Middle East conflicts shouldn’t derail the strong domestic growth story.

Rising Middle East tensions caused oil prices to briefly spike last week before reversing course on signs that further conflicts between Israel and Iran would likely be muted. Still, it was a stark reminder of how disruptions and turmoil in the area can quickly boost energy prices and spark fears of lower economic growth.

In that environment, it’s worth remembering an important fact: The U.S. today is more energy-independent than it’s been in 30-plus years.

According to the U.S. Energy Information Administration, the United States has been a net total energy exporter since 2019, with higher exports than imports.

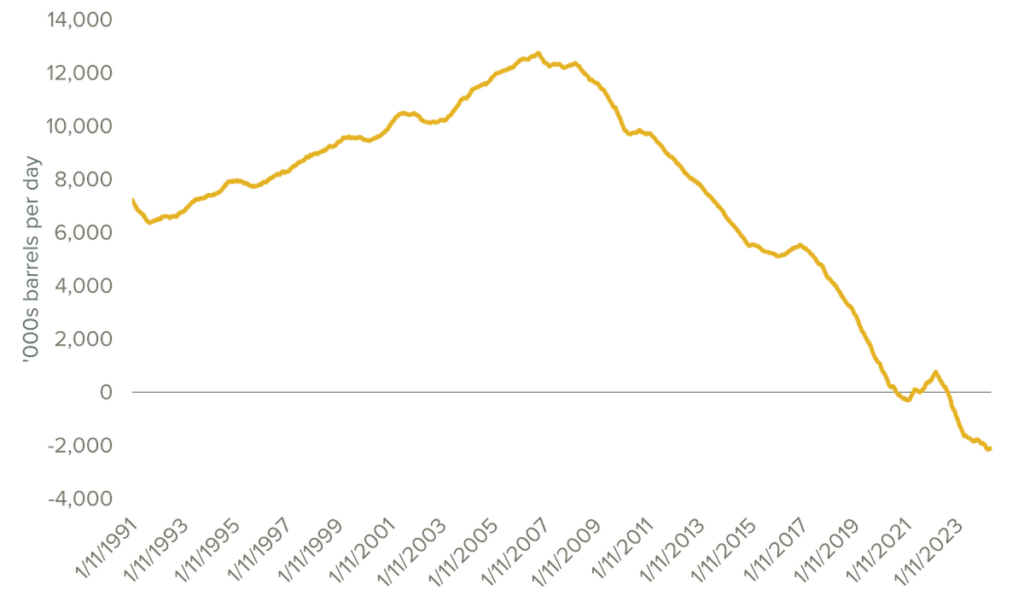

- Our net imports of crude oil and other refined energy products are negative, at -2.1 million barrels per day (see the chart below).

- The U.S. currently accounts for approximately 16% of total global crude oil production—nearly double what it was just 15 years ago.

In short, we’re producing more energy domestically and importing less—reducing our overall dependence on the Middle East.

U.S. Department of Energy Crude Oil and Refined Products | Net Imports: 52-Week Moving Average

Source: U.S. Energy Information Administration, calculations by Horizon Investments, as of 04/22/2024

The upshot: While a larger escalation in the Middle East than what we’ve seen so far could certainly mean higher energy prices in the short term, we believe U.S. economic growth would be relatively unphased in the longer term due to our moving towards becoming an energy-independent nation.

This commentary is written by Horizon Investments’ asset management team. Past performance is not indicative of future results. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves the risk of loss.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. The opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed. Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2024 Horizon Investments, LLC.