Market volatility spikes—but how much should you worry about it?

The first full week of August started with a bang: The S&P 500 dropped 3% in one day while the VIX—known as Wall Street’s “fear index”—spiked from around 23 to an intraday high of 66 before settling at a still-elevated 38.

A key reason for all this excitement was an employment report showing fewer jobs were created in July than expected, although not enough to signal a major problem in the labor market. If that seems a bit odd, you’re not alone. Big spikes in the VIX—an index that essentially measures expected future stock market volatility—tend to occur when extremely significant events unfold.

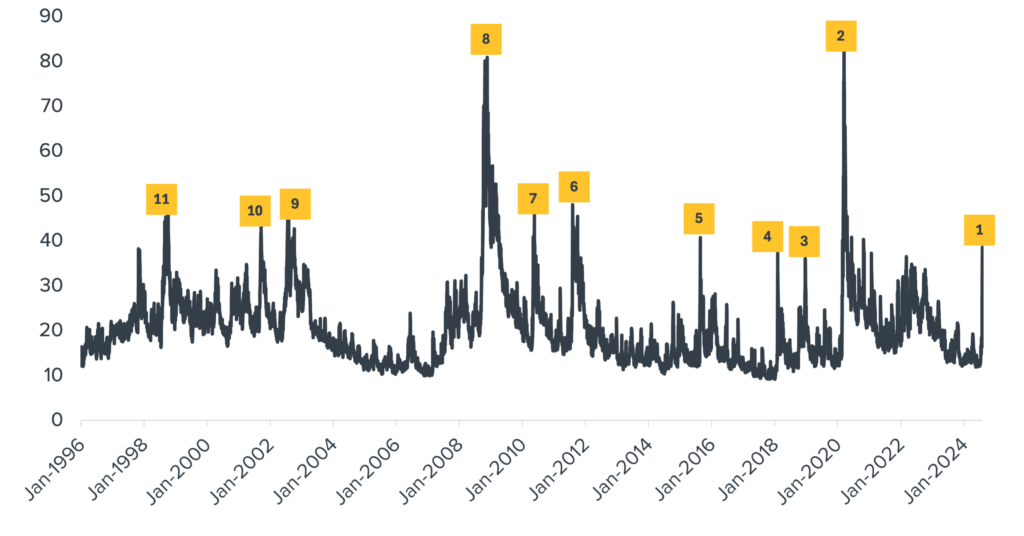

The VIX soared from approximately 14 to over 80 in 2020, when it became clear that a global pandemic was rapidly developing (see #2 in the chart below). Other notable moments include the 2010 European debt crisis that threatened the global financial system (#6) and the September 11 attacks (#10).

A History of VIX (“Fear Index”) Spikes

Source: Bloomberg, calculations by Horizon Investments, as of August 5, 2024.

But such a sharp move higher following a somewhat disappointing jobs report, particularly in an economy that’s experienced some of the lowest unemployment in decades, strikes us as an overreaction likely to be short-lived. Similar VIX increases—such as when there were concerns about Fed policy in late 2018 (#3) or China’s currency devaluation in 2015 (#5)—have tended to fade relatively quickly, and markets typically marched higher.

The takeaway: Don’t let a spike in market volatility throw you off your goals-based investment plan.

The CBOE Volatility Index (VIX), also known as the Volatility Index, is a market index that measures the expected volatility of the U.S. stock market over the next 30 days. The VIX is calculated using the weighted prices of S&P 500 put and call options traded on the Chicago Board Options Exchange (CBOE). The S&P 500 is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. References to indices, or other measures of relative market performance over a specified period of time are provided for informational purposes only. Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. The composition of an index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility, or tracking error targets, all of which are subject to change. Information obtained from third party sources is believed reliable but has not been vetted by the firm or its personnel. This commentary is written by Horizon Investments’ asset management team.

Past performance is not indicative of future results. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves the risk of loss. The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. The opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed. Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2024 Horizon Investments, LLC.