Yahoo Finance: Embrace Volatility

While inflation remains sticky in areas like services and housing, Mike sees an opportunity to

Intuitive technology that supports your advisors

Goals-based strategies managed by Horizon Investments

Our latest thoughts, in and on the media

Our regular look at the market’s most revealing number

Our in-depth thinking on goals-based investing

What we do—and why we do it

What we do—and why we do it

Topics

While inflation remains sticky in areas like services and housing, Mike sees an opportunity to

Inflation concerns, rather than growth expectations, could be behind the rise in 10-year yields, especially

OVERVIEW Stocks posted another quarter of positive returns — despite some significant volatility along the

https://www.youtube.com/watch?v=-f7S0cz_D-4&t=95s We remain bullish on equities, anticipating that continued support from the Fed will drive

Are you ready? All eyes are on Jerome Powell on Wednesday as investors await the

What happened last week Stocks Rebound: U.S. large caps posted their best week of the

September holds its notorious history of challenging stocks. How could interest rate cuts affect the

What happened last week Price Action: Poor September seasonality may be to blame for a

Despite Nvida’s recent slump, the market kept moving. Chief Investment Officer Scott Ladner joins Schwab

What happened last week NVDA: Nvidia’s (NVDA) beat and raise was not enough to impress

What happened last week Powell Pivot: Chair Powell validated the market’s view that a rate

What happened last week Softening Economic Data: Cooler than expected inflation data weighed on interest

What happened last week Price Action: MAG-7 leads U.S. equity indices to fresh all-time highs

What happened last week Reversion Price Action: Year-to-date equity trends continued their reversal last week;

What happened last week AI vs. the Rest: Year-to-date equity trends reversed last week as

What happened last week AI Theme: NVIDIA (NVDA) rally to $3T in market capitalization vaults

What happened last week Revenge of the Meme Traders: Small-caps outperformed large-caps on resurgent trading

What happened last week Semis: NVDA’s “beat and raise” earnings report reignited the AI trade

What happened last week Price action: China led on a green week for global stocks,

What happened last week Stocks rose for the first time in four weeks on the

OVERVIEW Following a third-quarter slump, stocks roared back to life during the final three months

OVERVIEW During the third quarter of 2023, investors hit “pause” on the rally that had

https://youtu.be/mWhUrUv0Ffo?feature=shared Hear Zach cover what Horizon is taking from recent economic data, our expectations for

CIO Scott Ladner joined Schwab Network to discuss recent employment and inflation data, factors behind

There are few signs of the economic struggles predicted at Jackson Hole last year. Attention

https://youtu.be/e26Kr8v2gvg Head of Portfolio Management Zach Hill, CFA® covered why the Fed matters less today,

Is the Fed’s battle to contain inflation finally done? The market seems to think so.

Hear Zach Hill, CFA®, cover earnings season, Fed policy, and what Horizon is watching in

Overview Financial markets suffered sizable—in some cases, historic—losses in 2022. Soaring inflation combined with an

CIO Scott Ladner joined Yahoo Finance Live to discuss Fed policy and inflation, economic data,

Categories

Topics

While inflation remains sticky in areas like services and housing, Mike sees an opportunity to navigate this complexity. He spotlighted healthcare as a potential hidden

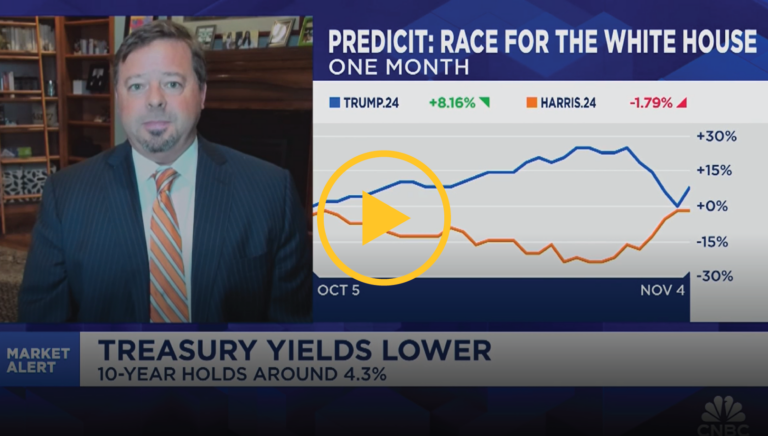

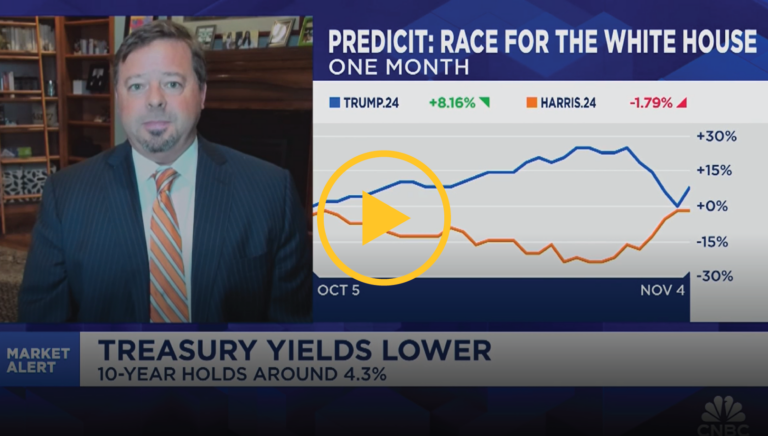

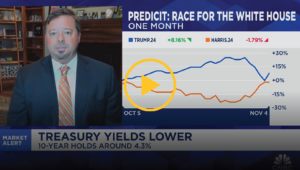

Inflation concerns, rather than growth expectations, could be behind the rise in 10-year yields, especially as prediction markets fluctuate with the election. Chief Investment Officer

OVERVIEW Stocks posted another quarter of positive returns — despite some significant volatility along the way—with several equity market indices recording a string of record

https://www.youtube.com/watch?v=-f7S0cz_D-4&t=95s We remain bullish on equities, anticipating that continued support from the Fed will drive markets higher as we close out the year. Head of

Are you ready? All eyes are on Jerome Powell on Wednesday as investors await the Federal Reserve Board’s near-certain decision to cut the federal funds

What happened last week Stocks Rebound: U.S. large caps posted their best week of the year, up about 4% and mostly reversing the worst week

September holds its notorious history of challenging stocks. How could interest rate cuts affect the market’s response? Chief Investment Officer Scott Ladner joins BNN Bloomberg

What happened last week Price Action: Poor September seasonality may be to blame for a more than 4% decline in U.S. large caps. AI Woes:

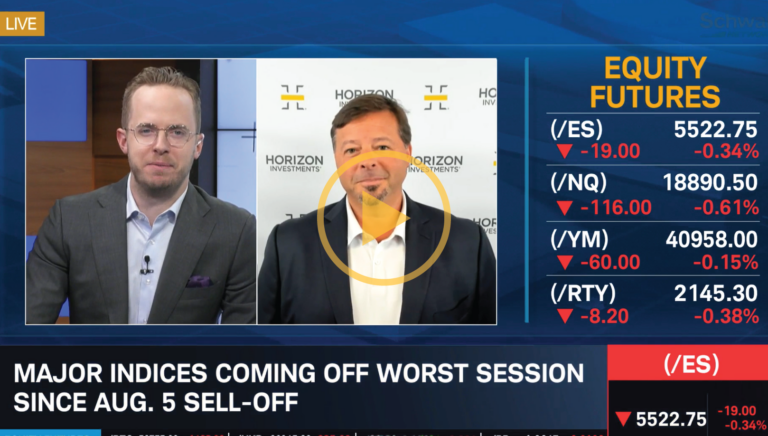

Despite Nvida’s recent slump, the market kept moving. Chief Investment Officer Scott Ladner joins Schwab Network to discuss a shift in focus to the broadening

What happened last week NVDA: Nvidia’s (NVDA) beat and raise was not enough to impress investors, resulting in a nearly double-digit sell-off. Strong Data: Second

What happened last week Powell Pivot: Chair Powell validated the market’s view that a rate cut is coming in September. Markets Rally: Investors took comfort

What happened last week Softening Economic Data: Cooler than expected inflation data weighed on interest rates; September rate cut now the base case. Equity Markets

What happened last week Price Action: MAG-7 leads U.S. equity indices to fresh all-time highs as small-caps and large-cap value decline. Softening Economic Data: Unemployment

What happened last week Reversion Price Action: Year-to-date equity trends continued their reversal last week; small caps and internationals led U.S. mega-cap technology. U.S. Debate:

What happened last week AI vs. the Rest: Year-to-date equity trends reversed last week as small-caps led mega-cap tech; quarter/month-end and specific product rebalancing flows

What happened last week AI Theme: NVIDIA (NVDA) rally to $3T in market capitalization vaults U.S. large caps to fresh all-time highs. Strong Payrolls Data:

What happened last week Revenge of the Meme Traders: Small-caps outperformed large-caps on resurgent trading in “meme-stocks.” Slightly Softer U.S. Data: 1Q U.S. GDP was

What happened last week Semis: NVDA’s “beat and raise” earnings report reignited the AI trade and propelled mega-cap tech to fresh all-time highs. Hawkish Fedspeak:

What happened last week Price action: China led on a green week for global stocks, ratcheting higher as Chinese policy support continues to improve the

What happened last week Stocks rose for the first time in four weeks on the back of strong earnings. Economic data was weak, with GDP

OVERVIEW Following a third-quarter slump, stocks roared back to life during the final three months of 2023. The S&P 500 index of large-company stocks rallied

OVERVIEW During the third quarter of 2023, investors hit “pause” on the rally that had lifted stocks higher for much of the year. The major

https://youtu.be/mWhUrUv0Ffo?feature=shared Hear Zach cover what Horizon is taking from recent economic data, our expectations for Fed and monetary policy, and our positioning across equities and

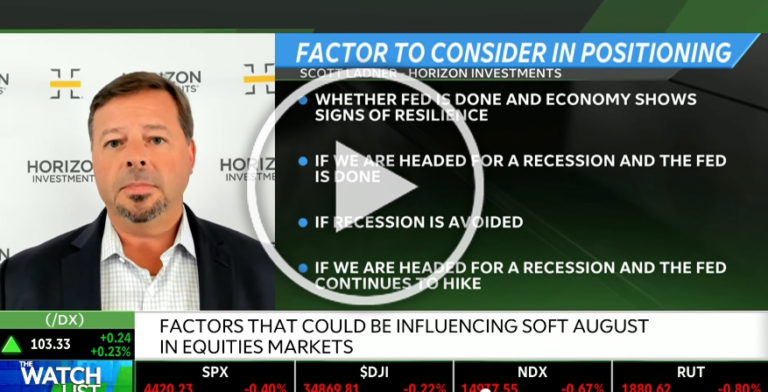

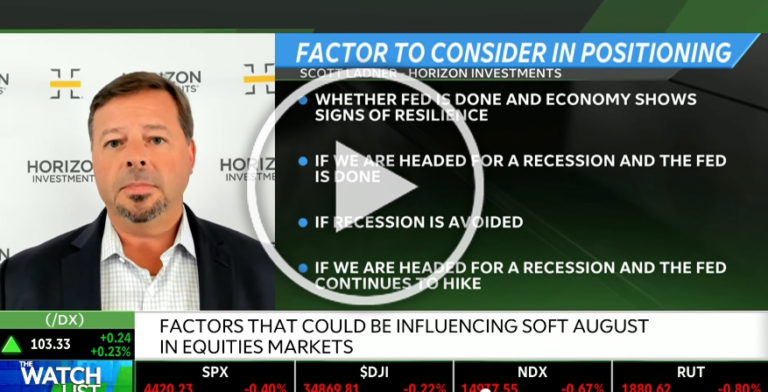

CIO Scott Ladner joined Schwab Network to discuss recent employment and inflation data, factors behind soft August, and artificial intelligence.

There are few signs of the economic struggles predicted at Jackson Hole last year. Attention will be focused on Wyoming this week, where the 46th

https://youtu.be/e26Kr8v2gvg Head of Portfolio Management Zach Hill, CFA® covered why the Fed matters less today, takeaways from earnings season, and under-the-radar macro themes we are

Is the Fed’s battle to contain inflation finally done? The market seems to think so. Recent comments from multiple Wall Street firms and economists suggest

Hear Zach Hill, CFA®, cover earnings season, Fed policy, and what Horizon is watching in the markets. https://youtu.be/27YkbeBM_yc

Overview Financial markets suffered sizable—in some cases, historic—losses in 2022. Soaring inflation combined with an aggressive monetary policy response by the Federal Reserve Board created

CIO Scott Ladner joined Yahoo Finance Live to discuss Fed policy and inflation, economic data, and overall volatility. Watch the Video