It’s been bleak days—and lots of them—for bond investors.

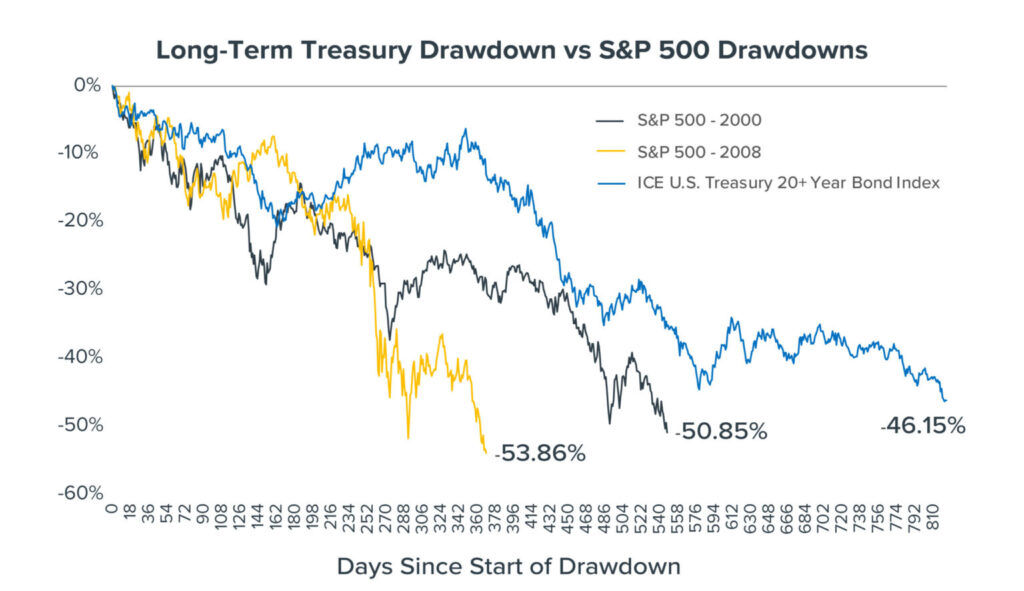

As the fourth quarter begins, bonds are on track for a third consecutive calendar year of losses—an unprecedented outcome, should it come to pass. Long-term Treasury bonds’ slog lower has lasted a whopping 823 trading days (as of 9/29/23), as rising rates have pummeled fixed-income investors with a -46.14% total return over that time (see the chart).

Amazingly, this current bond drawdown has lasted longer than the stock market slides of 2000 to 2002 (when the tech bubble burst) and 2008 to 2009 (the global financial crisis)—with a return nearly as bad as we saw in both bear markets.

The path to higher interest rates that we’ve been on has caused significant pain for many bond investors. There is some good news, however:

- When rates peak—and we may be there or close—the economy and stocks may be set up for success. Keep in mind that the long-term drivers of equilibrium interest rates are inflation and economic growth, and increases in productivity primarily drive growth. Therefore, we see falling inflation coupled with rising bond yields potentially as a healthy sign incentivizing more productive investment.

To see what that could mean, consider that the 10-year Treasury’s yield averaged 6.65% and inflation averaged 3% during the 1990s—a decade that saw the S&P 500 deliver an 18.2% annualized return. - With rates much higher than a few years ago, longer-duration bonds look relatively attractive. Example: Aggregate bonds today yield around 5.4%, with a duration (interest-rate sensitivity) of approximately six years. If rates rise by one percentage point over the course of a year, those bonds’ total return would be just below 0%. But a one percentage point drop in rates would result in a nearly 12% total return.

From an asset allocation perspective, exposure to short-duration bonds has paid off well in recent years. However, as rates have increased, the risk-return tradeoff has begun to shift in favor of longer-term bonds—a development we are watching closely within our core bond positioning.

Disclosures

This commentary is written by Horizon Investments’ asset management team.

Past performance is not indicative of future results.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments.

The S&P 500 index is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. The ICE U.S. Treasury 20+ Year Bond Index, is market value-weighted and is designed to measure the performance of U.S. dollar-denominated, fixed-rate securities with minimum term to maturity greater than twenty years. Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. An index’s composition may not reflect how a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Individuals cannot invest directly in any index. Indices are unmanaged and do not have fees or expense charges, which would lower returns.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money.

Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves risk of loss, and in periods of market growth, risk mitigation strategies can be expected to lag in performance behind equity strategies that do not focus on risk mitigation.

This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed.

Other disclosure information is available at hinubrand.wpengine.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2023 Horizon Investments LLC