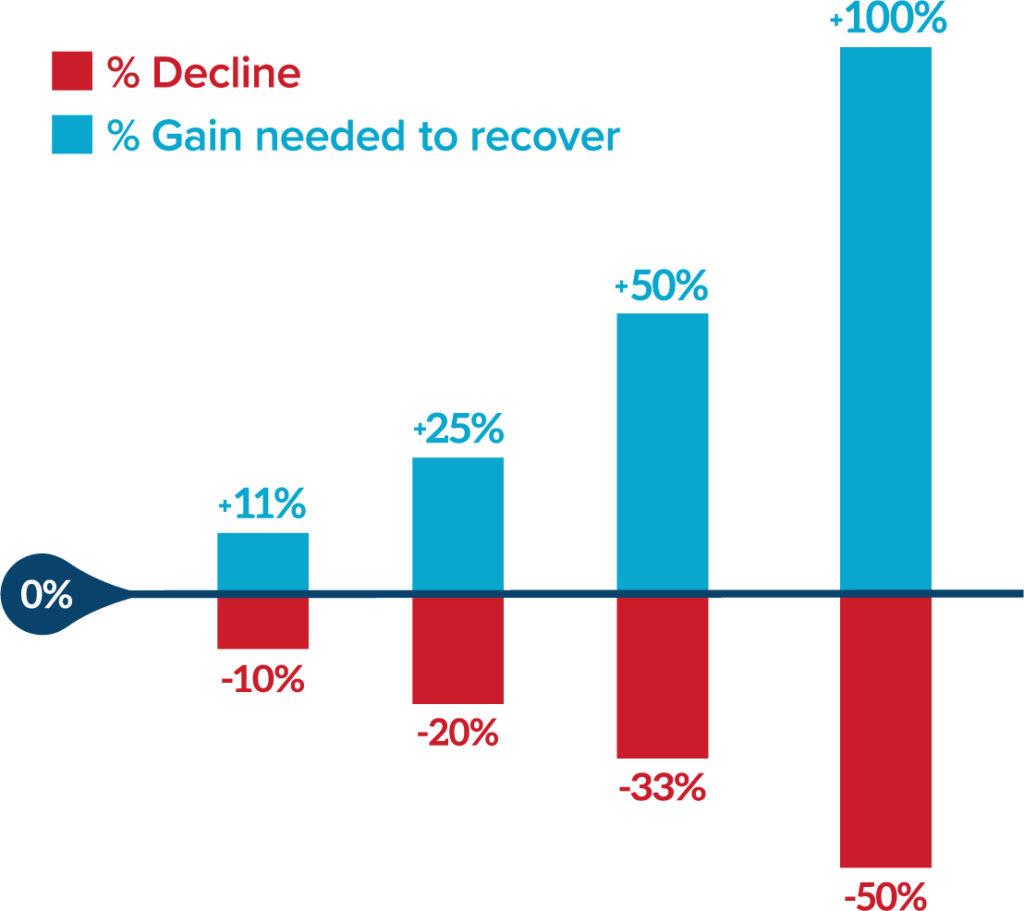

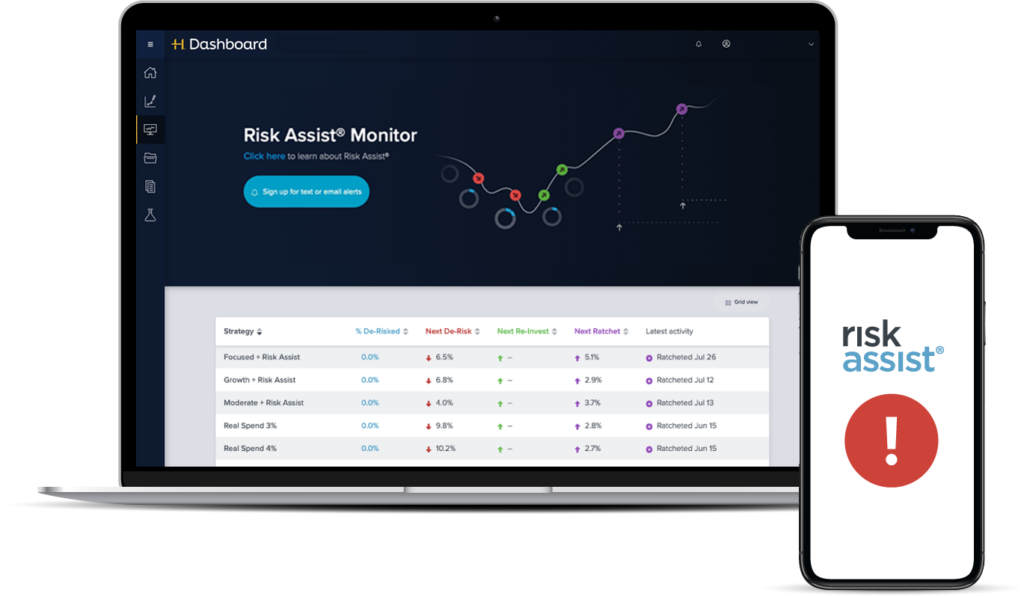

RiskAssist® is NOT A GUARANTEE against loss or declines in the value of a portfolio; it is an investment strategy that supplements a more traditional strategy by periodically modifying exposure to fixed income securities based on Horizon’s view of market conditions. While Risk Assist was designed with the goal of limiting drawdown, Horizon is not able to predict all market conditions and ensure that Risk Assist will always limit drawdown as designed. Accounts with Risk Assist® are not fully protected against all loss. Furthermore, when Risk Assist® is deployed (whether partially or entirely) to mitigate risk for an account, the account will not be fully invested in its original strategy, and accordingly during periods of strong market growth the account may underperform accounts that do not have the Risk Assist® feature. Clients may lose money. Horizon Investments makes no predictions, representations, or warranties herein as to the future performance of any portfolio. Past performance is never a guarantee of future results. There may be economic times where all investments are unfavorable and depreciate in value. Any risk management processes described herein include an effort to monitor and manage risk, but should not be confused with and do not imply low risk or the ability to control risk.