Investors won’t have to dip into their savings to pay for their Thanksgiving feasts this year, but they may choke on their pumpkin pie when they see the bill.

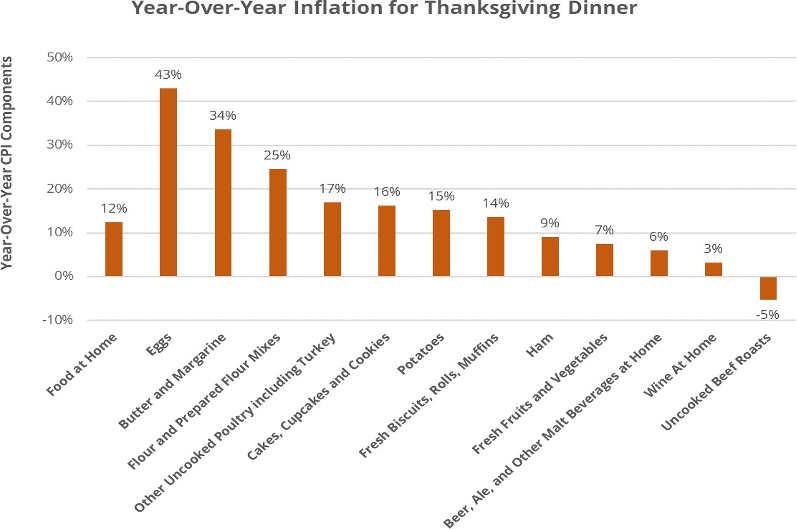

The reason, of course, is inflation. Food prices overall are up 12% over the past year, but some key ingredients that go into Turkey Day dinners have seen much sharper increases. The eggs, butter, and flour you need for those delicious pies, cakes, potatoes, and gravy? They’ll cost you (respectively) 43%, 34%, and 25% more than in 2021. And you’ll shell out 17% more for that turkey.

The good news: If you’re game for a nontraditional holiday, you can get by on the cheap. Ham prices are up less than 10% from last year—and beef roasts are a screaming bargain, down 5%. (A real value play, there!)

Either way, wine drinkers shouldn’t notice much of a dent in their vino budgets this year.

Regardless of how you celebrate, all of us at Horizon wish you a very Happy Thanksgiving!

Source for all data: Bureau of Labor Statistics, 10/31/22

Disclosure:

This commentary is written by Horizon Investments’ asset management team.

Past performance is not indicative of future results.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments.

This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed.

References to indices or other measures of relative market performance over a specified period of time are provided for informational purposes only. Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. An index’s composition may not reflect how a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change.

Individuals cannot invest directly in any index.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2022 Horizon Investments LLC