Are there potential opportunities beyond the handful of big stock market winners?

The equity market has spent the better part of 2024 notching a series of new record highs. But a small handful of mega-cap names (such as Nvidia) are driving nearly all of those gains—while other stocks are spinning their wheels or stuck in reverse.

The silver lining: That could mean potential opportunities for long-term outperformance.

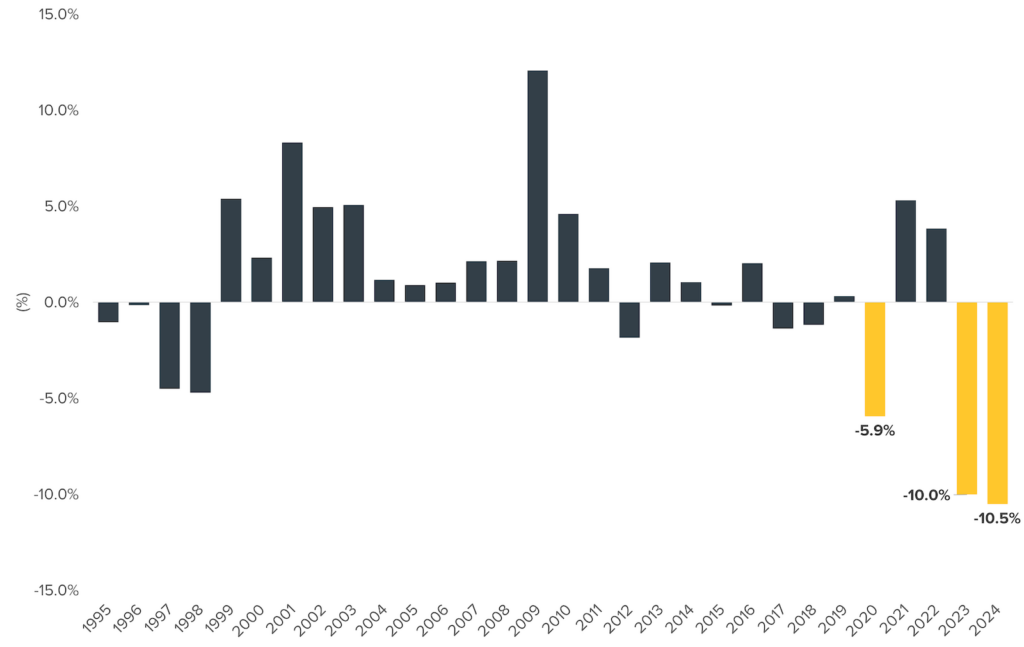

Consider that the market-cap weighted S&P 500 (in which the stocks with higher market caps carry greater weight in the index) is up 13.9% so far this year, but the equal-weighted version of that same index is up just 3.4%. That -10.5% gap represents the worst start in a calendar year* for the equal-weighted index in at least three decades (see the chart).

Excess Returns of the S&P 500 Equal-Weighted Index vs. S&P 500 Market-Cap Weighted Index

(YTD Through June 14 for Each Year)

Source: Bloomberg, calculations by Horizon Investments, as of June 14, 2024. It is not possible to invest directly into an index.

The upshot: Market breadth these days is poor, with just a handful of stocks doing exceptionally well. In that environment, active managers may find it challenging to outperform buy-and-hold passive strategies—and investors who don’t own the index’s biggest names could face significant risk of short-term underperformance.

Historically, it’s not uncommon for a few stocks to dominate overall returns for a stretch. Perhaps more importantly, ignored market segments typically don’t remain overlooked forever. The current imbalance may present a wealth of potential opportunities in stocks that are currently being left behind (such as value, small-caps and dividend-payers).

We continue to believe that portfolios with tactical allocation strategies can serve goals-based investors well. By diversifying investments, we believe investors may be better equipped to maintain equity exposure in narrow markets such as today’s and stay positioned to capture potential opportunities that may be currently underappreciated by the market.

* Through June 14.

The S&P 500® Equal Weight Index (EWI) is the equal-weight version of the widely-used S&P 500. The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight – or 0.2% of the index total at each quarterly rebalance. The S&P 500 Index or Standard & Poor’s 500 Index is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. References to indices, or other measures of relative market performance over a specified period of time are provided for informational purposes only. Reference to an index does not imply that any account will achieve returns, volatility or other results similar to that index. The composition of an index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Information obtained from third party sources is believed reliable but has not been vetted by the firm or its personnel.

This commentary is written by Horizon Investments’ asset management team. Past performance is not indicative of future results. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves the risk of loss.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. The opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed. Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2024 Horizon Investments, LLC.