A growing number of stocks are having their moment in the sun

Everybody loves a good comeback story: Seabiscuit. The Mighty Ducks. 493 stocks in the S&P 500 index.

The majority of the S&P 500’s recent returns were driven by the so-called Magnificent 7—the small group of mega-cap tech stocks such as Nvidia and Apple. Meanwhile, many of the remaining 493 stocks in the index have struggled to gain meaningful ground.

But the tide has begun to turn in recent weeks, with a growing number of stocks and market sectors overtaking that select group of leaders (at least in the short term).

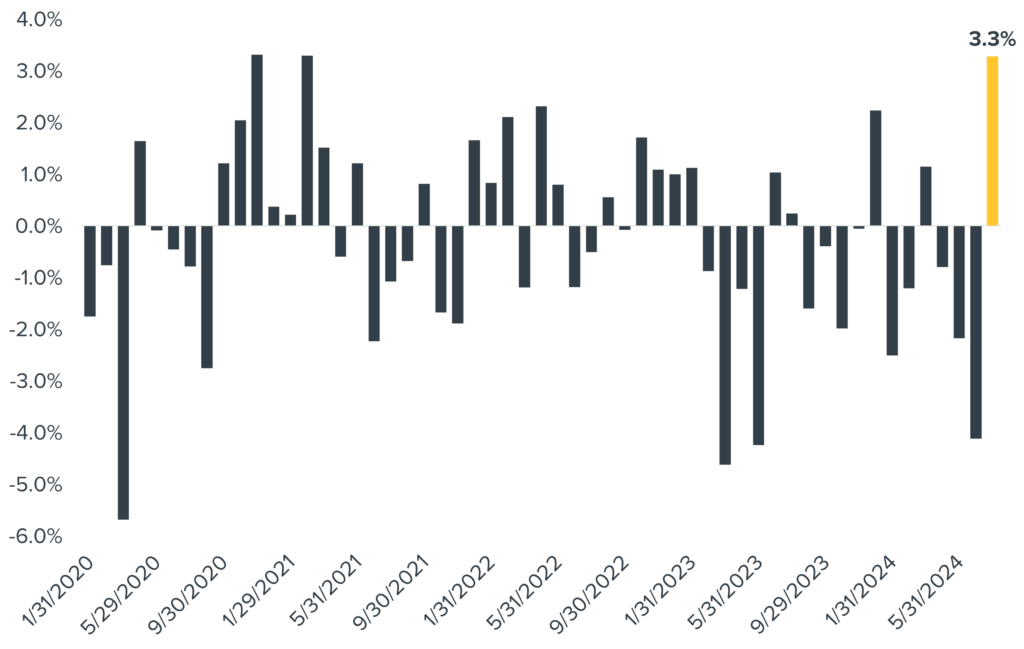

The result: The equal-weighted version of the S&P 500 index is up 3.3% for the month of July* compared to the market-cap-weighted version, marking the largest monthly outperformance since late 2020 (see the chart). Many investors are cheering this shift, as it gives the overall market a broader foundation of strength for potential future gains.

S&P 500 Equal-Weight Versus Market-Cap-Weight Performance

Source: Bloomberg, calculations by Horizon Investments, as of July 29, 2024. Past performance is not indicative of future results. Indices are unmanaged and do not have fees or expense charges, both of which would lower returns. It is not possible to invest directly in an index.

We’re seeing a similar broadening out elsewhere, too. Long-suffering small-cap stocks have suddenly come alive in recent weeks, beating their large-cap peers by the widest monthly margin since the early 2000s.

Why the shift? We think it’s due mainly to mounting evidence that inflation is falling to a level that will allow the Fed to cut short-term interest rates soon.

The bigger question is just how durable and sustainable these recent trends are. This week’s monetary policy meetings of the Fed, the Bank of England, and the Bank of Japan—as well as the busiest week of the second-quarter earnings season here in the U.S.—should give investors clarity on where the market is likely headed from here, and which stocks may go along for the ride.

*as of July 26, 2024

The S&P 500 Equal Weight Index (EWI) is an equal-weight version of the S&P 500 Index, which is market capitalization-weighted. The S&P 500 is a market-cap-weighted index, which means that the weight of each company in the index is based on its market capitalization. Small and Large Cap stocks are represented here by broad-based small and large cap indices; contact us for more information. References to indices, or other measures of relative market performance over a specified period of time are provided for informational purposes only. Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. The composition of an index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility, or tracking error targets, all of which are subject to change. Information obtained from third party sources is believed reliable but has not been vetted by the firm or its personnel.

This commentary is written by Horizon Investments’ asset management team. Past performance is not indicative of future results. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves the risk of loss.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. The opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed. Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2024 Horizon Investments, LLC.