Inflation was hot last month, but it seems all but certain to get even hotter amid the Ukraine war.

The Consumer Price Index (CPI) rose 7.9% year-on-year in February, notching a fresh 40 year high. While the increase met Wall Street’s expectations, providing a feeling of relief that it wasn’t worse, that’s of little comfort.

Overshadowing CPI is the specter of much higher inflation in the months ahead, fueled by soaring prices for oil, gasoline, grains and metals amid the unprecedented trade and business-dealing sanctions put on Russia by both governments and corporations.

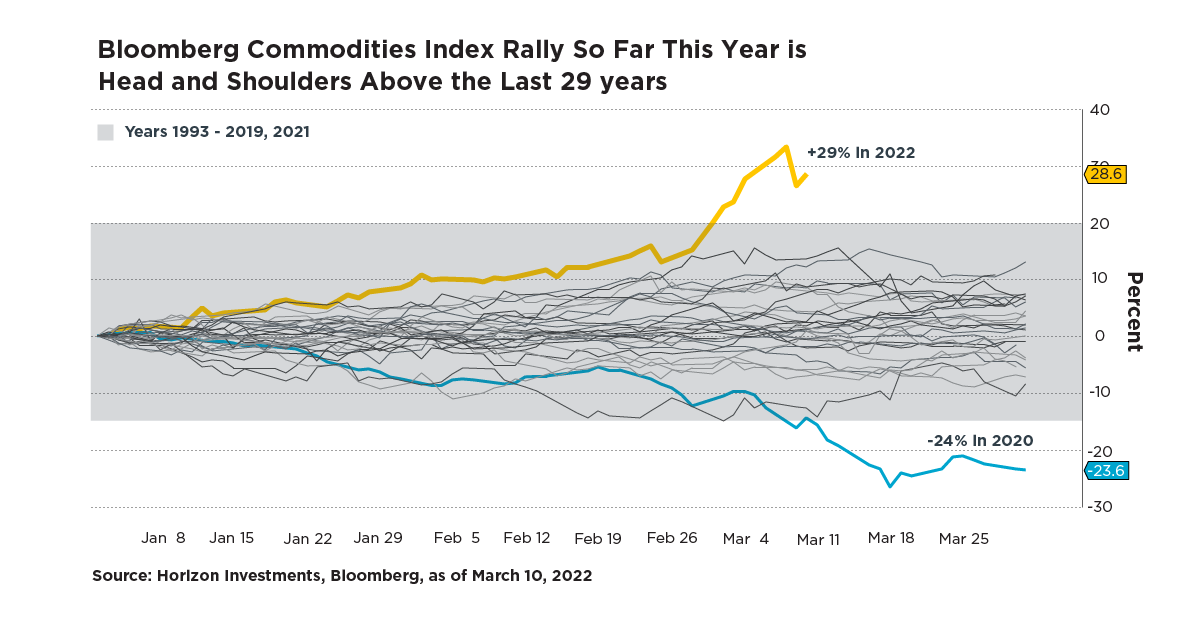

The Bloomberg Commodities Index was up 29% through March 10, with the bulk of that gain coming since the hostilities began. This year sticks out like a sore thumb in the chart below, which compares the commodities index’s performance from the first quarter of 2022 to the prior 29 years’ first quarters.

The parabolic rally in commodities since the Russian/Ukraine war began threatens not only to cause even larger jumps for CPI, it’s also darkening the outlook for the world economy. Global GDP growth is now seen at 4.0%, down from 4.3% before the war started, according to Bloomberg’s survey of economists.1

Investors are concerned the soaring cost of living may cause stagflation (meaning slow GDP growth and high prices), or a recession. Stock and bond markets experienced large swings this week as investors grappled with a multitude of possible economic outcomes caused by the war and the reaction in markets to the fallout from the West’s sanctions and Russia’s responses.

For the average American, they’re likely going to feel the initial effects of the commodities rally at the gas pump and in the supermarket. In the first nine days of March, the national average gasoline price rose 19% to a record $4.32 a gallon2. The cost of food will likely rise, too. U.S. wheat futures soared 29% to a record in the first seven trading days of March, while corn futures were up 5.4%, according to Bloomberg data. That comes on top of last month’s gains of 21.9% and 11.4%, respectively, for those futures contracts.

To be sure, there are offsetting positives that may soften commodities’ impact on the U.S. economy and American households – read our Big Number on oil prices and U.S. incomes.

We think the uncertainty and unpredictability of the war’s direction, and the market’s reaction to the fast-changing situation, could create a market environment where tactical, active investment management can be used for goals-based investors. Equity market returns are already quite different this year as traders parse where the war’s pain could be most intense. European stocks so far have borne the brunt of it. The MSCI Europe index was down 12.9% year to date through last Friday versus a loss of 9.4% for the S&P 500 and 7.2% for the MSCI Asia Pacific Index, according to Bloomberg.

There’s a divergence in performance in the bond market, too. Surprisingly, the junkiest bonds, rated CCC, have outperformed amid the war’s financial and economic jitters. The Bloomberg Caa U.S. High Yield Index was down 3.3% year to date through March 4, compared to a 5.4% loss for the Bloomberg U.S. Investment-Grade Corporate Bond Index.

We understand that for goals-based investors, roller-coaster markets may drive a desire to mitigate risk amid heightened fears of stagflation or a recession. Horizon Investments offers the Risk Assist strategy, which is designed with a disciplined, automated process to dynamically “de-risk” a portfolio during times of severe market stress. In doing so, it seeks to curb the behavioral investing impulses that can derail financial plans. Risk Assist also uses an automated process to ‘’re-invest’’ as market conditions improve, with the aim of keeping clients on track to achieve their goals.

1Source: Bloomberg, L.P. survey of 39 economists as of March 9, 2022

2Source: American Automobile Association daily national average gasoline price per gallon via Bloomberg

Further reading:

Q4 Focus Magazine: The Good, The Bad and The Ugly of Inflation

2022 Outlook: The Next Unprecedented Year

Any Retirement Salvation? Puny Yields in a Rate-Hiking Cycle

Disappearing Foreclosures Add to Housing Inflation Pressures

Is Inflation Pressure Easing? Factory Input Costs Tumble Again

Abnormally Low Rates Remain Even If Fed Hikes in 2023

Americans Give Up on Inflation Remaining Tame

If Inflation Returns, Bond’s Diversification Power May Disappear

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

It’s Getting Harder to Fund Retirement Using Bonds

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, contact Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

Other disclosure information is available at hinubrand.wpengine.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2022 Horizon Investments LLC