Economic data deluge

Today’s avalanche of economic data for March reinforces what an abnormal recession and recovery the U.S. is experiencing amid the pandemic and multiple rounds of government stimulus. Following up on Horizon Investments’ inflation report earlier this week, we want to highlight spending on big-ticket items and why the unsustainable path it’s on signals to us that a rise in inflation is likely temporary.

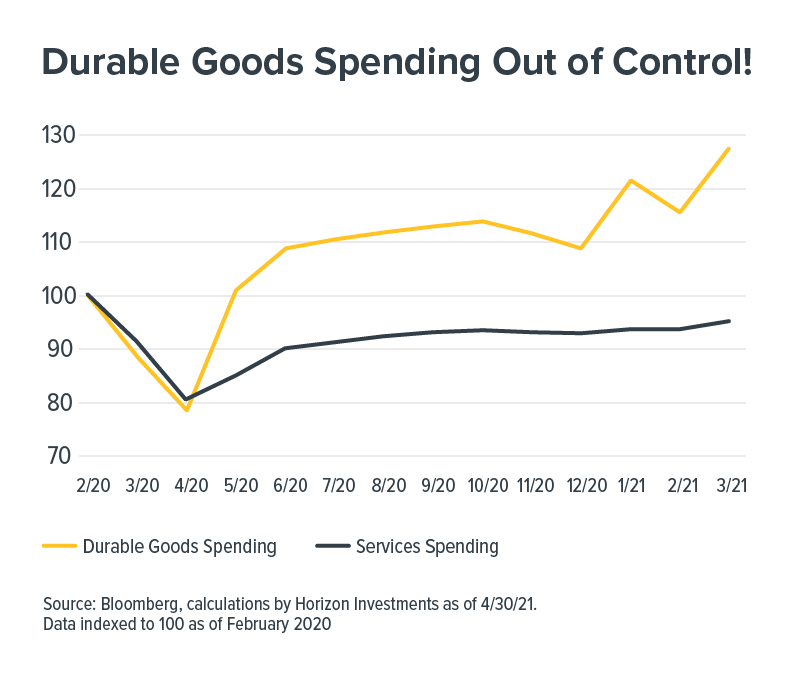

American spending on durable goods — things such as cars, furniture, appliances, computers and other long-lasting products — is 28% higher than where it was in February last year before the economy was shut down, according to Horizon’s calculations using Commerce Department data.1 And it may have been propelled by government stimulus checks, which sent household income soaring at an annualized rate of 21.1% in March.

Durable goods spending is also incredibly strong compared to the trend it was on in the years before the pandemic hit. Big-ticket spending is running nearly 20% above the trend in the five years pre-COVID, according to Horizon’s calculations. Spending on services, in contrast, is running 8% below the pre-pandemic trend.

Source: Bloomberg, calculations by Horizon Investments, as of 3/31/2020

Pre-COVID levels are from February 2020, Pre-COVID trend is the five-year average before February 2020

In short, nothing about the current economic environment is normal. In Horizon’s view, the competition among shoppers for many of the same items goes a long way to explaining some of the inflation fears that people have – and rightly so, if you need a used car or want to renovate your house.

However, the spending on durable goods may strongly shift to services when we can all travel and live in a more normal way as more people are vaccinated and local economies reopen. That change in spending, along with the bracing effect of high prices, will go a long way to putting a dent in big-ticket spending as well as the inflation fears that are on everyone’s lips right now.

1 https://www.bea.gov/news/2021/personal-income-and-outlays-march-2021

Related stories:

Inflation Fixation, Bubble Trouble and Goals-Based Planning: Market Notes

Americans Retiring Early May Benefit from a Goals-Based Solution

Widows Are at Higher Risk of Falling Into Poverty

Many Investors Tried to Trade the Pandemic Plunge in Stocks

Are Bonds in a Bear Market? That’s the Wrong Question to Ask

If Inflation Returns, Bond’s Diversification Power May Disappear

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

Only Two Words Matter to Markets: Stimulus Spending

PIIGS Fly and Other Stories of Investors Reaching for Risky Bets

Momentum’s No Longer the Stock Market King, Vaccine Will Raise New Leadership

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, contact Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

To discuss how we can empower you please contact us at 866.371.2399 ext. 202 or info@horizoninvestments.com.

Get a print version of this commentary.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index. The visuals shown above are for illustrative purposes only and should not be considered a guarantee of success or a certain level of performance. Horizon Investments’ models are not intended as investment advice. Both the asset allocation and dispersion models analyze the performance of exchange traded funds that we believe are representative examples of either a stock market segment, a measure of an investment factor utilized by quantitative analysts or a geographic segment.

The Real Spend® retirement income strategy is NOT A GUARANTEE against market loss and there is no guarantee that the Real Spend® strategy chosen by an investor will be successful for the entirety of an investor’s retirement. Clients may lose money. Real Spend® is an asset allocation strategy that uses an investment model to (i) plan savings amounts and overall asset allocation during the distribution phase of retirement planning, (ii) compute target retirement wealth, assuming a retirement budget and a spending-investment strategy after retirement, (iii) compute the transition from the accumulation phase to the retirement phase, and (iv) generate the spending-investment strategy after retirement. Our retirement spending investment strategy uses an allocation model that replenishes cash needed for withdrawals. Before investing, consider the investment objectives, risks, charges, and expenses of the strategy. All investing involves risk. This strategy is not an insurance product with payments guaranteed. It is a strategy that invests in marketable securities, any of which may fluctuate in value. There is a possibility of outliving the assets if market performance is lower than forecasts used in planning, or if longevity is longer than anticipated.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

Other disclosure information is available at hinubrand.wpengine.com.

Horizon Investments, the Horizon H and Real Spend are registered trademarks of Horizon Investments, LLC

©2021 Horizon Investments LLC