Overview

Investors faced a wall of worry during the second quarter that proved to be insurmountable for stocks, bonds and virtually every other asset class.

A whirlwind of forces converged to create high levels of stress and uncertainty about the economy, inflation, and global political stability. Those forces included:

- War in Ukraine causing energy prices to surge across the globe

- Covid-19 lockdowns in China further crimping already tight supply chains

- Persistently high inflation, including the biggest rise in prices in 40 years in May

- Negative GDP growth in the first quarter of 2022—the first drop in GDP since 2020

- Increasingly hawkish Fed policy rapidly pushing interest rates higher

Given that environment, it wasn’t shocking to see a growing number of economists and other market watchers predicting a recession soon. Nor was it surprising that the Consumer Confidence Index fell sharply, hitting its lowest point since 2013.

Stocks reacted to these conditions by sliding into a bear market, commonly defined as when equity markets are down 20% or more from their most recent all-time high. Bigger picture, the S&P 500 Index through June suffered its worst first half of a calendar year since 1970—down -19.96% year-to-date. Fixed income fared better but still poorly. The Bloomberg U.S. Aggregate Bond Index was down -10.35% during the quarter as rising rates put pressure on bond prices. The lone bright spot was commodities, which benefited as oil prices surged above $100 a barrel and gas prices hit record highs due to the Russia-Ukraine war’s impact on oil supplies.

Where we are today

These significant, and in some cases historic, developments leave investors asking two fundamental questions as we enter the third quarter:

- Where do we stand today?

- What is likely to occur in the coming months?

To assess current conditions, it’s important to examine three key factors that are having an outsized impact on the state of both the economy and the financial markets: inflation, the Federal Reserve Board, and consumers’ attitudes and spending.

Factor #1: Inflation

Despite the seemingly never-ending headlines about rising prices, there are incremental signs of good news regarding inflation.

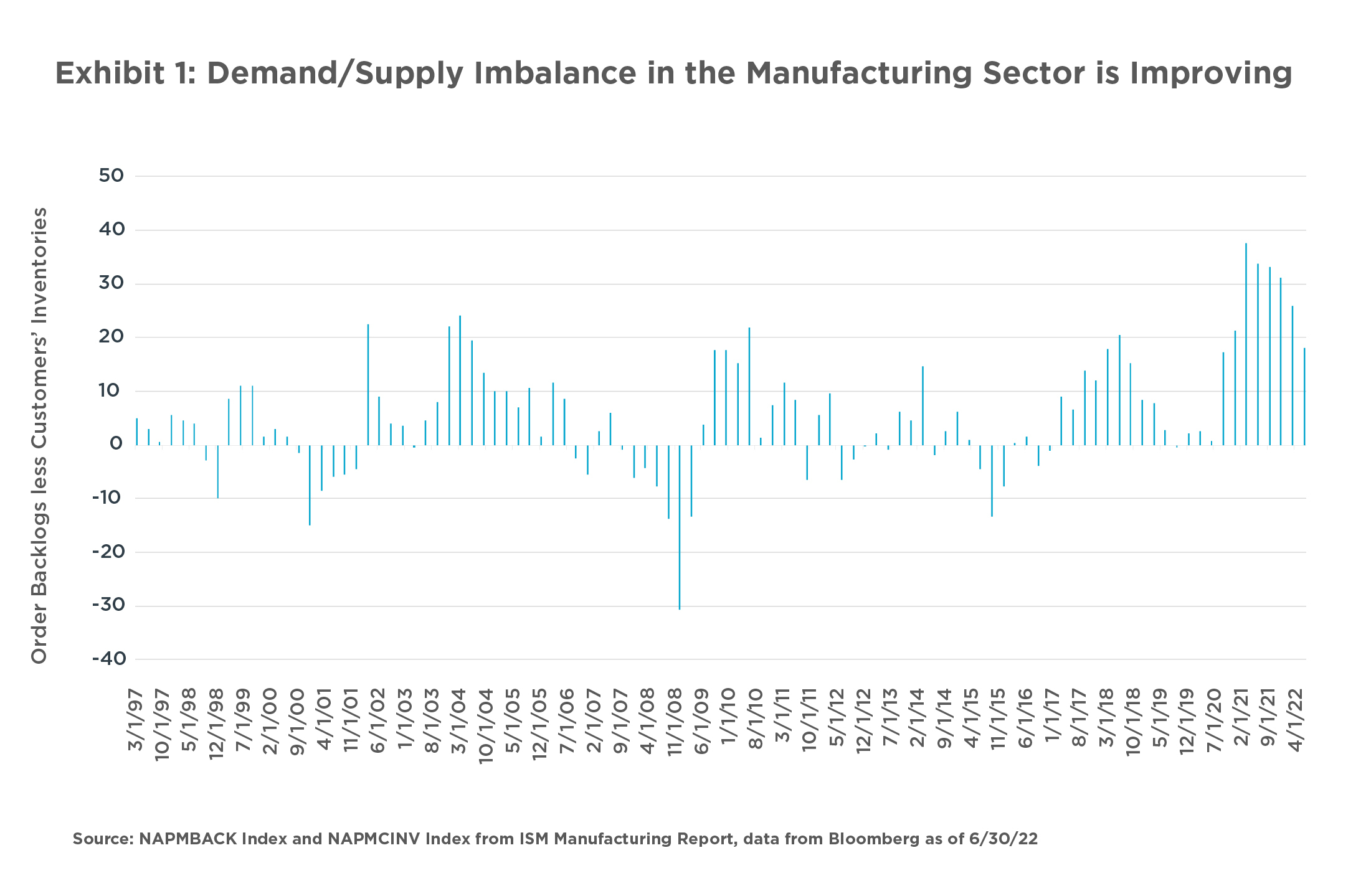

One such sign is an improvement in the imbalance between the supply of goods available and consumer demand for those products. One key driver of inflation, of course, has been the significant supply constraints met with excessive demand we have seen during the pandemic and beyond.

Today that supply-demand imbalance is improving. Exhibit 1 shows that new orders for goods relative to companies’ inventories are reverting toward more historical norms from what we saw during the worst of the pandemic in 2021. That said, it’s clear this reversion is occurring at a frustratingly slow, choppy pace—and that it is difficult to say when things will get back to “normal.” However, while demand is still much higher than supply, some of the worst inflationary pressures appear to be behind us.

The shifting nature of consumer demand is an important component in the current inflationary landscape. Right now, inventories of goods at retailers are far above their pre-pandemic trend, while future orders for those goods have plummeted to levels not seen since the earliest days of the pandemic and the 2008 financial crisis.

This development reflects a rapid post-pandemic shift in consumer preference–away from goods and toward services and experiences—that has left retailers with far too much costly inventory to store. In fact, as the second quarter ended, some major retailers (including Target, Wal-Mart, and The Gap) were considering refunding money for customer returns but allowing customers to keep the merchandise anyway.

Factor #2: The Fed/interest rates

The Federal Reserve Board’s increasingly aggressive efforts to tighten financial conditions and tamp down inflation have been met with mixed reviews by investors. However, one conclusion a growing number of economists and others have reached in recent weeks is that the Fed’s campaign is likely to result in a recession. In June, for example, economists surveyed by the Wall Street Journal said there was now a 44% chance of a recession—up from just 18% in January.1

One result of growing recession expectations is the market now expects the economy to need fiscal stimulus from the Fed as early as next year, and the market is now pricing in one interest rate cut sometime between June 2023 and December 2023.

Factor #3: The U.S. Consumer

High inflation, record-high gas prices, and the growing chorus of voices predicting a recession are significantly hurting the attitude and outlook of U.S. consumers—whose spending, of course, is responsible for generating approximately two-thirds of the U.S. economy’s growth.

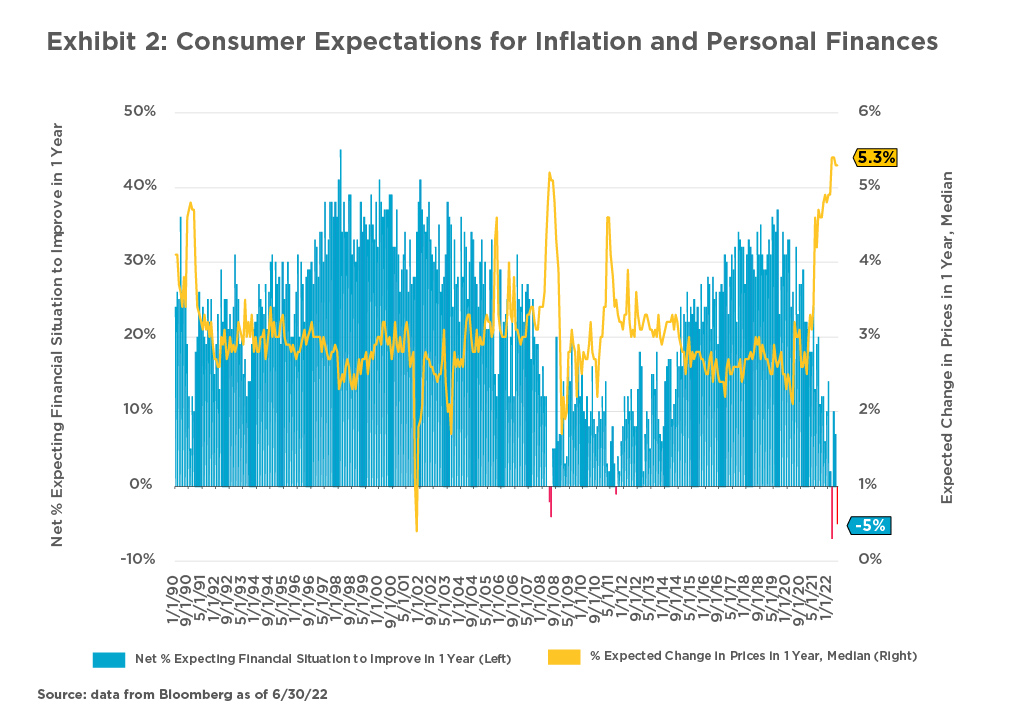

As the blue area line in Exhibit 2 reveals, consumers are more likely to say they expect their financial situation to worsen over the next 12 months than they are to say it will improve. In fact, the last time consumers were this negative about their financial futures was in the depths of the 2008-2009 global financial crisis.

One driving force behind that gloom: U.S. households today expect inflation to run at a 5.3% annual rate over the next year (see the yellow line in Exhibit 2) –up significantly from 4.2% one year ago. According to Fed Chairman Powell, this sharply higher expectation was a key reason why the Fed opted to raise short-term interest rates by 75 basis points in June instead of by just 50 basis points, as had earlier been expected.

1 Harriet Torry and Anthony DeBarros. “Recession Probability Soars as Inflation Worsens.” The Wall Street Journal, June 19, 2022

Three possible scenarios

Given factors such as these, how are issues around inflation, the economy, consumer spending and financial markets likely to play out in the coming months?

Addressing that question requires investors to confront the fact that the outlook today is extremely uncertain, and clarity is limited, given how rapidly events are unfolding and how many crosscurrents are at play in the current environment.

Rather than forecast one central expectation, we think it makes more sense to examine three potential scenarios that could unfold in the coming months–and point out some of the indicators that may tell us which of these scenarios is taking shape.

- In a rapidly deteriorating scenario, long-term inflation expectations would likely become de-anchored–increasing wage pressures and likely forcing the Fed to be more aggressive, leading to weaker earnings and economic growth.

- In a slowly improving scenario, pessimism would persist in the near term, but consumer strength driven by lower inflation would eventually win out.

- In a rapidly improving scenario, an exogenous event would likely cause inflation to fall sharply–mitigating current concerns about the economy and enabling the Fed to adopt a more neutral stance as the economy regained momentum.

Let’s examine each of these potential scenarios in greater detail.

Scenario #1: Rapid Deterioration

One outcome is that conditions worsen both significantly and quickly from where they are today. Developments and evidence that suggest a rapid deterioration in conditions is occurring would likely include the following:

Inflation stays stuck at high levels. Month-over-month Consumer Price Index readings, a measure of the average change in prices paid by consumers for goods and services, would stay around their current 6-month average of just over 0.7%. Annualizing that pace would likely lead to headline price increases in the 8-9% range, in line with our current reading and certainly at risk of altering expectations if sustained.

Corporate earnings forecasts are cut materially. If the Fed continues to be aggressive with its monetary policy in the face of firmly entrenched high levels of inflation, earnings estimates would likely fall quickly as real economic growth slows and corporate margins get squeezed by high input costs.

Labor market remains too hot. Continued excessive tightness in the job market would likely prompt wage pressures—which have been falling of late—to reassert themselves.

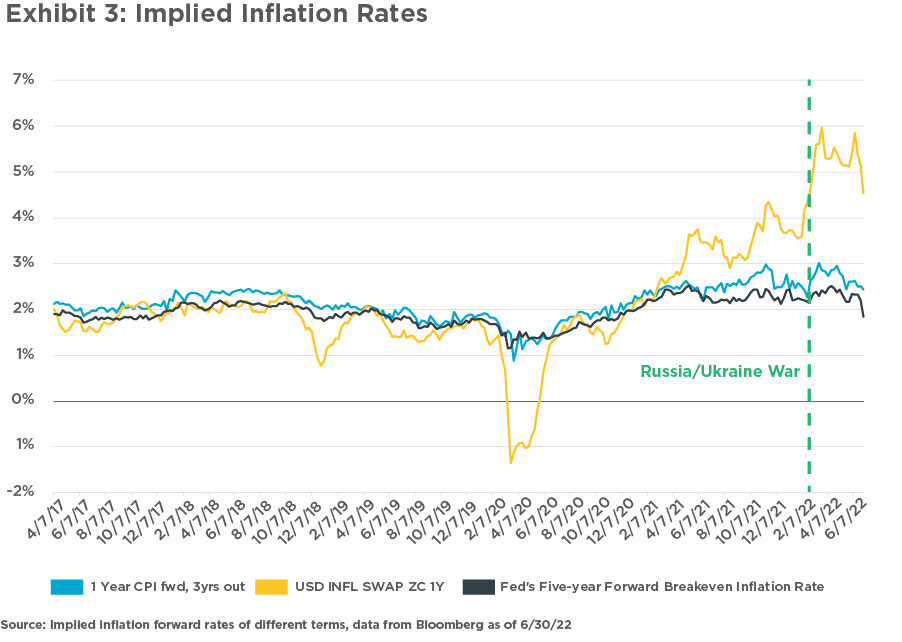

The Fed keeps raising interest rates aggressively. Currently, longer-term inflation expectations are well anchored in a narrow range. As seen in Exhibit 3, inflation expectations for 2022 are extremely high by historical standards. In particular, note how those expectations soared in the wake of the Russia-Ukraine War (represented by the green dotted line). But expectations looking out three years and five years from now remain remarkably consistent and low–between 2% and 3%.

Clearly, the market doesn’t see today’s inflation becoming a self-perpetuating cycle. However, in a rapidly deteriorating environment, we would expect to see those longer-term expectations become de-anchored and shoot up rapidly—prompting the Fed to raise rates for an extended period with no foreseeable end in sight. In some ways, such a scenario would resemble conditions seen in the 1970s and early 1980s, when the Fed waged a war on high inflation that caused interest rates to soar.

The impact of this scenario on financial markets would likely include the following outcomes:

- Global stock prices sinking lower

- Global bond yields rising higher at first, but falling later

- Credit spreads widening

- Commodities performing well initially, but poorly later

Scenario #2: Slow Improvement

Alternatively, conditions could improve slowly and incrementally—with either a smooth transition, or a more start-stop cadence. Signs that this slow improvement scenario is unfolding would likely include:

Inflation moderates. In this scenario, the inflation rate would fall to around 0.2% to 0.3% on a month-over-month basis—but would do so at a slow pace.

Demand for labor softens somewhat. Despite a relatively pessimistic outlook among small businesses, hiring plans appear to remain strong. In a slowly improving scenario, demand for labor would soften moderately, decreasing wage pressures and, in turn, overall inflation pressures. Likewise, layoffs would increase at a modest pace from the current levels.

Consumer spending patterns become more balanced. Recently, consumer spending on staples—necessities—has been a large driver of inflation. In a slowly improving environment with moderating inflation, those spending habits would start to be more in balance—with spending on discretionary categories (“nice to haves”) rising and staples spending falling.

Investors in this environment would likely experience outcomes such as:

- Global stock prices would remain range bound around current levels (until perhaps the 4th quarter of 2022)

- Global bond yields also would remain range bound

- Credit spreads would slowly improve

Scenario #3: Rapid Improvement

A third potential outcome is a rapid improvement in economic and market conditions. This is the least likely of the three scenarios, largely because it would be predicated on a significant and unpredictable event— such as the end of the Russia-Ukraine War. Signs that such an acceleration is starting would likely include:

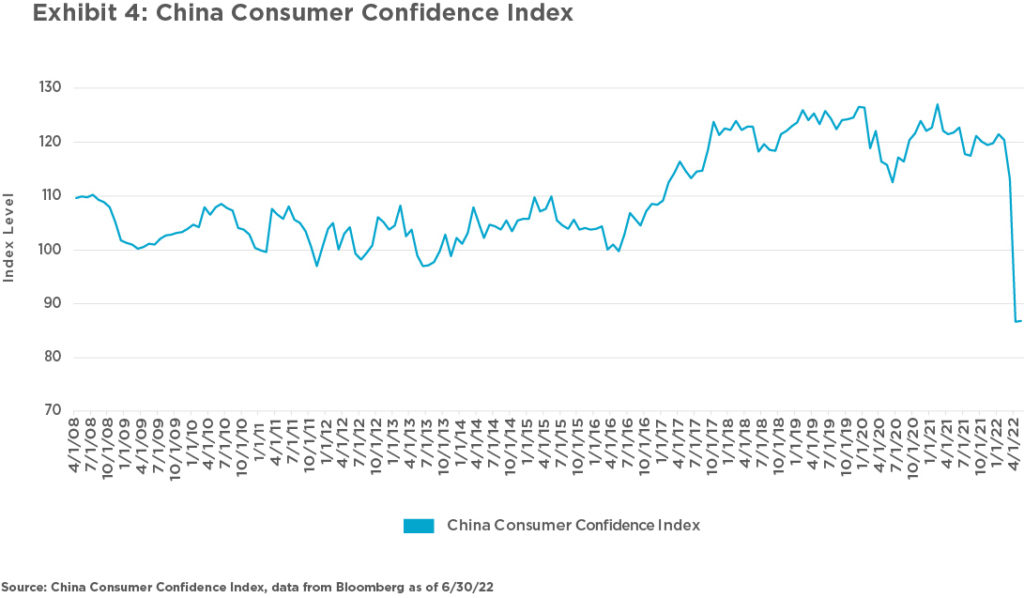

The end of the Russia-Ukraine War and/or the end of Zero-Covid policy in China. Supply chain bottlenecks could be greatly mitigated by more full participation of citizens in countries like China due to the lifting of Covid restrictions on the public/workers. That, in turn, could help further balance the global supply-demand picture and reduce current inflationary pressures. The end of China’s zero-Covid policy would also likely result in a rapid jump in Chinese consumer confidence (and therefore spending), which has fallen to historic lows (see Exhibit 4). Such a jump would likely shore up the medium-term outlook for global economic growth.

Likewise, an end to the Russia-Ukraine War would eliminate many of the issues (such as energy rationing) pushing prices higher–as well as improve European consumer confidence and enable industrial production in Germany to once again ramp up.

Sharply declining inflation expectations. In particular, oil prices would likely fall to the $70 to $90 range if fighting between Russia and Ukraine ended and Russian oil supplies returned to the global market. In the wake of gas falling back to perhaps $3 per gallon, consumer confidence would likely soar.

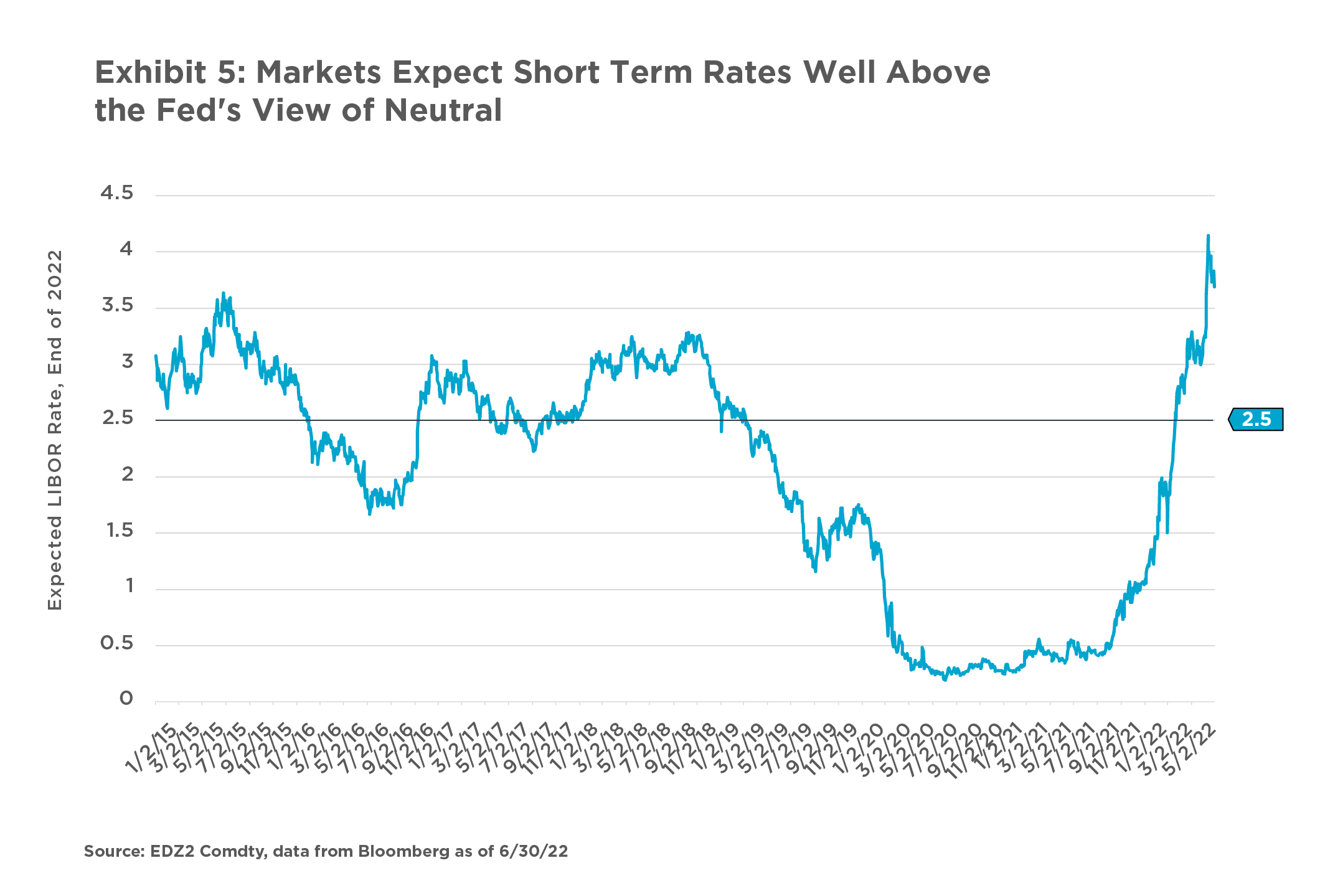

The Fed pivoting from hawkish to neutral monetary policy. If inflation pressures are mitigated, we would see expectations for the Federal Funds Rate to return closer to what we consider a neutral position of around 2.5% (see Exhibit 5).

Upward revisions to corporate earnings forecasts. Investors would boost their expectations for corporate profit growth and other financial results in an environment where inflation fell rapidly, and recession risk was largely removed from the picture. An additional positive sign would be strong guidance about future financial results from the companies themselves.

The potential implications of this scenario for financial markets include:

- Equities move significantly higher, especially growth stock sectors, as financial conditions loosen up once again

- Bond yields fall modestly, with the 10-year U.S. Treasury yielding around 2.5%

- Credit spreads tighten back to pre-pandemic levels

Conclusion

All eyes will continue to be on the rate of inflation, the magnitude of the Fed’s restrictive monetary policy, and the confidence and spending patterns of the U.S. consumer. Developments both at home and abroad are expected to shape those key factors’ evolution in the coming months and their resulting impact on the performance of the economy and the financial markets.

The rapid pace of change in economic conditions coupled with the heightened uncertainty we’re seeing today means that actions like making definitive forecasts—and engaging in market timing based on such forecasts—seem even more unreliable than usual. Instead, we will be watching for signposts and other evidence that may offer insight into the current path so we can base decisions on the reality of where we are—and where we anticipate we are heading.

The commentary in this report is not a complete analysis of every material fact in respect to any company, industry or security. The opinions expressed here are not investment recommendations, but rather opinions that reflect the judgment of Horizon as of the date of the report and are subject to change without notice. Opinions referenced are as of the date of publication and may not necessarily come to pass. Forward looking statements cannot be guaranteed.

We do not intend and will not endeavor to provide notice if and when our opinions or actions change. Horizon Investments is not soliciting any action based on this document. This document does not constitute an offer to sell or a solicitation of an offer to buy any security or product and may not be relied upon in connection with the purchase or sale of any security or device. The investments recommended by Horizon Investments are not guaranteed. There can be economic times where all investments are unfavorable and depreciate in value. Clients may lose money.

The S&P 500 or Standard & Poor’s 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities and collateralized mortgage-backed securities. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. Individuals cannot invest directly in any index.

Information has been obtained from sources considered to be reliable, but the accuracy and completeness cannot be guaranteed.

Horizon Investments is an investment advisor registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Horizon’s investment advisory services can be found in our Form ADV Part 2, which is available upon request.

Horizon Investments Gain Protect Spend and the Horizon H are registered trademarks of Horizon Investments.

© 2022 Horizon Investments, LLC.

HIM072022

NOT A DEPOSIT | NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY