Inflation Sticker Shock Is Spreading to More Everyday Products

It’s not your imagination. Month after month, the prices of more and more goods and services are going up at a shockingly fast rate.

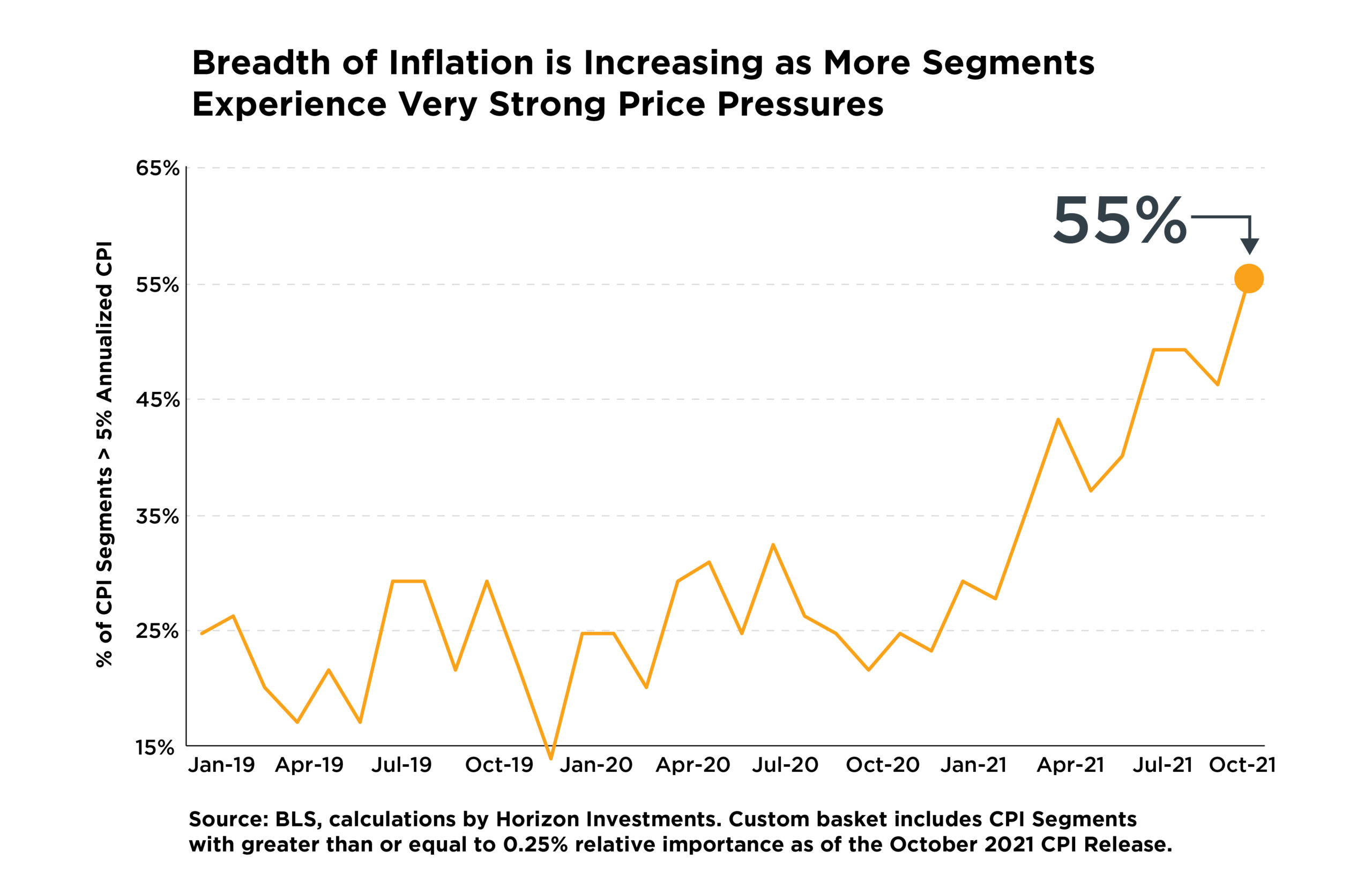

In October, the prices for more than half of the items in the Consumer Price Index (CPI) were rising at a rate of at least 5% per year, according to Horizon Investments’ calculations using Bureau of Labor Statistics data. A year ago, the same stat applied to only a quarter of the CPI’s items.

Among the wide range of things that got more expensive last month: gasoline, natural gas, electricity, used cars, full-service meals, flour, cereal, rice, beef, fish, pork, tools, and hardware. The rapid spread of fast-rising prices is spurring calls for politicians to find ways to reduce the pain.

Focusing just on the price increases, however, misses the larger inflation forces that are at play, forces that could still make this a temporary, supply-chain driven spike in the cost of living.

Worker productivity and technological innovation are two important deflationary forces. They played a major role in the tame inflation environment of the pre-pandemic years. Horizon Investments’ view is that if someone is going to argue that we’re going to experience rampant, long-lasting inflation, then they’re saying that the productivity and innovation engines in the U.S. are broken. We don’t agree with that. See our Q3 Focus, “2022 Outlook,” for articles on inflation and the economy that describe why we believe that this bout of inflation shall pass once supply chains are repaired.

Third quarter corporate earnings reports suggest productivity and innovation are still strong forces. Operating profit margins rose to 15% for the companies in the S&P 500 Index, according to Bloomberg data. Corporations have generally stayed ahead of price pressures through efficiency gains, labor-saving technology, product substitutions or price hikes for their own products.

Fatter profit margins are a testament to the flexibility, adaptability, and speed of change that can take place in modern companies, and helps explain why equities haven’t tumbled amid rising inflation.

Still, our view doesn’t diminish the potential pain inflation can cause retirees and those saving for retirement and other long-term goals. Higher prices are a direct threat as inflation-adjusted investment returns could buy less in the future. Inflation can be particularly difficult for investments in fixed income, especially for those whose returns are currently negative when taking the cost of living into account.

In today’s unusual period of time, Horizon Investments believes in the importance of adding as much equity exposure as someone is comfortable with for reaching their long-term financial goals. That includes people nearing or in retirement. They may need their nest egg to support them for a long time, potentially 25 years or more, with inflation being a key detail in determining their standard of living.

To put it simply: we believe equities currently offer more opportunities for inflation-beating returns than fixed income. And the current cost of living increases exemplify why our Real Spend® retirement income strategies tilt in favor of stocks rather than bonds in the quest to overcome longevity risk.

Further reading:

Baby Boomer Retirees May Be Crushed by Zero

3Q Focus Magazine: Outlook 2022, The Next Unprecedented Year

The Biggest Retirement Fear? Outliving My Money

Are Glide Path Strategies Still a Good Option for Retirement?

If Inflation Returns, Bond’s Diversification Power May Disappear

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, contact Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

The Real Spend retirement income strategy is NOT A GUARANTEE of ongoing income or against market loss. Real Spend is an integrated asset allocation strategy that uses an investment model to (i) plan savings amounts and overall asset allocation during the distribution phase of retirement planning, (ii) compute target retirement wealth, assuming a retirement budget and a spending-investment strategy after retirement, (iii) compute the transition from the accumulation phase to the retirement phase and (iv) generate the spending-investment strategy after retirement. Our retirement spending-investment strategy uses an allocation model that replenishes cash needed for withdrawals. Before investing, consider the investment objectives, risks, charges and expenses of the strategy. This strategy is not an insurance product with payments guaranteed. It is an investment strategy that invests in marketable securities. These products will fluctuate in value. There is a possibility of outliving the assets if market performance is lower than forecasts used in planning, or if longevity is longer than anticipated. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments, the Horizon H and Real Spend are registered trademarks of Horizon Investments, LLC

©2021 Horizon Investments LLC