Overview

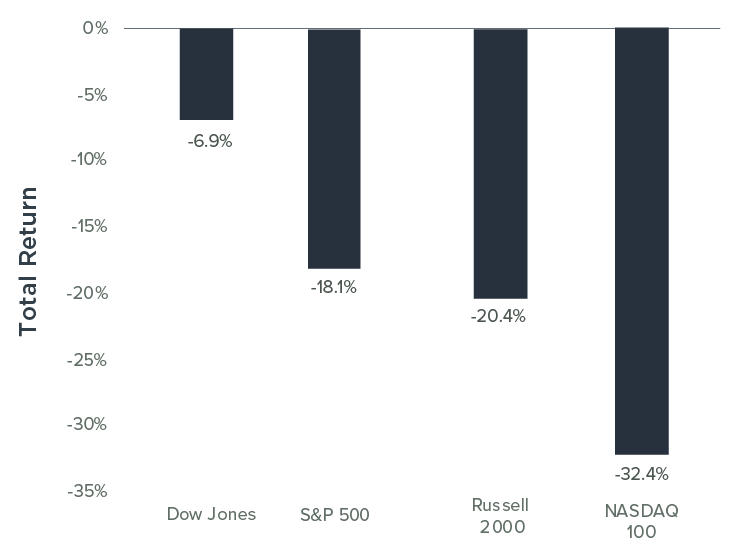

Financial markets suffered sizable—in some cases, historic—losses in 2022. Soaring inflation combined with an aggressive monetary policy response by the Federal Reserve Board created a deep sense of uncertainty among investors that dragged key market indices into negative territory for the year (see Exhibit 1).

Exhibit 1: Major Market Indices Down Sharply in 2022

Source: Bloomberg 12/31/22

When all was said and done, 2022 was the worst year for stocks since 2008. It was also among the most volatile: The S&P 500 experienced 46 daily moves of 2% or more, the most since the 2008-09 financial crisis.

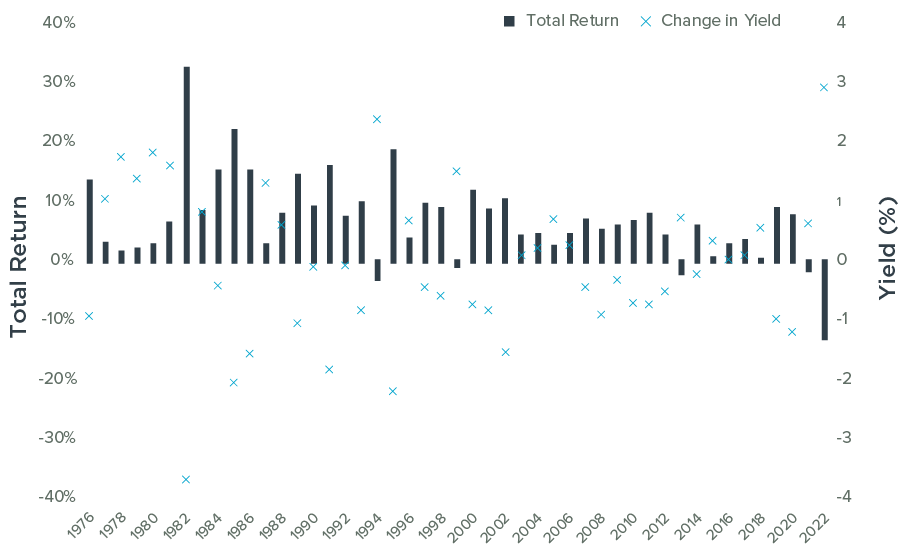

Bonds fared poorly, as the yield on the 10-year U.S. Treasury note soared from 1.50% at the end of 2021 to 3.836% by the end of 2022. Bond prices fall as yields rise, causing the Bloomberg U.S. Aggregate Bond Index to plummet 13% in 2022—the index’s worst performance on record by a wide margin (see Exhibit 2).

Exhibit 2: Bonds Suffer Historic Losses

Bloomberg 12/31/22

Several factors drove asset prices lower in 2022. Chief among them were the highest inflation rates seen in 40 years. Continued supply chain issues and a tight labor market stemming from the pandemic, coupled with strong consumer demand, pushed prices on goods and services continually higher for most of the year. Inflation accelerated greatly after Russia’s invasion of Ukraine, which caused oil and other commodities to soar. Example: U.S. crude oil prices topped $130 a barrel in March—a 13-year high—before drifting lower.

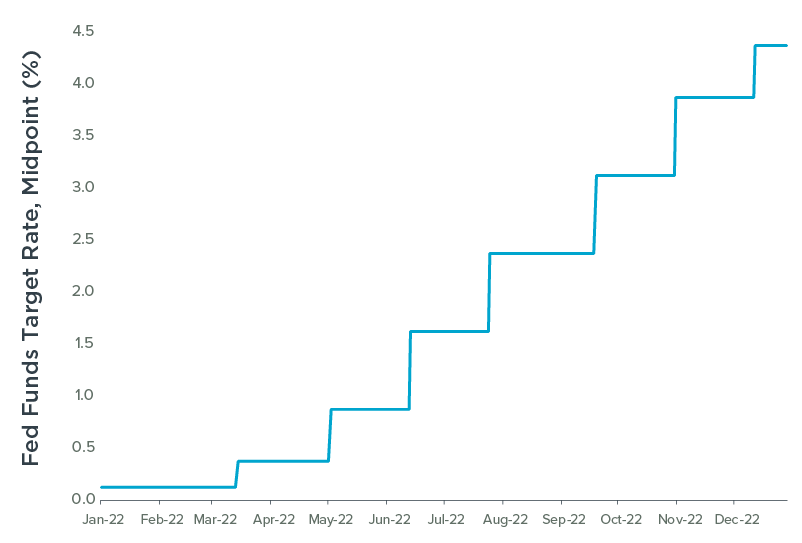

Rampant and “sticky” inflation prompted the Federal Reserve Board to aggressively increase short-term interest rates in an effort to reduce demand and rein in runaway prices. The Fed raised its target range for the Federal Funds Rate from 0.00% to 0.25% in December 2021 to 4.25% to 4.5% by the end of last year, including four atypically large 0.75-percentage-point bumps (see Exhibit 3). As a result, short-term borrowing costs are currently at their highest level since 2007.

Exhibit 3: Fed Rate Hikes Were Historically Fast in 2022

Bloomberg 12/31/22

The Fed’s strong response impacted bond prices while also fueling fears of an economic recession, which prompted investors to sell equities. Growth stocks in sectors such as technology were especially hard hit due to the higher cost of capital and ensuing multiple compression from rising interest rates.

In contrast, value stocks and defensive sectors (including health care, consumer staples, and utilities) performed well on a relative basis because investors perceived them as more financially stable and better able to withstand challenging economic conditions. As seen in Exhibit 4, the MSCI World Value Index beat the MSCI World Growth Index by 22.7 percentage points in 2022—the largest margin of value outperformance since the 25.8 percentage point spread back in 2000.

Exhibit 4: Biggest Year for Value vs. Growth Since 2000

Bloomberg 12/31/22

That said, only one equity market sector in the U.S. posted a positive return for the year: Energy gained 59% as the Russia-Ukraine war pushed the price of oil and natural gas higher.

Key Factors In Flux

The good news: We believe some major drivers of high inflation have begun to recede recently. Global supply chain constraints that fueled inflation are easing, for example, with less congested ports and significantly lower shipping costs. That’s one reason why prices for online goods in the U.S. fell in November at their fastest rate since the start of the pandemic. Meanwhile, the national average for regular gasoline fell to $3.21 a gallon by the end of 2022, down from its peak of $5.02 last June.

What’s more, the most recent inflation report of 2022 showed that prices in November rose 7.1% year-over-year—down from 8.2% in September and 7.8% in October.

As we sail into 2023, however, the waters remain somewhat murky—with many key economic factors still in flux. With that in mind, here are a few crucial issues we are focused on as we look to navigate through what seems likely to be a highly dynamic year ahead.

Wage Inflation: The Fed’s New Target

The recent moderation in overall price increases has some market watchers expecting the Fed to end its rate hikes soon. However, we believe the Fed still has more work to ensure rampant inflation is indeed stamped out and brought back down to the Fed’s target. Fed policymakers are well aware of the mistakes made during the 1970s, when the Fed pulled back on its inflation-fighting efforts too early and prices stayed stubbornly high for an extended period. The fact that the Fed expects the Federal Funds Rate to be above 5% this year suggests Chairman Powell and company are not easing up soon.

That said, we see the focus of the fight against inflation shifting in 2023—away from supply chains and consumer-driven demand toward conditions in the labor market. When looking for clues about what the Fed will do next, we think wage and employment data will likely become far more important this year than the headline CPI inflation numbers to which everyone typically pays attention.

The reason: While we see goods prices and energy prices moderating, wages are rising by around 6% on an annual basis (see Exhibit 5)—a rate that is not at all compatible with the Fed’s overall inflation target of 2%. Until wage pressures are alleviated—an outcome whose timeline remains uncertain—the Fed will likely not feel comfortable that inflation is sufficiently under control.

Exhibit 5: Wages Are Growing Well in Excess of Fed’s 2% Inflation Target

Source: Bloomberg 12/31/22

Wage inflation remains so robust mainly because most businesses still struggle to attract enough workers. Consider that less than 20% of all workers are employed by a company included in the S&P 500 Index. The vast majority of job postings are from small- to medium- sized businesses that have been dealing with labor shortages for more than two years. The unemployment rate going into 2023 was just 3.7%, one of the lowest on record, and unemployment claims continue to run at historically low levels.

Given demographic trends and the slower rate of immigration in the U.S., this tight labor supply is an issue that’s not easily solved. That, in turn, makes tamping down wage pressures a sizable challenge—and a fight that the Fed will engage with strongly through continued restrictive monetary policies.

If all that wasn’t enough, it’s worth noting that the level of overall financial conditions—another key inflation-related metric the Fed pays close attention to—was recently hovering around its long-term average. Given the 40-year-high levels, the Fed will likely take steps to tighten financial conditions beyond just an average level before calling the inflation “all clear” signal.

Will the Economy Fall into Recession?

As we begin 2023, many investors believe a short, shallow recession in the near future is unavoidable. Demand for goods is slowing as the Fed’s rate increases flow through the economy. And the housing market has also seen a decline in demand due to higher mortgage rates. For example, existing home sales have fallen for ten straight months. Historically, when housing slows, multiple other sectors of the economy (such as durable goods and retail) feel the pain.

Moreover, at multiple points last year, the yield on longer-term Treasury bonds dropped below that of shorter-term fixed-income securities. This yield curve inversion, an anomaly that occurs when short-term securities offer higher yields than longer-term ones, has often been a reliable predictor of recessions in the past.

We believe a recession is possible—but it’s not a foregone conclusion. Consider some key pillars of support for the economy that are currently in place:

- Strong labor market. While the tight labor market could keep inflation elevated, as noted earlier, it has an upside: Americans are working and earning more money. Betting against the economy when consumers have jobs and nominal spending power is not usually a winning proposition.

- Healthy personal finances. Despite a big increase in credit card debt, consumers’ balance sheets remain in good shape. For example, consumers’ ability to service their debt is solid, and according to the Wall Street Journal, it’s estimated that they recently had more than $1.2 trillion of excess savings on hand (defined as savings above what households would have been expected to have if the pandemic had not happened). Also, households’ net worth is 7.7 times their disposable personal income on average —up from 7.1 times at the end of 2019.

- Solid housing conditions. Encouraging supply and demand factors should help keep the housing market on relatively stable ground. Consider that we’ve seen many years of relatively low home supply, partly because the 2008 financial crisis caused homebuilders to pull back on new construction. And now, millennials (the largest demographic by percentage) are entering their prime home-buying years, which should help maintain strong demand overall.

The China Wildcard

As 2022 ended, China began to reopen its economy and wind down its highly restrictive “zero-covid” policy of lockdowns and quarantines. The reopening of the world’s second-largest economy will almost certainly benefit global growth and is a welcome change from the trend of U.S. consumers having to shoulder the load of growth in the global economy.

That said, China’s reemergence may be a bumpy ride. Remember that the U.S.’s rebound from the pandemic occurred in fits and starts due to Covid flare-ups and other factors. In China, where there is less immunity and a less robust vaccination effort, the road may be especially rocky in the near term—which may, in turn, create some potholes for the global economy. In addition, China’s reopening could fuel global inflation in commodities and other areas—adding even more challenges to the Fed’s efforts to tamp down rising prices.

A recession may eventually occur, of course. The probability of a Fed-engineered “soft landing” for the economy that investors hope for is relatively low, considering that we’ve seen recessions during nine of the past 12 times the Fed has tightened monetary policy. And although it’s likely that a near-term recession would be relatively short and shallow, it’s important to acknowledge that a deeper, more prolonged downturn is possible, given the uncertainties at work in the economy today.

Ultimately, we think investors seem overly certain that a short, shallow recession is inevitable and are underappreciating scenarios such as the economy “muddling through” a soft landing or the economy entering a prolonged recession.

Where are the Opportunities – and the Risks?

Given the many unknowns facing us as we start the new year, one obvious concern is how to best identify and capture opportunities—while spotting and sidestepping the most significant potential risks.

As we start 2023, some of the themes and ideas we are considering include the following:

- We expect value stocks to remain strong. As noted, value stocks outperformed growth stocks by a historic margin last year. We believe value will maintain its advantage in 2023, although perhaps not by the same magnitude. With higher (and potentially volatile) interest rates, capital is no longer as cheap as it once was. In that environment, we expect investors to prioritize characteristics such as cash flow, dividends, and relatively low volatility—typical hallmarks of value stocks. Our value positioning has primarily focused on energy and consumer staples in the U.S., but we may see interesting opportunities opening up for financials in the coming months. Additionally, the weakening dollar and the reemergence of China (see “The China Wildcard”) could create opportunities in value-heavy international markets.

- We believe growth stocks will remain unattractive. Growth stocks in sectors such as technology suffered significant losses in 2022—prompting some investors to predict a growth rebound in 2023. We disagree with this premise and think it’s too early to emphasize growth stocks. Consider the macroeconomic climate during the 2010s, when growth continually outperformed: low inflation and low interest rates. Today, the macro climate is nothing like it was then and is instead acting as a headwind against growth stocks. In addition, it was once believed that tech companies’ business models were impervious to the ebbs and flows of the economy. Of course, the last few years have shown us that tech and ad spending is more cyclical than investors believed. In our view, technology and tech-related stocks need a further valuation discount to become attractive again.

- Fixed income may offer tactical opportunities. The bond market rout has created compelling valuations and yields, albeit with some caveats. For example, high-yield bonds offer attractive yields—but recession risks mean that investors need to pay close attention to these bonds’ credit quality and default risk. And while the bond market overall presents opportunities, those opportunities could rise or fall as conditions develop. Further Fed hawkishness could send yields even higher, for example, while yields could reverse course if the risk of a recession grows and investors flock to bonds for perceived safety.

Given these factors, the Horizon portfolios have been structured in a somewhat defensive manner, emphasizing value and higher-quality stocks. However, we are not positioning for a recession at the moment since (as previously noted) we believe that there is little evidence to suggest one is imminent.

Meanwhile, we continue carefully monitoring interest rate volatility as a key factor in our allocation decisions. Many market participants expect the two-year Treasury note to fluctuate by nine basis points per day, on average, over the next six months. Movement of that magnitude for a risk-free asset such as a short-term Treasury would be extraordinarily volatile. If Treasury rates fluctuate wildly, the volatility of other assets whose valuations are tied to those rates (such as equities, commodities, and corporate credits) will likely stay elevated as well. When we see Treasury yield volatility revert to more historically normal levels—say, two basis points per day—it may be a sign to take on additional risk in the portfolios.

Flexibility is Crucial

Ultimately, we believe 2023 will be a highly fluid environment as numerous economic and market conditions evolve—perhaps rapidly and unexpectedly at some points. We believe an active, tactical investment approach is well suited to such an environment, as it enables investors to respond to emerging opportunities and burgeoning threats.

In addition, we expect risk mitigation strategies to be helpful in the coming year. As last year demonstrated, it seems clear that the Fed won’t hesitate to take the necessary actions to get inflation under control–a fact that makes any market rallies based on the notion of a “Fed pivot” in its policy inherently unstable. The heightened volatility and uncertainty that we could experience will likely highlight the need for risk management as an important component of many investors’ goals-based planning, as equities likely won’t fully recover until inflation is well and truly tamed.

Past performance is not indicative of future results. The commentary in this report is not a complete analysis of every material fact with respect to any company, industry, or security. The opinions expressed here are not investment recommendations but rather opinions that reflect the judgment of Horizon as of the date of the report and are subject to change without notice. Opinions referenced are as of the date of publication and may not necessarily come to pass. Forward-looking statements cannot be guaranteed.

We do not intend and will not endeavor to provide notice if and when our opinions or actions change. Horizon Investments is not soliciting any action based on this document. This document does not constitute an offer to sell or a solicitation of an offer to buy any security or product and may not be relied upon in connection with the purchase or sale of any security or device. The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money. Any risk management processes described herein include an effort to monitor and manage risk, but should not be confused with and do not imply low risk or the ability to control risk.

The S&P 500 or Standard & Poor’s 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The Dow Jones Industrial Average (DJIA) is a stock market index that tracks 30 large, publicly-owned blue-chip companies trading on the New York Stock Exchange and Nasdaq. The Russell 2000 Index measures the performance of about 2,000 of the smallest publicly traded companies in the U.S. The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities, and collateralized mortgage-backed securities. The MSCI ACWI Index is designed to represent the performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 24 emerging markets. The MSCI World Value Index captures large and mid-cap securities exhibiting overall value style characteristics across 23 Developed Markets (DM) countries. The MSCI World Growth Index captures large and mid-cap securities exhibiting overall value style characteristics across 23 Developed Markets (DM) countries. References to indices, or other measures of relative market performance over a specified period of time are provided for informational purposes only. Reference to an index does not imply that any account will achieve returns, volatility or other results similar to that index. The composition of an index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Individuals cannot invest directly in any index.

Information obtained from third party sources is believed reliable but has not been vetted by the firm or its personnel. Horizon Investments is an investment advisor registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Horizon’s investment advisory services can be found in our Form ADV Part 2, which is available upon request.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments.

© 2023 Horizon Investments, LLC.

HIQFA-012023

NOT A DEPOSIT | NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY