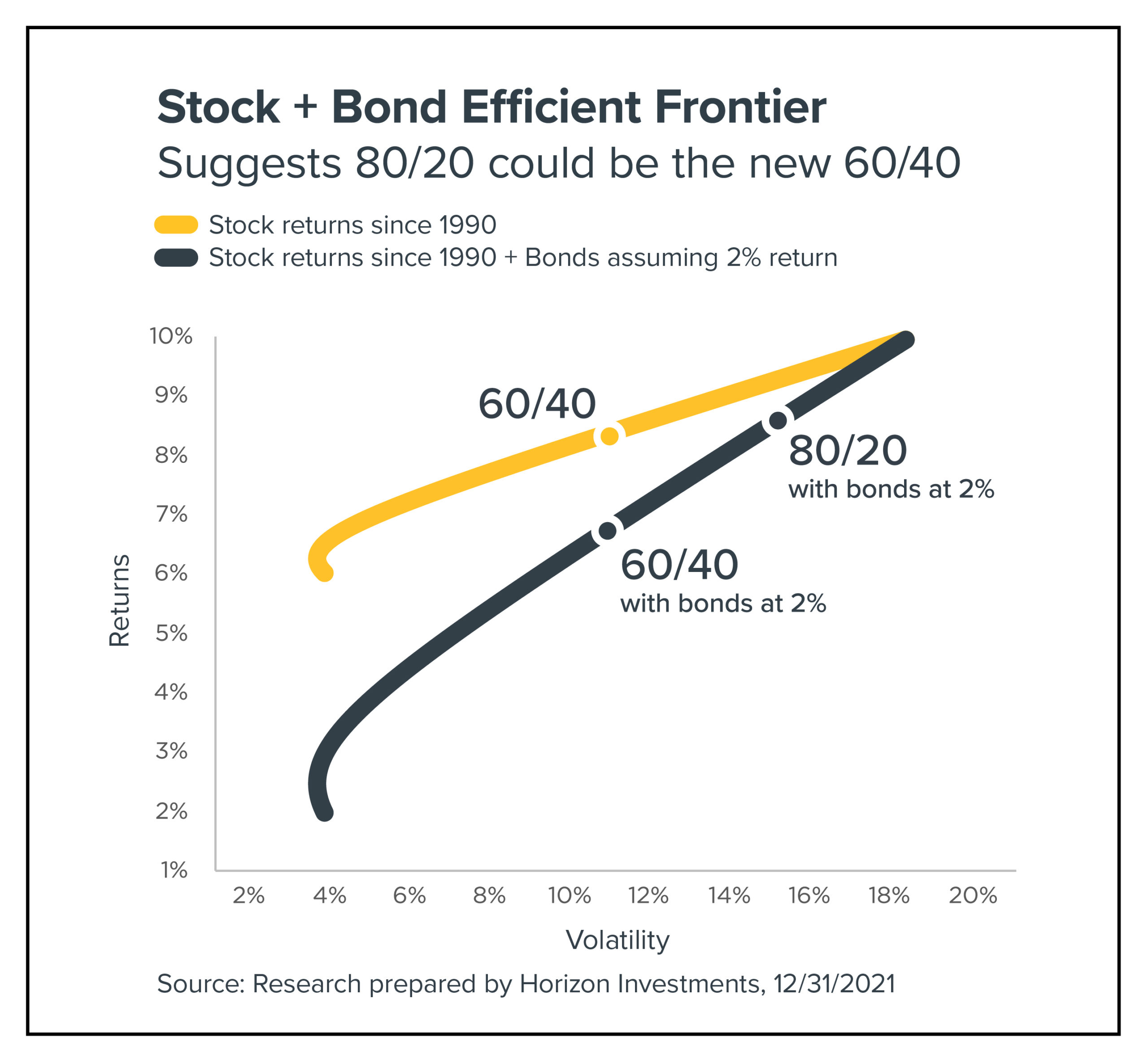

Horizon believes there is a case for a new investment framework. As shown in figure 1 to the right, the Stock + Bond Efficient Frontier suggests the current low interest-rate environment means the 60/40 portfolio might not have the same return expectations that investors have witnessed historically.[1]

Many advisors face a decision: 1) swap out bonds for risk mitigated and/or defensive equities and transition to an 80/20 portfolio to maintain the same return expectations, or 2) decrease return expectations and adjust a client’s financial plan accordingly.

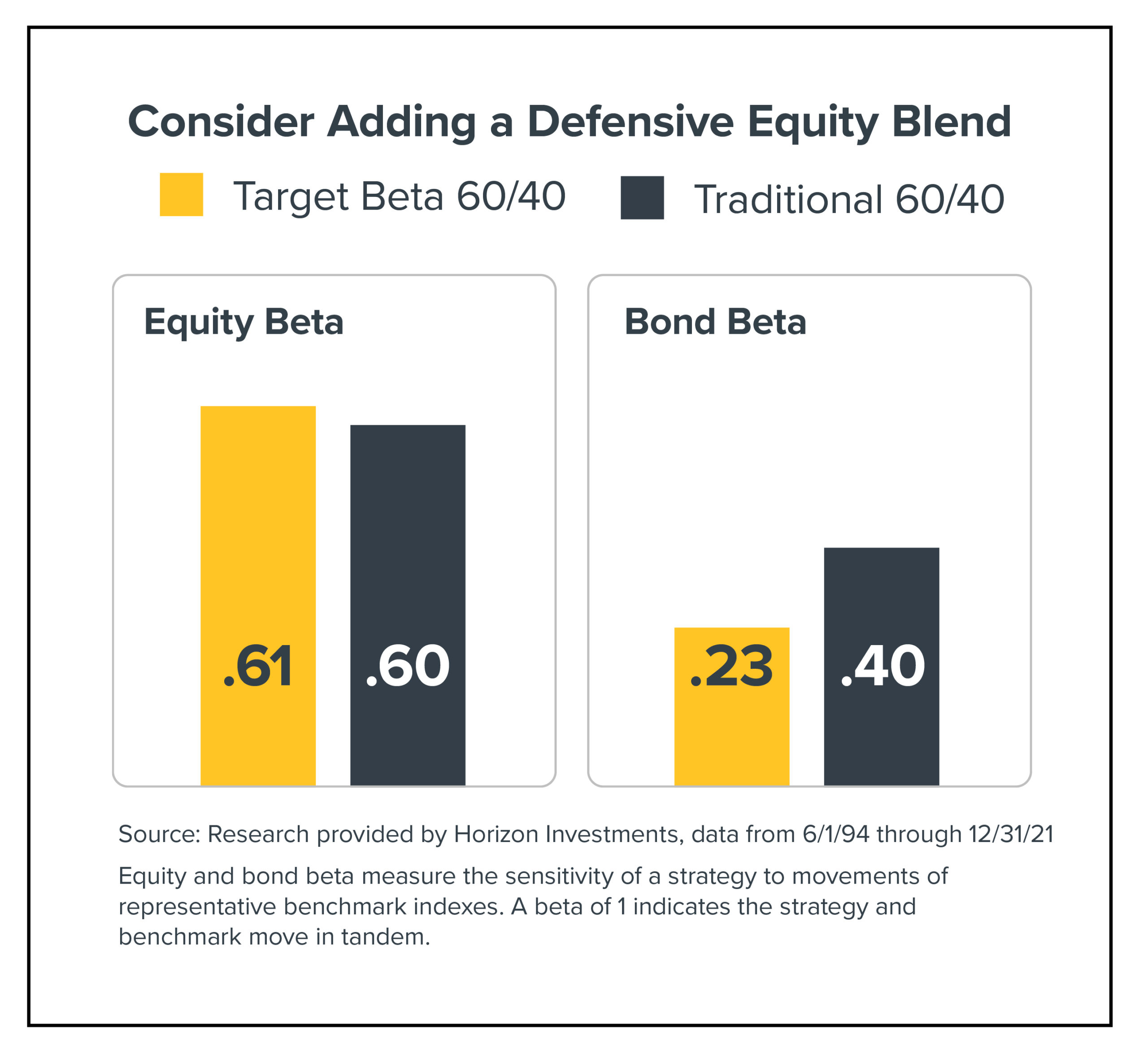

The aim of using equities with defensive qualities is to keep the equity beta stable versus a traditional 60/40 portfolio, while reducing sensitivity to the bond market, as shown in figure 2.[2] We realize that swapping other securities for bonds is not a straightforward task. Bonds have valuable diversification and portfolio volatility benefits. And we think those benefits should be front of mind when an advisor considers replacing bonds in a portfolio.

How can advisors implement these insights into practice?

Consider three potential solutions:

- Use a defensive equity blend, such as exposure to stocks that rank high on the low volatility factor, defensive equities, tactical equities, or hedged equities as a partial replacement for fixed income.

- Employ a total return solution with systematic distributions, a layer of risk mitigation techniques, and an increase in the equity tilt in the portfolio.

- If adding equities is not possible, consider adding tactical, non-core fixed-income exposures, such as senior loans and preferred stock, to existing bond portfolios, with the aim of boosting returns.

We believe advisors can benefit from learning about the effects of low rates on the traditional 60/40 portfolio, and may consider whether they should look at increasing equity market exposure in order to reach a client’s long-term goals.

[1] The yellow line shows historical returns since 1990 for the S&P Total. Return (Index), while the navy line assumes a 2% return for the Bloomberg Barclays Aggregate Bond Index (bonds) and the same historical returns for stocks.

[2] Target Beta 60/40 portfolio consists of 20% equity (S&P 500 Total Return index), 20% fixed income (Bloomberg U.S. Aggregate Bond Index) , and 60% of a defensive equity blend consisting of low volatility (S&P Low Volatility Total Return Index), equity factors (an equally weighted combination of the S&P Value, S&P Quality, S&P Low Volatility, and S&P Momentum Total Return Indices), tactical equity (Horizon Risk Assist Index), and an equity option collar (60% CBOE S&P 500 BuyWrite Monthly Index and 40% CBOE S&P 500 5% Put Protection Index ); traditional 60/40 consists of S&P 500 Index and Bloomberg U.S. Aggregate Bond Index.

Disclosure:

This information is for educational use only and should not be considered a recommendation to buy or sell any product. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. Opinions expressed are as of the date of publication. We do not intend and will not endeavor to provide notice if and when our opinions or actions change. Forward looking statements cannot be guaranteed. The investment strategy or strategies discussed may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives and financial circumstances.

Past performance does not guarantee future results. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. Individuals cannot invest directly in any index. More information about the calculations provided by Horizon is available upon request. The figures included are for illustrative purposes only and should not be considered a guarantee of success or a certain level of performance.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC.

© 2022 Horizon Investments, LLC.