Container ship orders are up 149% this year, mirroring a surge in shipping costs, pointing to another inflation relief valve in the economy

Federal Reserve Chairman Jay Powell repeated his view at last week’s Jackson Hole meeting1 that the jump in inflation would be “transitory’’ as supply bottlenecks clear.

Horizon Investments would largely agree, as our Q2 Focus article on the economy argued that clues on where inflation is headed will likely come from supply and demand dynamics.

Despite all the twists and turns in the economy in the last 18 months, Horizon believes the old adage, the `cure for high prices is high prices,’ still applies. As the saying goes, higher prices often bring additional supplies to market, as buyers experiencing sticker shock often delay purchases – relieving the pressure to jack up prices further.

It reminds us of the physics principle that every action causes a reaction. And frenzied price moves often beget a passionate response. That’s been clear in the collapse of lumber prices,2 the expected moderation in home price increases,3 and a rolling over of wholesale used car prices in June and July.4 (Related Big Number: Home Prices to the Moon? Americans Say `No Thanks’)

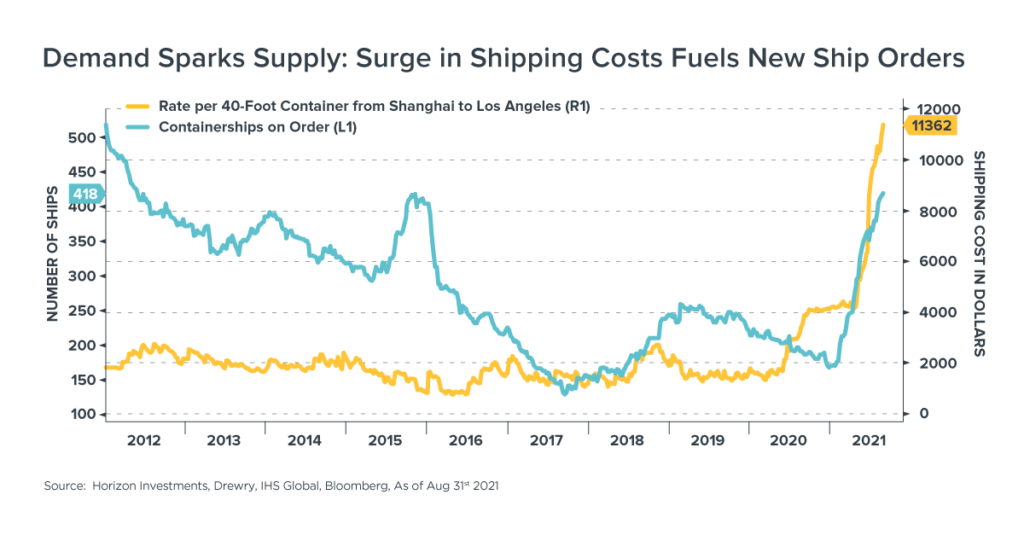

The shipping industry is the latest supply/demand imbalance to grab headlines5 as the price for sending a 40-foot container by ship from Shanghai to Los Angeles currently resembles a chart of a hot meme stock. The price has soared 172% this year. There are manifold reasons behind it: ships are stuck in port traffic, China closed some ports amid Covid outbreaks, and U.S. companies are racing to replenish thin inventories ahead of what’s expected to be a strong holiday shopping season.

What’s been left out of the reporting about shipping is the stunning leap in orders for new container ships. This year’s 149% increase is the biggest eight-month jump in data available back to 2005 (see chart below). Past shipping booms have been snuffed out by overbuilding and softening demand. When and whether that will turn out to be the case this time is unknowable. It takes many months to build and launch a new container ship, so this part of the inflation story may not take a dramatic turn until sometime in 2022. But the ingredients are in place for history to repeat itself.

Past shipping booms have been snuffed out by overbuilding and softening demand. When and whether that will turn out to be the case this time is unknowable. It takes many months to build and launch a new container ship, so this part of the inflation story may not take a dramatic turn until sometime in 2022. But the ingredients are in place for history to repeat itself.

While shipping is probably not something the average investor or advisor thinks about, it’s another example of Horizon’s larger argument: the supply and demand forces that can rein in inflation are quickly appearing as prices leap and more consumers complain that prices are unattractive for houses, cars, or appliances.6 And that adds a layer of nuance to otherwise facile forecasts of where inflation could be headed.

That kind of uncertainty surrounding inflation is embraced by Horizon Investments. As a goals-based investment manager (read our Redefining Risk paper to understand our goals-based philosophy), we take an active approach to managing money, utilizing a multi-disciplinary research process to tilt our portfolios to what we view to be attractive market segments, especially in our Accumulation strategies. Horizon’s tactical process seeks to capture investment opportunities with the aim of producing high, risk-adjusted returns amid an uncertain world.

Additionally, our Real Spend® retirement income strategies seek to combat the specialized inflation and longevity challenges retirees face during their post-career years (Download our distribution stage brochure for further details)

The other big jigsaw puzzle piece surrounding inflation is wages and hiring. Media reports of signing bonuses and hourly pay raises are ubiquitous, but it’s not clear that the higher wages are an economy-wide phenomenon. Nor is it clear whether rising worker productivity completely offsets the cost of the fatter paychecks – as it has in the past two decades – which would short-circuit concerns of spiraling wage inflation.

The July employment report out on Friday will give us more clues, yet the data may be muddied given the surge in Covid cases and extended unemployment benefits. Yet each passing month, we believe, will make the inflation situation clearer and show whether `transitory’ is the right word to use — stay tuned.

To download a copy of this commentary, click the button below.

Further reading:

Ouch! Plunging Chinese Stocks Lag U.S. Equities by 32% This Year

Home Prices to the Moon? Americans Say `No Thanks’

Over 65 Years Old and Working? That’s Not as Common Anymore

Are Glide Path Strategies Still a Good Option for Retirement?

Junk-Bond Yields Don’t Provide Much of a Cushion Against Inflation

Americans Taking Early Retirement May Benefit From a Goals-Based Solution

If Inflation Returns, Bond’s Diversification Power May Disappear

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

It’s Getting Harder to Fund Retirement Using Bonds

1 Investopedia.com, “Powell Signals No Fed Policy Shift at Jackson Hole,’’ August 27, 2021

2 Financial Post, “’Unprecedented Collapse’ in Lumber Prices Forces One Canadian Sawmill to Curb Production,’’ August 23, 2021

3 Forbes.com, “Will The Housing Market Cool Off By Fall?,’’ August 10, 2021

4 Axios.com “Cars Are Back to Being Depreciating Assets,’’ August 9, 2021

5 Reuters.com, “China-U.S. Container Shipping Rates Sail Past $20,000 to Record,’’ August 5, 2021

6 news.Yahoo.com, “Consumers Are Complaining About High Prices More Than Ever,’’ July 19, 2021

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times where all investments are unfavorable and depreciate in value. Clients may lose money. Strategies are subject to risks including general market risk and risks related to economic conditions. Underlying investments fluctuate in price and may be sold at a price lower than the purchase price resulting in a loss of principal. The underlying investments are neither FDIC insured nor guaranteed by the U.S. Government. The investment strategy or strategies discussed may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives and financial circumstances.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2021 Horizon Investments LLC