Will December bring glad tidings to small-company stocks?

Small-cap stocks have had quite the slog this year. Punished by rising interest rates and lingering fears of economic weakness, the Russell 2000 Index has struggled to a year-to-date return of just 4%.

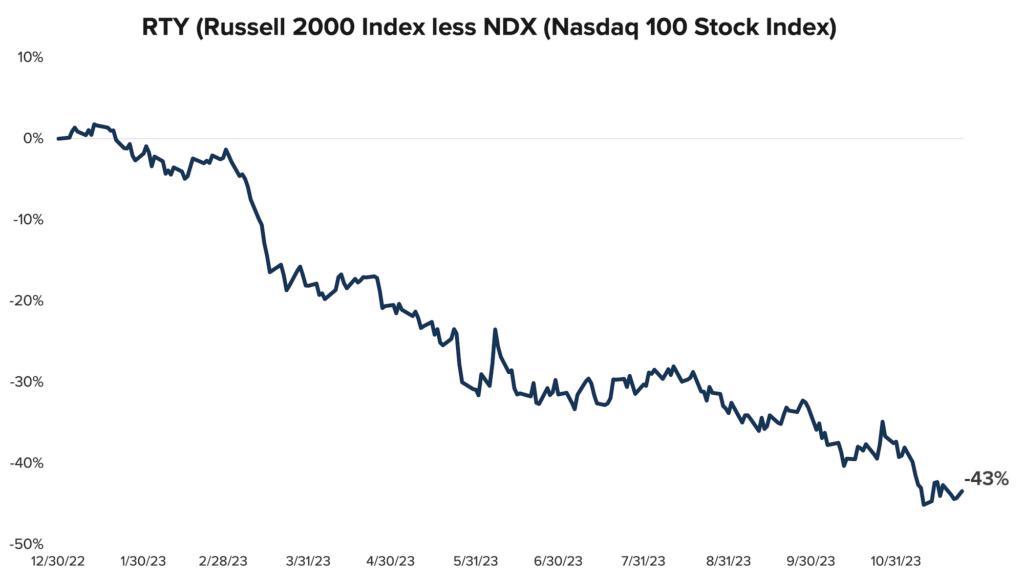

Worse, compared to the tech-heavy (and overperforming) Nasdaq 100 Index, the Russell 2000 has recorded one of its poorest relative performances on record. The chart shows that the small-cap index has underperformed the Nasdaq 100 by 43% this year—the biggest gap since 1998 (when small-caps underperformed by 88%) and 1999 (-80%).

Small Caps Lag Tech Stocks By 43%

The good news: That extreme chasm could spell opportunity as we close out 2023. Given the likelihood that the Fed is done raising short-term rates and that long-term rates have peaked, investors’ attention may soon pivot away from all things tech toward small caps and their low valuations. The market’s tepid reaction to AI-darling Nvidia’s third-quarter results last week suggests such a shift might be underway.

Another potential positive for small caps is seasonality. Historically, December is the best month for small-cap relative performance. Over the past 30 years, the Russell 2000 Index has beaten the Nasdaq 100 by 1.7% on average during December.

Longer-term, small caps still face headwinds that concern us—such as greater sensitivity to interest rates, overall lower financial quality, and relatively little exposure to the AI trend—but in the remaining weeks of 2023, we believe good things may indeed come in small packages.

Disclosure

The NASDAQ-100 Index includes 100 of the largest domestic and international non-financial companies listed on The NASDAQ Stock Market based on market capitalization. The Russell 2000® Index measures the performance of the small-cap segment of the US equity universe.

This commentary is written by Horizon Investments’ asset management team. Past performance is not indicative of future results. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves risk of loss.

Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. An index’s composition may not reflect how a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Individuals cannot invest directly in any index. Indices are unmanaged and do not have fees or expense charges, which would lower returns. The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed. Other disclosure information is available at www.horizoninvestment.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2023 Horizon Investments LLC