Is the seventh month of the year a stock investor’s best friend?

While scorching temperatures continue to sweep across much of the country, equity investors may want to look for a different kind of heat that could be headed their way soon.

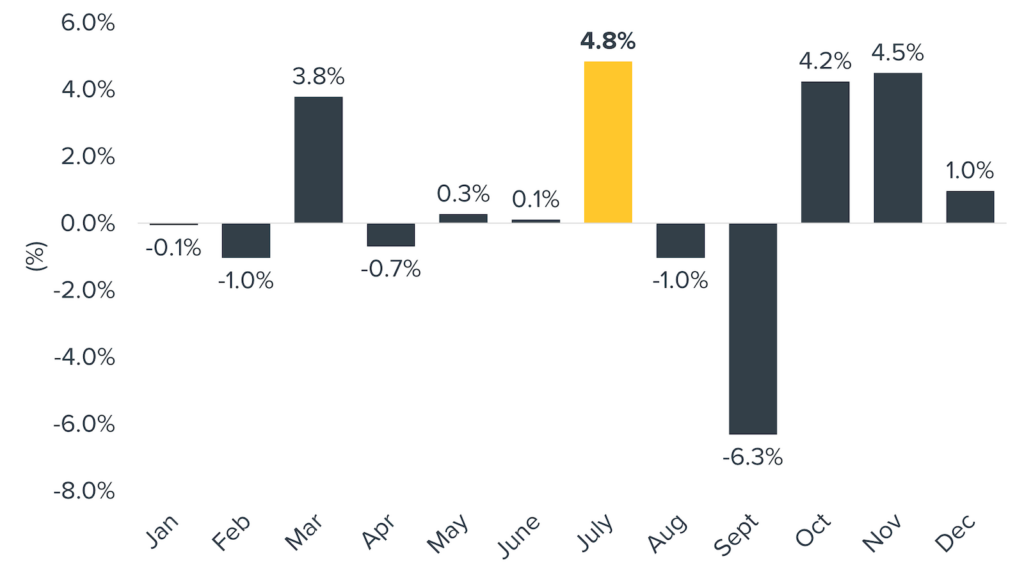

The reason: Stocks in July have gained 4.8% on average over the past three calendar years—outperforming all other months (see the chart).

S&P 500 Average Monthly Returns (2021 – 2023)

Source: Bloomberg, calculations by Horizon Investments, as of June 21, 2024. Indices are unmanaged and do not have fees or expense charges, both of which would lower returns. It is not possible to invest directly in an index.

What’s more, the seventh month hasn’t just posted strong returns in recent years: July has also outperformed, on average, over the past two decades!

One possible reason: Stock market volume is typically very light during July, as much of Wall Street heads out on vacation. Therefore, new developments (especially surprising ones) may have an outsized impact—and more market-moving power.

At Horizon, we’ve got our eyes on several upcoming items on July’s calendar, including:

(in chronological order)

- The French election: The early July election in France could change the country’s balance of power in ways that impact Eurozone stocks.

- Unemployment: Despite a surprisingly strong May jobs report, the U.S. labor market has been somewhat softening. The first week of July will reveal the latest about unemployment.

- Inflation: In mid-July, we’ll see whether recent cooler-than-expected inflation data may be the start of a trend—or just a blip.

- Earnings: The second-quarter earnings season starts at the end of the second week of July. We’ll evaluate whether the first quarter’s strong results have carried over.

- AI trends: The last two weeks of the month will see earnings results from mega-cap names such as Microsoft, Google, and Amazon—which will offer insights into the state of the artificial intelligence market and its overall impact.

- Interest rates: The Fed’s meeting during the final two days of July is its last meeting until September.

There’s no way of knowing whether this July’s market performance will echo history, of course—but we’ll be closely sizing up plenty of potential opportunities in the coming weeks.

The Standard and Poor’s 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. References to indices, or other measures of relative market performance over a specified period of time are provided for informational purposes only. Reference to an index does not imply that any account will achieve returns, volatility or other results similar to that index. The composition of an index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Information obtained from third party sources is believed reliable but has not been vetted by the firm or its personnel.

This commentary is written by Horizon Investments’ asset management team. Past performance is not indicative of future results. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves the risk of loss.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money. This commentary is

based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. The opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed. Other disclosure information is available at hinubrand.wpengine.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2024 Horizon Investments, LLC.