The S&P 500’s lowest correlation level in years suggests outperformers and underperformers should emerge.

Think the S&P 500’s low volatility these days means all is calm and serene? Think again—and don’t be surprised to see big outperformers and big underperformers among many stocks that make up that index.

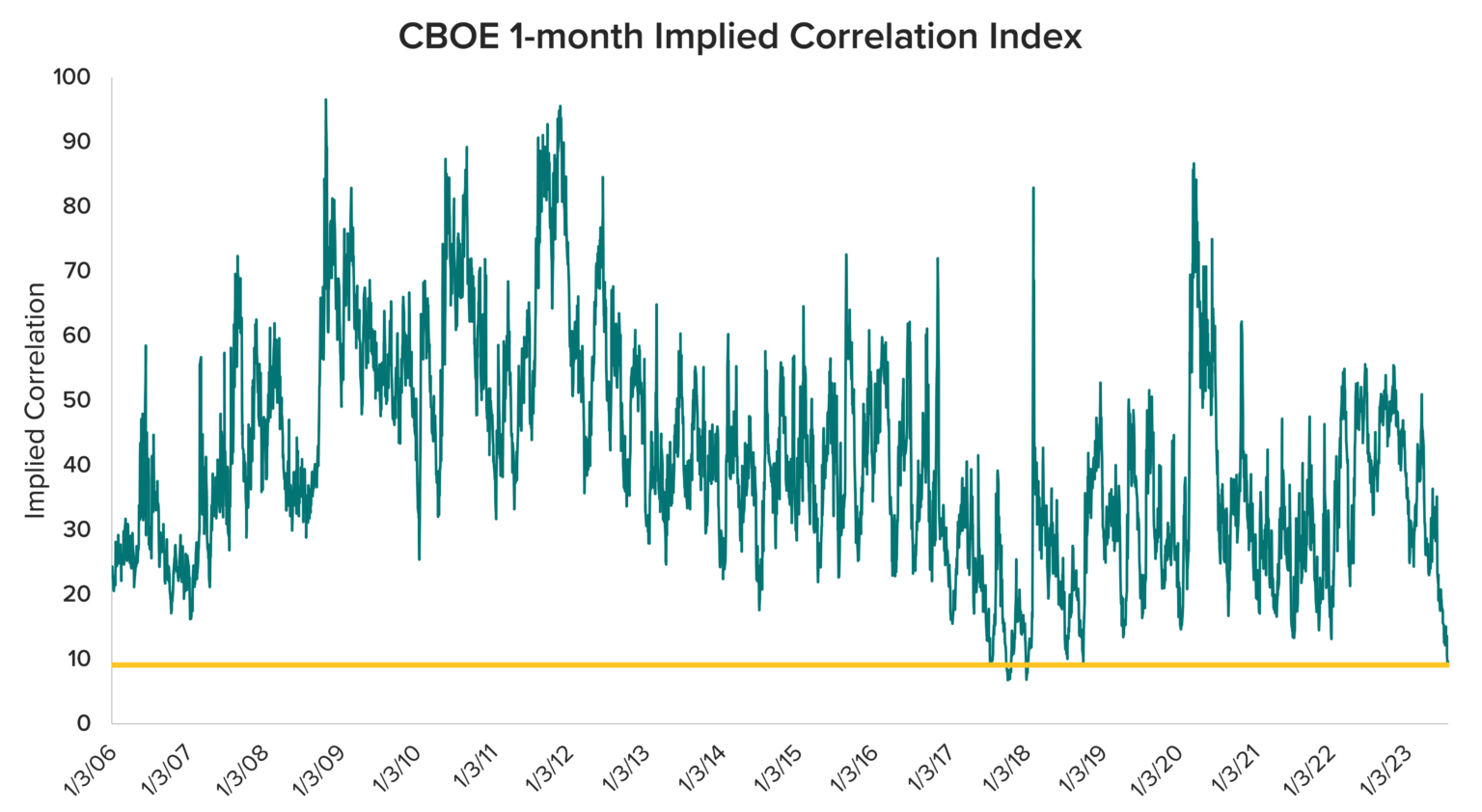

To understand why, check out a metric known as implied correlation. The CBOE 1-Month Implied Correlation Index—essentially a sister index of the widely followed VIX volatility index—measures the extent to which the top 50 stocks in the S&P 500 are expected to move in lockstep.

- An extremely high correlation means most stocks should behave the same way at the same time—moving together almost as a unit.

- An extremely low correlation means individual stocks may be all over the place—with some soaring, others plummeting, and still others going nowhere.

Today, that correlation index has sunk to 9.1—the lowest level since 2017 (see the chart). So while the lake’s surface (the S&P 500 overall) looks placid, there’s plenty of action below the waterline at the micro level.

That could be potentially great news for stock pickers and active managers who seek to identify specific investments they believe are positioned to outperform. For example, as second-quarter earnings season kicks into high gear this week, we expect emerging themes such as artificial intelligence—and companies’ ability to incorporate it effectively into their business models—to play a significant role in separating the winners from the losers across all market sectors.

Disclosures

This commentary is written by Horizon Investments’ asset management team.

Past performance is not indicative of future results.

The S&P 500 or Standard & Poor’s 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The CBOE 1-Month Implied Correlation Index measures correlation market expectations by quantifying the spread between the S&P 500 index implied volatility and the average single-stock basket component implied volatility. VIX is the ticker symbol and the popular name for the Chicago Board Options Exchange’s CBOE Volatility Index, a popular measure of the stock market’s expectation of volatility based on S&P 500 index options.

It is not possible to invest directly in an index.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money.

Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves risk of loss, and in periods of market growth, risk mitigation strategies can be expected to lag in performance behind equity strategies that do not focus on risk mitigation.

This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed.

Other disclosure information is available at hinubrand.wpengine.com.Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2023 Horizon Investments LLC