Few investors decided to ride out the March 2020 stock market swoon; just 26% of 1,000 randomly selected investors reported that they did nothing amid the rout, according to DALBAR’s 2021 Quantitative Analysis of Investor Behavior report

When financial markets went haywire in March 2020, people pursuing a traditional financial plan may have been tempted to do something – anything – rather than let their dreams evaporate. The plunge and quick rebound to new stock market highs provides a clear example of why Horizon Investments believes the right course of action is to build a goals-based financial plan focused on staying on track to reach your objectives rather than paying attention to the stock market’s roller-coaster ride.

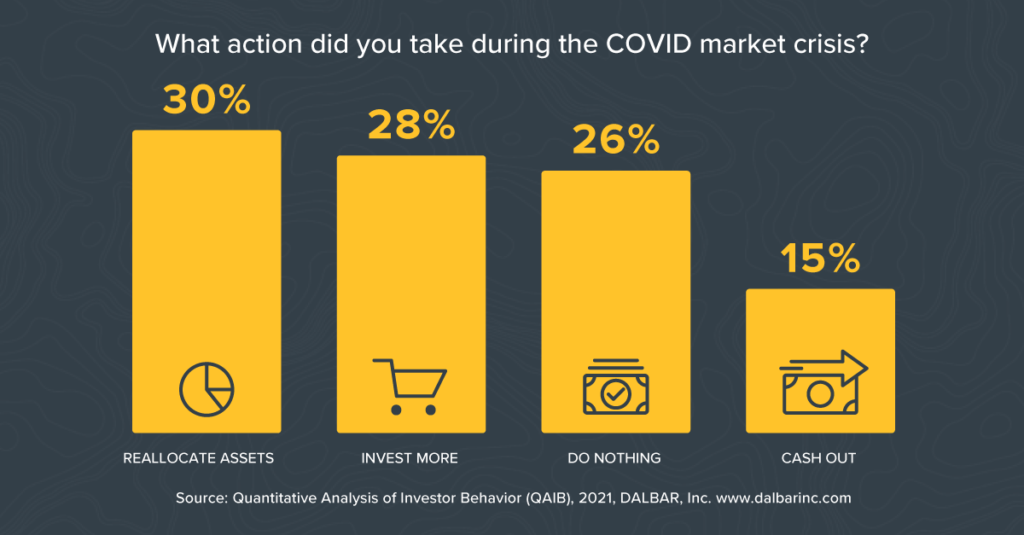

New data suggest many people in March of last year were unable to avoid emotion-driven trading. Among those surveyed by DALBAR Inc. for its recently released 2021 Quantitative Analysis of Investor Behavior report,1 15% of investors cashed out while 30% reallocated assets. 26% of respondents said they did nothing, and the remainder invested more.

A key component of goals-based financial planning is to conquer emotional decisions by focusing people on what they’re saving and investing for; that can help tamp down the urge to trade which can damage long-term returns.

March 2020 highlighted three important investing ideas for people who are on a goals-based journey:

- It’s a good idea to discuss with your advisor ahead of time how to react to the inevitable

gyrations in markets and then stick to those decisions. - The market’s movements are impossible to predict – and so there’s no way to reliably pick

tops and bottoms in prices. In other words, we believe market timing is a poor investment

strategy. - If fear and emotion drive someone to sell stocks during a market swoon and then they

have to decide when to get back in, that could leave them further away from reaching their

goal than if they had done nothing.

New research on investor behavior demonstrates the value of filtering out short-term market noise, especially if your goal lies far in the future. Researchers showed people short- and long-term stock market charts to see if the different time frames affected their behavior. They found that “investors exhibit significantly higher trading volume if they view short-term as opposed to long-term price charts. Consequently, they also pay substantially higher trading fees which results in lower average net returns.”

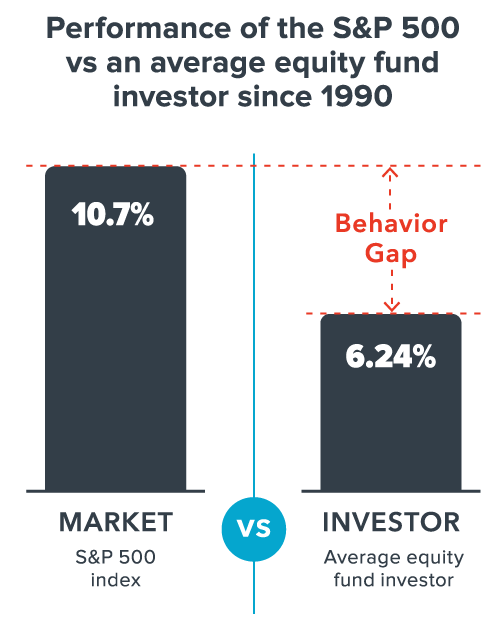

Real-world data supports the researchers’ findings. The underperformance of the average equity-fund investor versus the S&P 500 index – likely due to trading and poor timing – amounts to 4.5% over the last 30 years, according to DALBAR.1

A maxim of goals-based planning is that focusing on short-term market movements can be dangerous to your long-term financial health. Horizon Investments considers that maxim in all of the investment strategies we’ve built. Because we believe what truly matters at the end of a goals-based journey is being able to live life on your terms. Learn how Horizon Investments tackles the challenge of managing emotion-driven behavior by visiting protect.horizoninvestments.com.

1 Quantitative Analysis of Investor Behavior (QAIB), 2021, DALBAR, Inc. www.dalbarinc.com

2 Borsboom, Charlotte and Janssen, Dirk-Jan and Strucks, Markus and Zeisberger, Stefan, “History Matters: How Short-Term Price Charts Hurt Investment Performance” (March 23, 2021, Social Science Research Network ID 3722819)

To download a copy of this commentary, click the button below.

Further reading:

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

It’s Getting Harder to Fund Retirement Using Bonds

Disappearing Junk Bond Yields

Soaring Innovation Companies Go Cold as Interest Rates Rise

If Inflation Returns, Bond’s Diversification Power May Disappear

Inflation Could Be Coming, Are You Ready?

Widows Are at Higher Risk of Falling Into Poverty

Small-Cap EPS Growth Expected to Be 4x Faster Than S&P 500

Biden, Trump Agree: Make America’s Growth Great Again

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, please reach out to Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

To discuss how we can empower you please contact us at 866.371.2399 ext. 202 or info@horizoninvestments.com.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2021 Horizon Investments LLC