Demand for new homes is way down. What does that mean for investors?

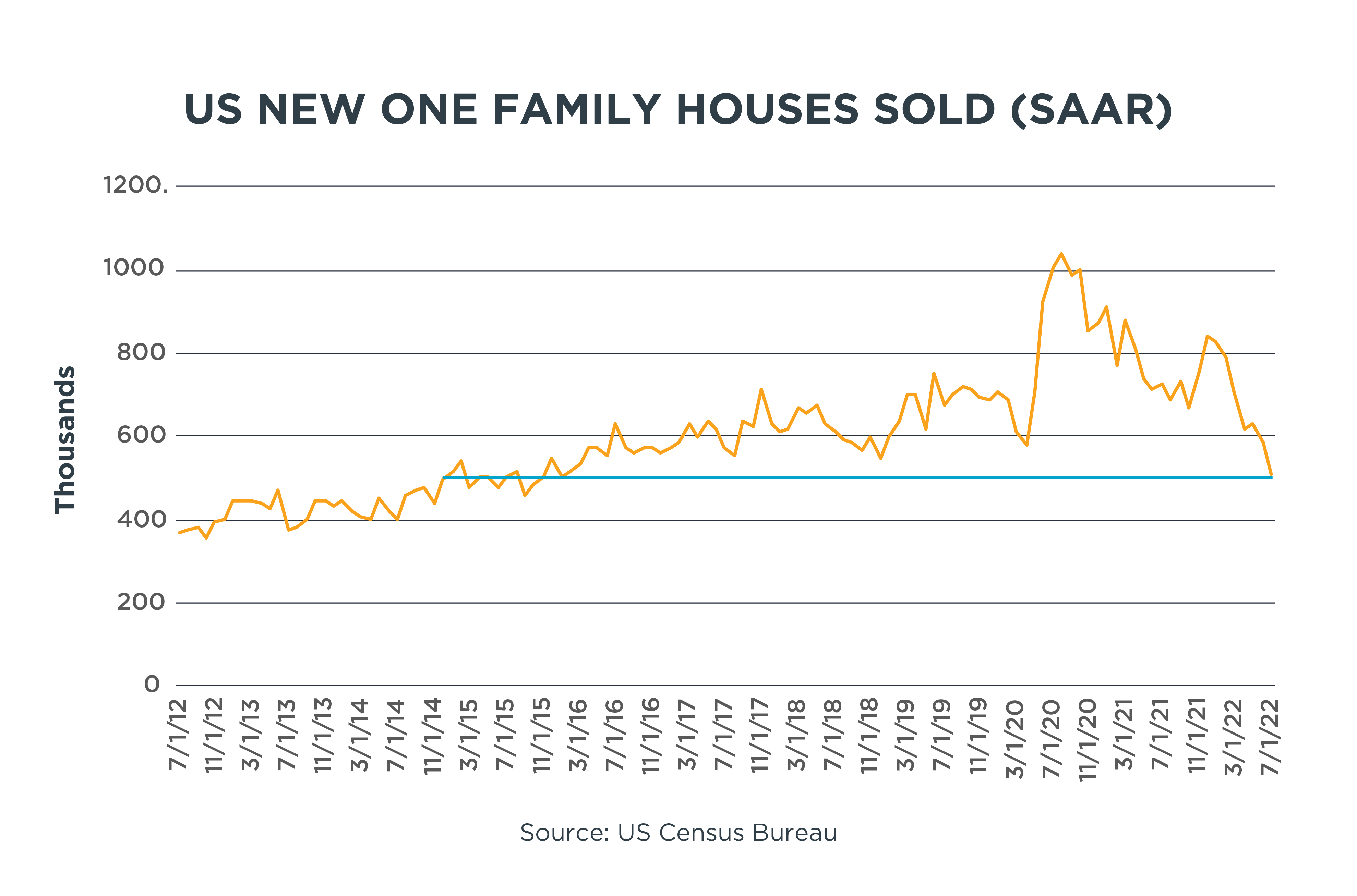

New home sales plunged in July, falling nearly 13% to a seasonally-adjusted rate of 511,000. That’s the worst pace for new home sales since January 2016.

As we noted in June—see “Mortgage Payments Are Through the Roof”—the spike in both mortgage rates and the average monthly mortgage payment would pour cold water on the U.S. housing market. This latest news about new home sales was an outcome we have been anticipating.

The real issue is what the worst showing for new home sales in six-and-a-half years means for investors. Conditions in the housing market have often been a leading economic indicator—a harbinger of things to come.

Does this latest weakness signal a recession and pain for equity markets?

Economic activity is expected to contract during a recession. However, that does not necessarily coincide with what occurs in equity markets. Consider these facts from our latest research report, “What Constitutes a Recession?”:

- Historically, the stock market has peaked on average six months before the start of a recession and has typically hit bottom an average of four months before a recession’s end (measured by the S&P 500).

- The average recession since WWII has lasted 10.3 months—which means historically, the stock market, in many cases, had already started its recovery halfway through the economic pullback.

- On average, the stock market fell just over 4% during post-WWII recessions. In exactly half of the post-war recessions, however, the stock market wasn’t down during the recession.

The upshot: Investors who jump in and out of the equity market due to recession fears could miss the early stages of a market recovery—the economy is not the stock market. By focusing on market pricing and drawdowns in our Risk Assist® strategy, we seek to mitigate losses. In addition, our Risk Assist® strategy is designed to systematically reinvest into the market while equities recover — thus striking a balance between risk mitigation and market participation. Our view is that this disciplined process can potentially help investors with the goal of risk reduction to navigate the multiple macroeconomic cross currents (such as developments in the housing market) we are experiencing in today’s environment.

This commentary is written by Horizon Investments’ asset management team.

The Risk Assist® algorithm uses a disciplined, automated process to dynamically “de-risk” a portfolio during times of severe market stress. In doing so, it seeks to curb the behavioral investing impulses that can derail financial plans. Risk Assist® is also designed to address the question of when to “re-invest” the portfolio. As market conditions improve, the strategy is restored to its intended portfolio mix using the same disciplined and automated process, with the aim of keeping clients on track to achieve their goals. Risk Assist® is NOT A GUARANTEE against loss or declines in the value of a portfolio; it is an investment strategy that supplements a more traditional strategy by periodically modifying exposure to fixed income securities based on Horizon’s view of market conditions. While Risk Assist was designed with the goal of limiting drawdown, Horizon is not able to predict all market conditions and ensure that Risk Assist will always limit drawdown as designed. Accounts with Risk Assist® are not fully protected against all loss. Furthermore, when Risk Assist® is deployed (whether partially or entirely) to mitigate risk for an account, the account will not be fully invested in its original strategy, and accordingly during periods of strong market growth the account may underperform accounts that do not have the Risk Assist® feature. Clients may lose money.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. The S&P 500 Index or Standard & Poor’s 500 Index is a market-capitalization-weighted Index of the 500 largest US publicly traded companies. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. The opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments, Risk Assist® and the Horizon H are registered trademarks of Horizon Investments, LLC

©2022 Horizon Investments LLC