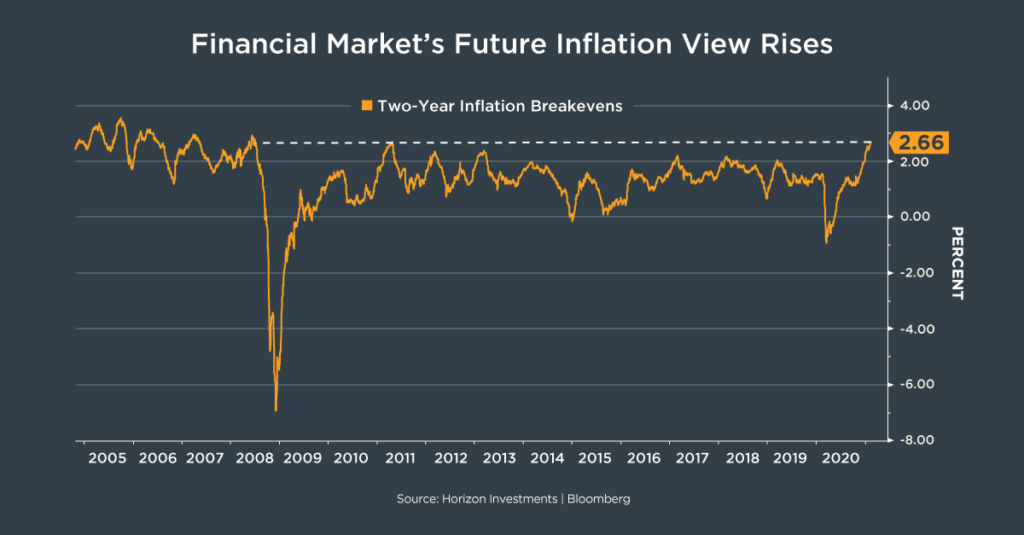

Two-year inflation breakeven rate (the market’s future inflation view) is the highest in 12 years, raising the risk of an inflation surprise

Inflation isn’t a problem now, but financial markets are saying it could be soon. Traders are pricing in the possibility that Consumer Price Inflation (CPI) leaps to 2.66% from 1.4% today, judging by the two-year breakeven rate which has staged a stunning turnaround and sits at its highest point since 2008.

Breakevens, a proxy for the CPI, are largely tracking the rise in oil prices, as energy is a large part of CPI. The key issue for fixed-income markets is whether inflation is more than just a jump in energy. Cornerstone Macro1 says its barometer for everything-outside-of-oil is climbing and is nearly at an all-time high in its database, a potential indicator that inflation is becoming more deeply embedded in the economy.

The two-year breakeven’s strong rally suggests that the pain trade in bonds is a continued grind higher in yields as the world economy and consumer spending recover from the pandemic. That increases the possibility that traditional bond market portfolio allocations may not generate any returns for years (see our recent Big Number report on expected returns).

Horizon Investments’ doesn’t expect runaway inflation, however we are focused on how markets may react as CPI rises. Our active management approach embraces a diversified set of both traditional and alternative fixed-income instruments, including preferred equities, convertible bonds, bank loans and emerging market debt. The alternatives could be especially valuable for investors in retirement who are relying on their fixed-income investments to generate inflation-beating returns. This diversified approach is also designed to reduce the potential downside of owning any individual fixed-income segment.

1Cornerstone Macro, “Breakeven Rates: What’s Driving Them and Where To,” Feb. 16, 2021

Further reading:

Disappearing Junk Bond Yields

Do Bonds Really Offset Stock Market Declines?

If Inflation Returns, Bond’s Diversification Power May Disappear

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

High & Mighty Stocks; Feeling Inflationary?; Game Stopped: Market Notes

Bond Market Bears Growling as 10-Yr Yield Tops 1%

It’s Getting Harder to Fund Retirement Using Bonds

7.9 Trillion Reasons Not to Fight the Fed, ECB, BOJ or BOE

The Stock Market Is Strange, But Not Broken by GameStop: Market Notes

In Current Markets, Only Two Words Matter: Stimulus Spending

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, please reach out to Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

To download a copy of this commentary, click the button below.

To discuss how we can empower you please contact us at 866.371.2399 ext. 202 or info@horizoninvestments.com.