Innovation stocks, like Tesla, have gone cold, falling an average of 38% from their respective 52-week highs

Does 2021 strike you as a replay of 1999? The investment theme now, as it was then, is to buy the companies on the leading edge of new technologies as it appears those innovations are going to take over the world. It certainly seems reasonable to think Tesla, Zoom Technologies and Plug Power are telegraphing what the future could look like, just as Cisco, Qualcomm and Intel did two decades ago.

The problem is that the innovators don’t necessarily live up to the hype given competition, rapid changes in technology and – in the case of 2000 and 2021 – higher interest rates that dent the valuations of highly speculative companies.

From a fundamental investing point of view, nosebleed equity valuations only make sense when interest rates are falling or steady. That’s why the driver of this year’s interest rate move – concerns about a trend change to higher inflation – could be especially corrosive to the innovators.

Their lofty valuations rest on interest rates remaining low – which allows investors to apply a smaller discount to future cash flows. As rates rise, that discount has to increase, and lower valuations are the natural result.

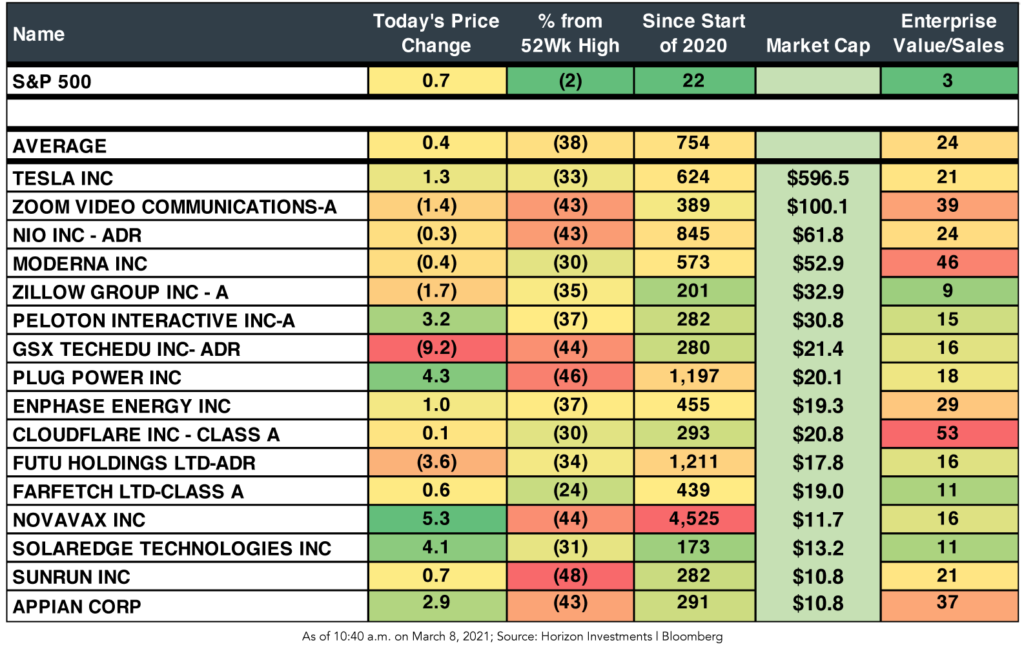

No surprise, then, that the innovators are having a rough time as the bond market sells off. Horizon Investments’ performance table for the innovators shows the pain: down an average of 38% from their individual 52-week highs. That’s denting their average gain since the start of 2020, now at 754%. That’s still a huge rally, but as the boilerplate warning goes, past performance is no indication of future returns. And if you bought them recently, you are likely feeling some pain.

The innovators’ main Achilles heel is their lofty valuations – their average enterprise value to sales ratio is 24, 8x higher than the S&P 500. But they also face questions about limitations to their growth, the emergence of strong and well-heeled competitors, an uncertain regulatory environment and an economic re-opening that cuts into demand for their products and services.

The market is waking up to these concerns, and the recent rotation in equity trends shows the value of an active investment process against a changing macro backdrop. One year ago, when Covid was beginning to shut down economies across the globe, the biggest tilt in Horizon’s equity allocation was toward the economically insensitive large-cap tech stocks. But as clarity around the economic outlook has improved, we have reallocated that exposure towards other parts of the market that we believe should benefit from an uptick in global growth, including smaller cap equities and emerging markets.

Further reading:

You May Need a Bigger Down Payment for a New Home: Big Number

Emerging Markets Are Surging – And Evolving: Market Notes

Inflation Could Be Coming, Are You Ready?

Disappearing Junk Bond Yields

Do Bonds Really Offset Stock Market Declines?

If Inflation Returns, Bond’s Diversification Power May Disappear

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

High & Mighty Stocks; Feeling Inflationary?; Game Stopped: Market Notes

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, please reach out to Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

To download a copy of this commentary, click the button below.

To discuss how we can empower you please contact us at 866.371.2399 ext. 202 or info@horizoninvestments.com.