Inflation is on everyone’s lips, and rightfully so. The new $1.9 trillion stimulus package – and proposals for even more federal spending – raise the prospect that strong GDP growth and a tsunami of consumer spending will unleash higher prices for everything. Isn’t that the reason that such an obscure product like lumber is getting so much attention even though its inflationary impact is miniscule?

For goals-based advisors and their clients, the critical questions are: Is the dis-inflationary trend of the last few decades morphing into persistently higher inflation and rising interest rates; and does a goals-based plan need to change to reflect the potential reality?

Inflation is a difficult thing to define, in part because each person’s buying habits affect their perception of it. If you’re not buying lumber, then the meteoric rise in price may not be apparent to you other than in news stories.

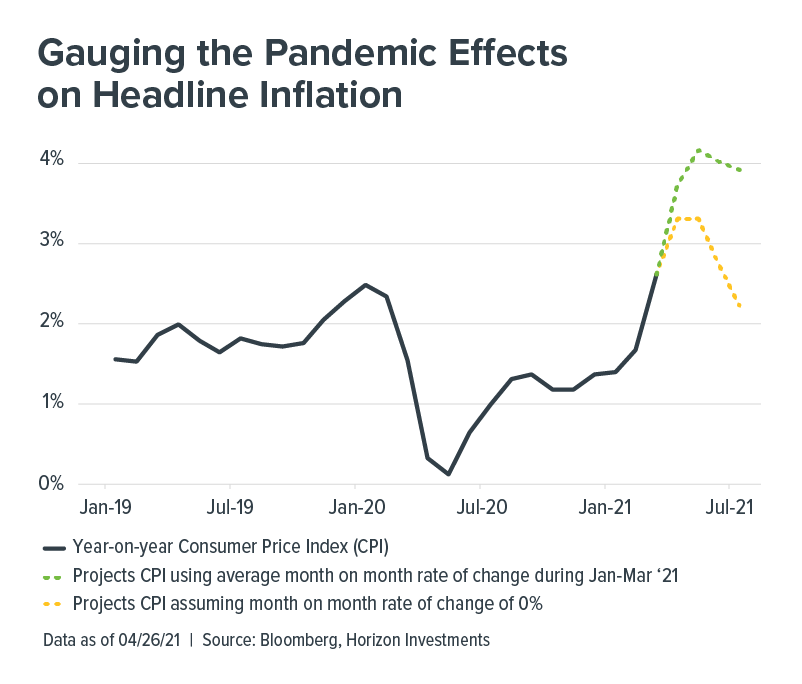

For the purposes of this blog post, we need a common inflation barometer, and Horizon Investments’ goals-based perspective focuses on the Consumer Price Index (CPI). The index affects markets and is the topic of news stories that influence the public’s view. Will CPI readings get hotter? Yes, if you’re measuring this year’s prices against 2020’s depressed readings when the economy was shut down. Economists talk about that as a “base effect,” meaning part of the expected CPI surge reflects the fact that last year was so weak.

Inflation headlines are coming

The chart above illustrates Horizon’s projection for initially hot inflation readings, and then a cooling off. The green line uses this year’s average month-to-month increase in CPI and applies that to the next few months. The hypothetical scenario produces a 4%+ year-on-year inflation rate at the peak.

Even a benign scenario – assuming no month-to-month acceleration in CPI (the yellow line) – has headline inflation printing over 3%, which would be a nine-year high.

But the important point is that once we get past April, May and June, the year-on-year surge fades, because by that point in 2020 inflation was rebounding, and so the “base effect” on the data also fades. An everyday example of the phenomenon comes from the gas station.

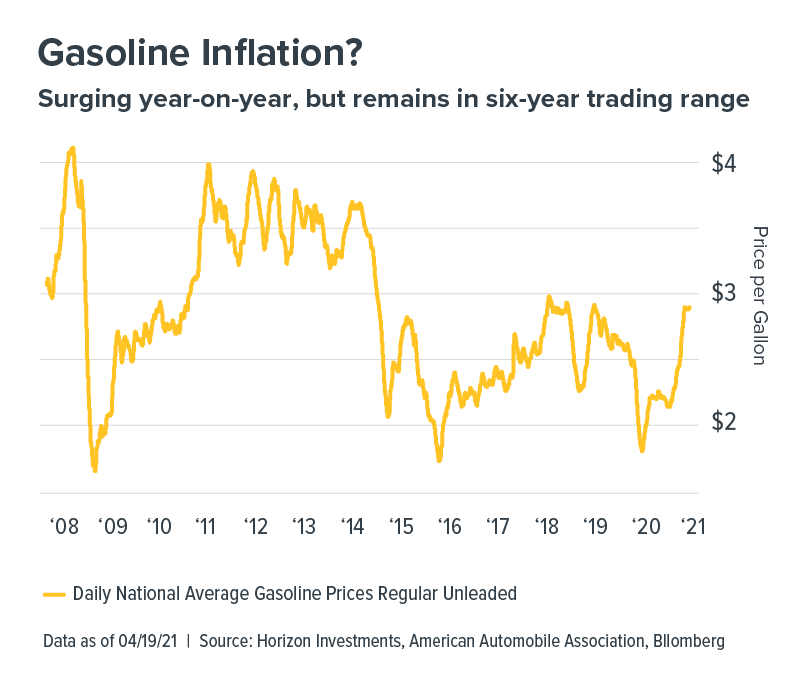

Pump prices are 22% higher compared to March last year!! And the national average price is nearing $3 a gallon when it was closer to $2 just a few weeks ago!! True. But remember that recency bias colors our perception. What’s forgotten is that last year’s price was unusually low, and in the months ahead the year-on-year increase will be smaller than it was in March. We also should remember that current gasoline prices are normal compared to the last few years. (FYI, there’s no supply/demand imbalance in gasoline like there is in lumber. Gasoline days of supply is currently 26, according to Energy Department data as of April 21, inline with the average of 24 days’ supply for the 20 years stretching from January 2000 to March 2020.)

CPI measures hundreds of things

When measuring inflation, gasoline is just one of hundreds of items tracked by CPI. The year-over-year surge in pump prices was offset to some degree by items which were tumbling in price with people at home, such as clothing and auto insurance. It’s important to remember that whatever headline is driving the inflation-to-the-moon narrative, it’s usually just a small part of what’s being measured. CPI is constructed as an average of what people spend their money on. And its most-important items, shelter and food, are given the most weight, as they affect everyone.

|

Most Important Items in Headline CPI

|

|||

|---|---|---|---|

|

SHELTER

|

FOOD

|

HEALTH

|

ENERGY

|

|

33%

|

14%

|

9%

|

7%

|

Source: Bureau of Labor Statistics

But what shelter does not measure is the price that someone pays to buy a new or existing home. Instead, what the government’s shelter component measures is the ongoing cost of owning a home or renting an apartment. And that rate of inflation is much less than the news media headlines that shout about home-buyer bidding wars and record high home prices in some areas, which affect only a portion of the population.

Disinflationary drivers haven’t gone away

The big inflation stories lately focus on the supply/demand imbalances, such as we see in lumber or homes or the stuck ship in the Suez Canal. Those problems can happen during economic rebounds and amid changing consumer tastes, and historically they’ve been solved sooner rather than later.

Horizon Investments’ view is that the pandemic has not weakened the long-term disinflationary drivers of the last 20 years: global trade, disruptive technology, rising worker productivity and an aging population. We believe those factors will re-assert themselves once normalcy returns, causing CPI to remain tame.

The one item that would shift our view is a sustained increase in the Employment Cost Index (ECI). More than wages, the ECI captures the total cost of employee benefits. And it is free from the influence of shifting employment, which is especially important currently given how the economic shutdown affected low-wage employment while white-collar jobs were relatively unscathed.

2020 by the Numbers

International patent applications +4% to record high 275,900

Data as of March 2, 2021. Source: World Intellectual Property Organization

U.S. nonfarm business sector productivity +2.5%, largest annual increase since 2010

Data as of March 4, 2021. Source: Bureau of Labor Statistics

People aged 65 or older globally is expected to increase from 9.3% in 2020 to 16.0% in 2050.

Data as of October 2020. Source: United Nations

Whether it will happen depends on worker output, or productivity. If higher wages and benefits result in greater output, that should put no upward pressure on broad inflation measures. There’s evidence that may happen. If work-from-home becomes ingrained, that could lead to a 5% boost in U.S. productivity, Bloomberg News reports citing a study co-authored by researchers at Stanford University, the University of Chicago Booth School of Business and the Instituto Tecnológico Autónomo de México that polled over 30,000 U.S. workers.1 The study found that 20% of full workdays will be from home after the pandemic, compared with just 5% before it began.

The ECI data isn’t as sexy as lumber prices or GameStop’s stock – however, it’s the crux of the inflation question and it will play a prominent role in the Federal Reserve’s future discussions of whether inflation is getting too hot and interest rate hikes are needed.

Goals-Based plans & inflation

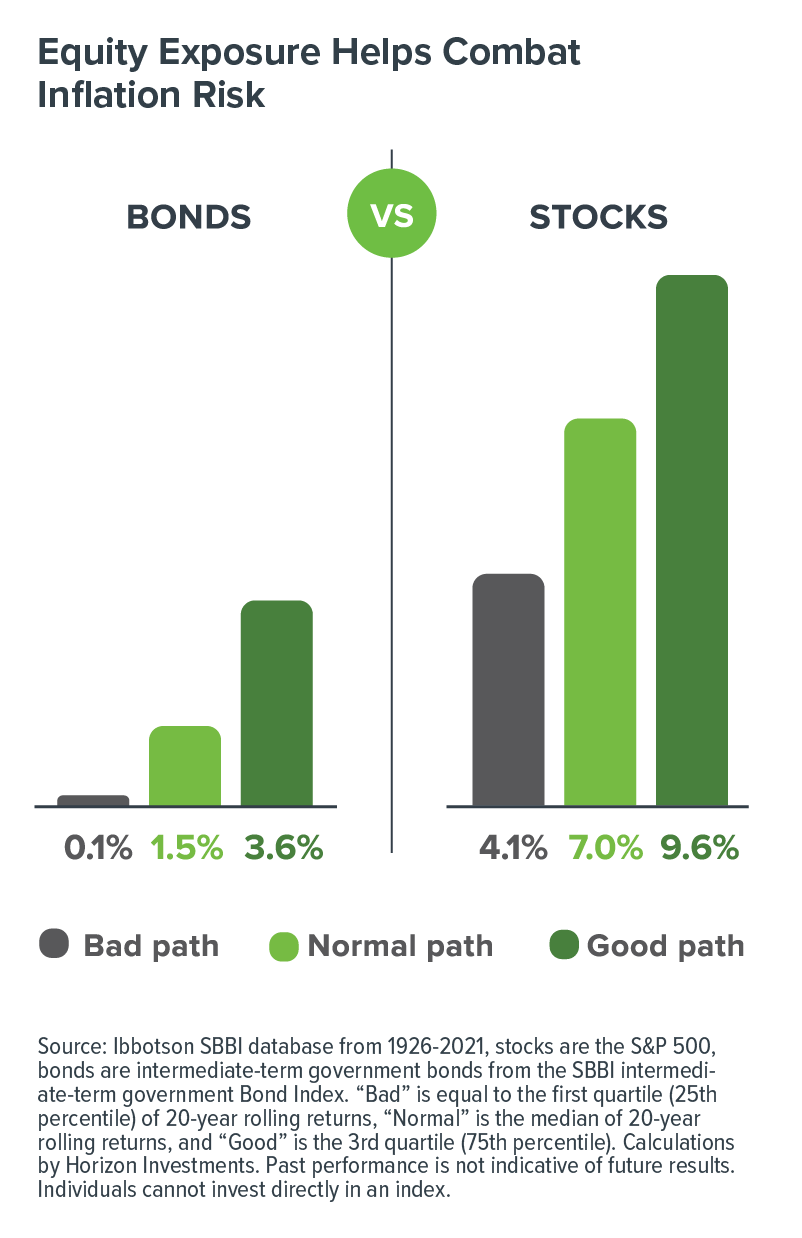

For goals-based investors in the Gain and Protect stages, we believe the inflation conversation is largely a distraction. Wages would likely respond to an increase in inflation, and over long periods, stocks have historically outpaced the rising cost of living.

In Horizon’s research on retirement funding shows that even during a “bad” 20-year rolling return period for stocks, inflation-adjusted returns outpace the best periods for a broad bond-market investment.

Inflation risk is a more urgent issue for newly retired people, who face a 20- to 30-year retirement. Today’s low bond yields, we believe, are unlikely to beat the current rate of inflation, and bond returns will be hamstrung if inflation accelerates (see our Q1 Focus report “Crushed by Zero”).

Horizon created its Real Spend® suite of solutions with the goal of mitigating retirement inflation risks better than traditional portfolio construction which calls for more bond exposure as people age.

Our flexible investment strategy – embracing bond alternatives alongside traditional fixed-income – allows us to adapt should the Federal Reserve decide to combat inflation by raising interest rates. In addition, Real Spend® portfolios are designed to tilt to equities because we believe in their long-term, inflation-beating power.

We believe the combination of these components within a single strategy gives retirees the best probability of ensuring people don’t outlive their money. In an environment where inflation risks are higher than they’ve been in years, Horizon’s Real Spend® strategies offer a solution rooted in research, yet practical in application.

1 “Work From Home to Lift Productivity by 5% in Post-Pandemic U.S.,” Bloomberg News, 4/22/21

Related stories:

Soaring Innovation Companies Go Cold as Interest Rates Rise: Big Number

You May Need a Bigger Down Payment for a New Home: Big Number

Emerging Markets Are Surging – And Evolving: Market Notes

Inflation Could Be Coming, Are You Ready?

Disappearing Junk Bond Yields

Do Bonds Really Offset Stock Market Declines?

If Inflation Returns, Bond’s Diversification Power May Disappear

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

Only Two Words Matter to Markets: Stimulus Spending

PIIGS Fly and Other Stories of Investors Reaching for Risky Bets

Momentum’s No Longer the Stock Market King, Vaccine Will Raise New Leadership

It’s Getting Harder to Fund Retirement Using Bonds

7.9 Trillion Reasons Not to Fight the Fed, ECB, BOJ or BOE

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, contact Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

To discuss how we can empower you please contact us at 866.371.2399 ext. 202 or info@horizoninvestments.com.

Get a print version of this commentary.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index. The visuals shown above are for illustrative purposes only and should not be considered a guarantee of success or a certain level of performance. Horizon Investments’ models are not intended as investment advice. Both the asset allocation and dispersion models analyze the performance of exchange traded funds that we believe are representative examples of either a stock market segment, a measure of an investment factor utilized by quantitative analysts or a geographic segment.

The Real Spend® retirement income strategy is NOT A GUARANTEE against market loss and there is no guarantee that the Real Spend® strategy chosen by an investor will be successful for the entirety of an investor’s retirement. Clients may lose money. Real Spend® is an asset allocation strategy that uses an investment model to (i) plan savings amounts and overall asset allocation during the distribution phase of retirement planning, (ii) compute target retirement wealth, assuming a retirement budget and a spending-investment strategy after retirement, (iii) compute the transition from the accumulation phase to the retirement phase, and (iv) generate the spending-investment strategy after retirement. Our retirement spending investment strategy uses an allocation model that replenishes cash needed for withdrawals. Before investing, consider the investment objectives, risks, charges, and expenses of the strategy. All investing involves risk. This strategy is not an insurance product with payments guaranteed. It is a strategy that invests in marketable securities, any of which may fluctuate in value. There is a possibility of outliving the assets if market performance is lower than forecasts used in planning, or if longevity is longer than anticipated.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments, the Horizon H and Real Spend are registered trademarks of Horizon Investments, LLC

©2021 Horizon Investments LLC