Chip stocks have come out swinging to start 2023

In what could be a harbinger of things to come for the markets, semiconductor stocks are heating up this year. For example:

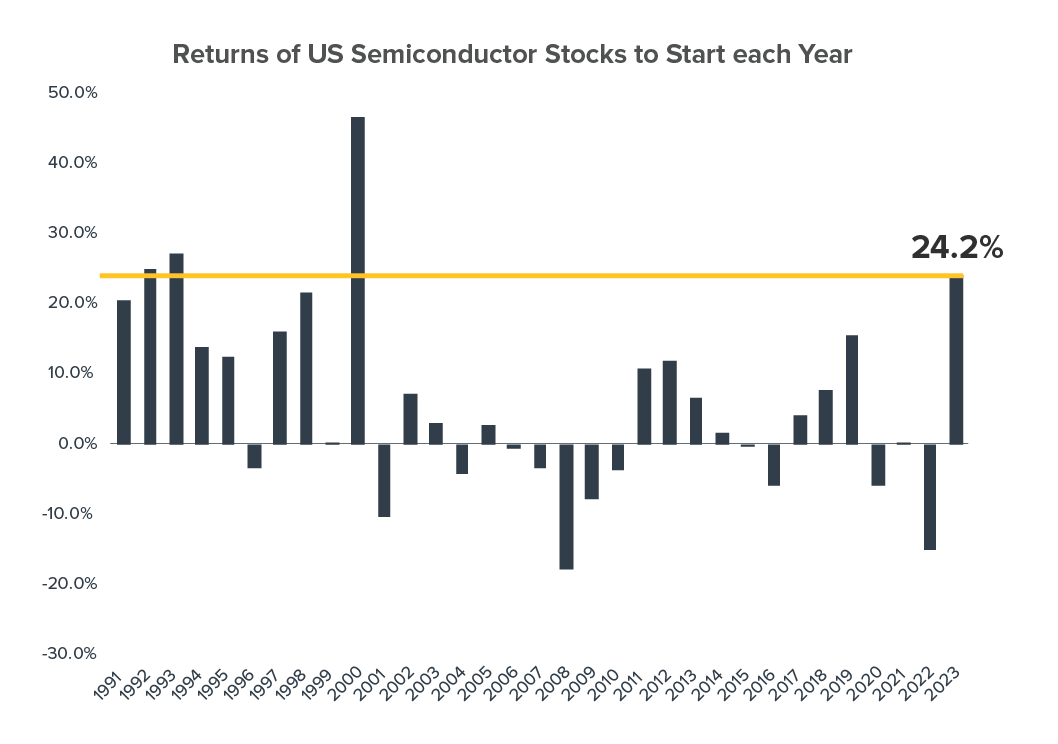

- The S&P 500 Semiconductor and Semiconductor Equipment Industry Group Index is up 24.2% year to date*, versus 5.7% for the S&P 500.

- It’s the chip sector’s best calendar-year start in more than 20 years (see the chart, which shows the index’s YTD performance through the first 42 trading days of each year going back to 1991).

The index has logged the 2nd-best YTD performance of all 24 industry indices so far this year. (Only the automobile sector has done better.)

Source: Bloomberg as of March 8, 2023

Some investors are cheering that news because semiconductor stocks can often be seen as a leading indicator of the broader market’s future results.

One reason: Chips are increasingly the first step in the supply chain for lots of businesses—indeed, the number of products that don’t include some type of semiconductor seems to be shrinking every day. Conditions in the chip sector, therefore, offer one way to assess the prospects for the economy and stock market (similar to the role the transport sector has historically played).

To be sure, this semiconductor gauge isn’t calling for an imminent bull run. In recent months, some chipmakers have reported stronger-than-expected financial results, while others have disappointed Wall Street. The sector also is navigating its way through an excessive inventory of semiconductors that arose after the pandemic created a major chip shortage.

That said, the U.S. economy remains strong—consider January’s surprisingly robust consumer spending and retail sales, for example. Continued strength would likely mean healthy demand for lots of chip-enhanced goods from across multiple sectors of the economy.

Given these conditions, we have implemented a less-defensive posture in Horizon’s portfolios by modestly increasing the level of equity risk—while remaining watchful for emerging signs of weaker growth that could put pressure on riskier assets.

* Through March 8, 2023

This commentary is written by Horizon Investments’ asset management team.

Past performance is not indicative of future results. Information obtained from third party sources is believed reliable but has not been vetted by the firm or its personnel.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money.

Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves risk of loss, and in periods of market growth, risk mitigation strategies can be expected to lag in performance behind equity strategies that do not focus on risk mitigation.

This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed.

The S&P 500 or Standard & Poor’s 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The S&P 500 Semiconductor and Semiconductor Equipment Industry Group Index represents the semiconductor companies within the S&P Total Market Index. Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. An index’s composition may not reflect how a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Individuals cannot invest directly in any index.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2023 Horizon Investments LLC