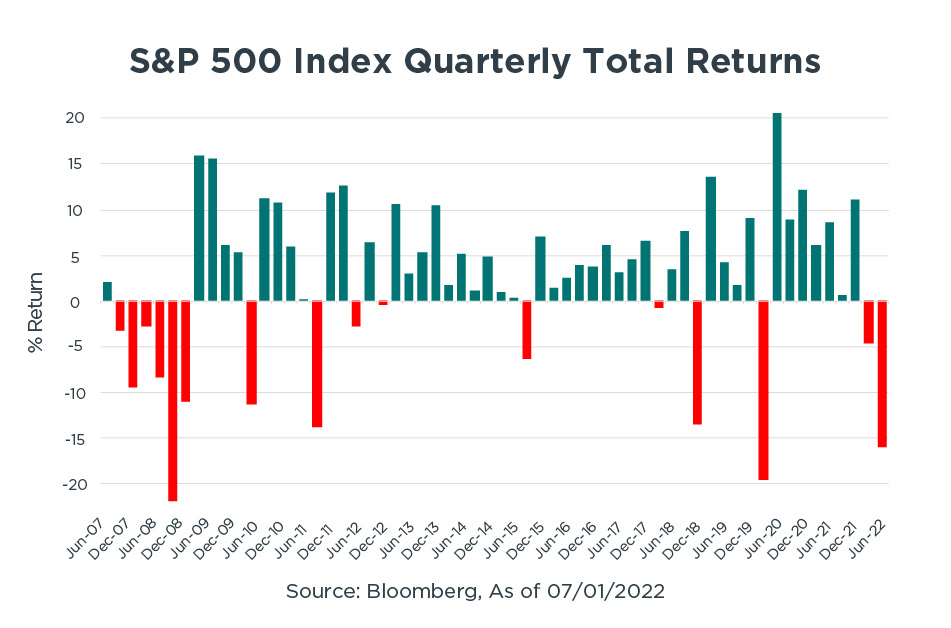

The S&P 500 hasn’t seen two consecutive quarters of negative returns since the global financial crisis—until now, that is.

The index’s -16.1% return during the second quarter of 2022 follows a -4.6% loss over the first three months of the year. The last time the S&P 500 experienced back-to-back quarterly declines was the fourth quarter of 2008 and the first quarter of 2009 when the index fell -21.9% and -11.0%, respectively.

All told, the S&P 500 has suffered its worst first six months to a calendar year since 1970—52 years ago.

Where does all this leave investors as we head into the second half of 2022? At Horizon, we are assessing the probability of three scenarios we believe are most likely to occur in the coming months:

- Rapid deterioration, characterized by continued high inflation and aggressive Fed monetary policy that takes global stocks lower.

- Slow improvement, in which conditions improve in stages over time and financial assets trade in a relatively narrow range.

- Rapid improvement that sees sharply declining inflation expectations coupled with accelerating global economic growth and a pivot by the Fed to a neutral policy.

This environment is a good reminder of the importance of considering a disciplined risk mitigation approach as part of a well-rounded investment toolkit. While results like the ones seen this year tend to be relatively rare, they can significantly impact an investment plan if investors aren’t prepared to address them.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. The opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments, and the Horizon H, and Gain Protect Spend are registered trademarks of Horizon Investments, LLC

©2022 Horizon Investments LLC