- ServicesHow we help advisors guide clients through their life journeys

Intuitive technology that supports your advisors

- Solutions

Marrying investment strategies to financial planning

Investment management consulting service

Customizable actively managed single-stock portfolio

Intuitive, investor-friendly planning softwareGoals-based investing with Horizon Funds

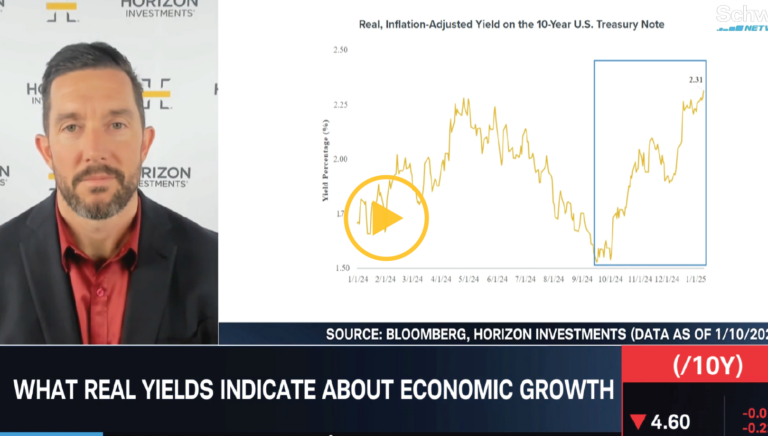

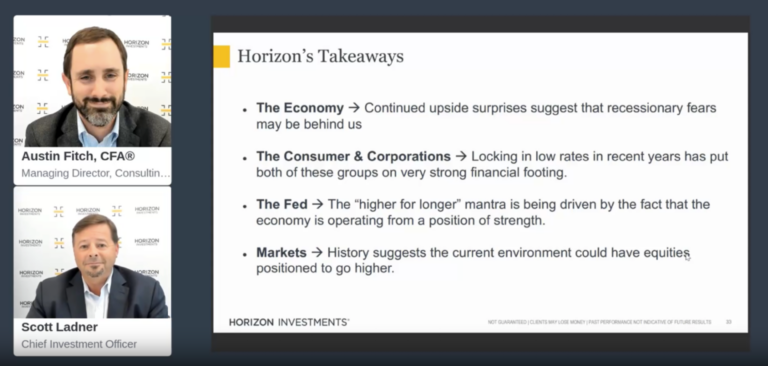

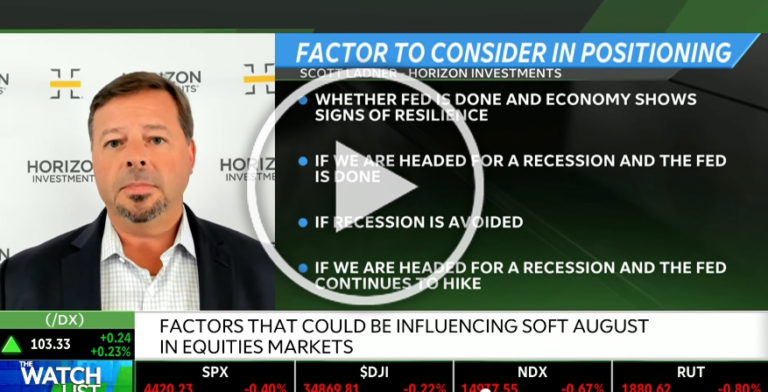

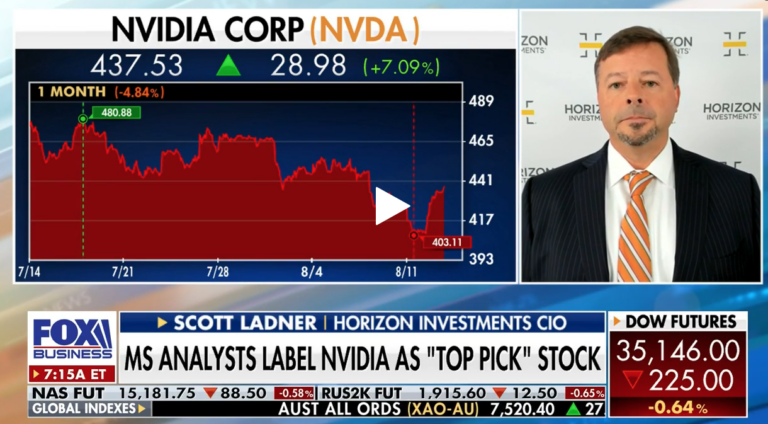

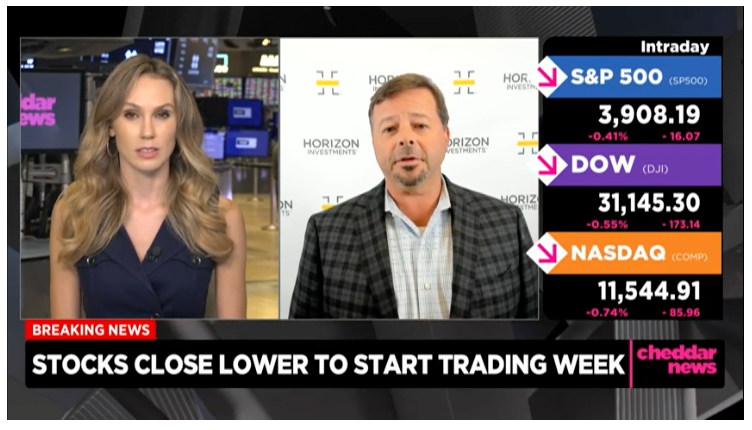

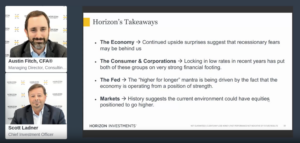

- Insights

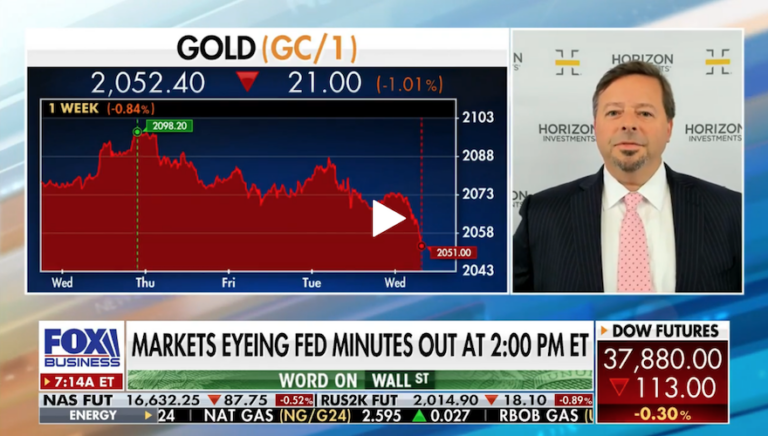

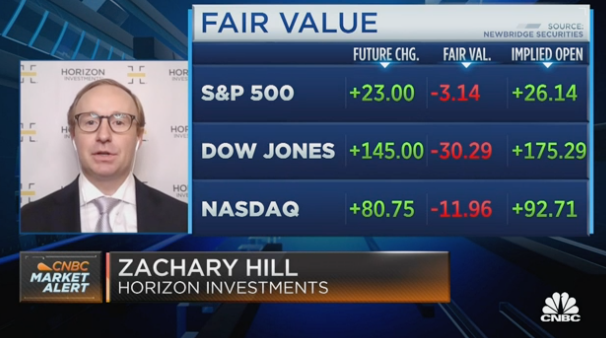

Our latest thoughts, in and on the media

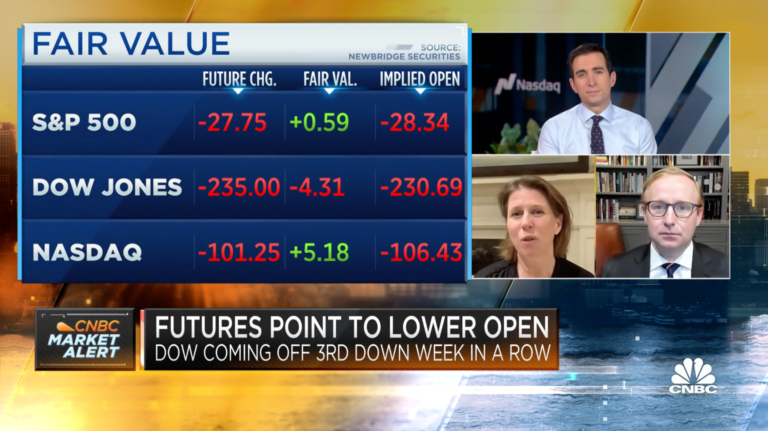

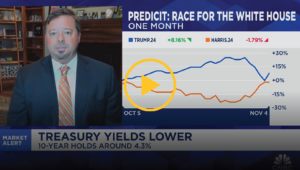

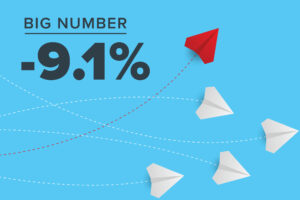

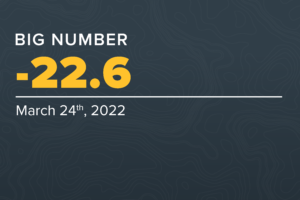

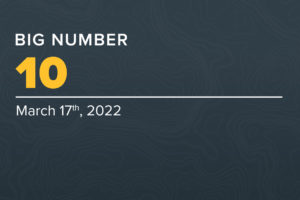

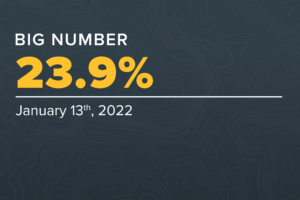

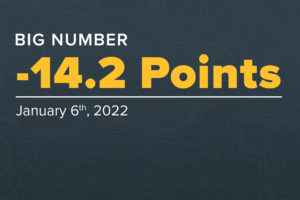

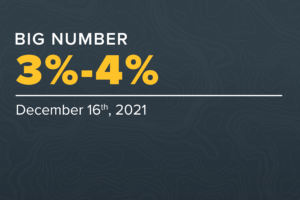

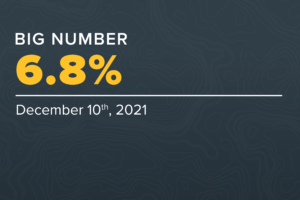

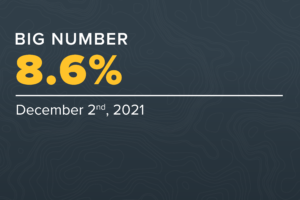

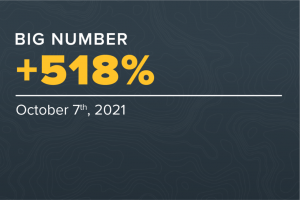

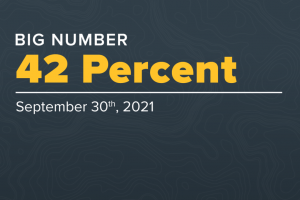

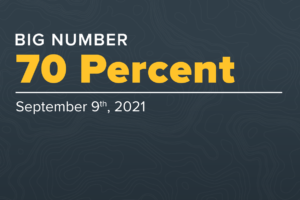

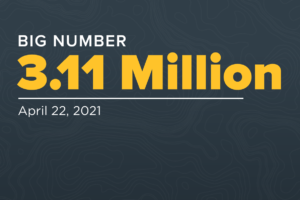

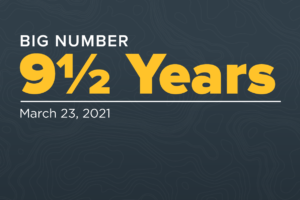

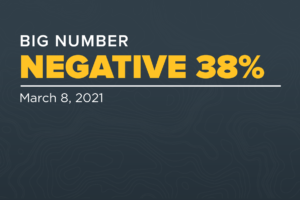

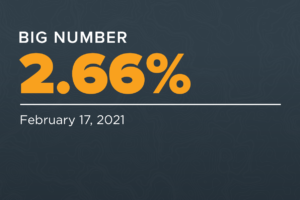

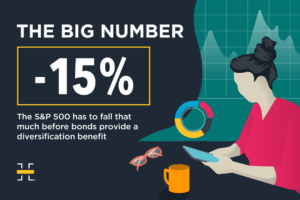

Our regular look at the market’s most revealing number

Our in-depth thinking on goals-based investing

- Who We Are

What we do—and why we do it

What we do—and why we do it

Our culture and open positions

Meet our senior teamFind your contact at Horizon InvestmentsMeet our investment team - Login

- Contact