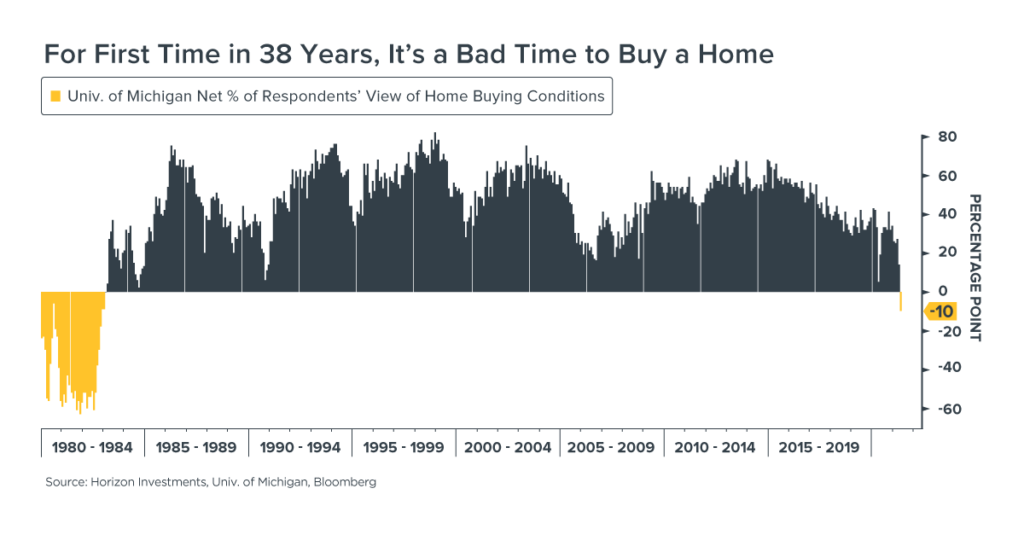

Bidding wars for homes has soured people on reaching for the American dream: for the first time in nearly 40 years, a majority of University of Michigan survey respondents, 54%, say it’s a bad time to buy a house.

There’s always a limit to how much any buyer will pay, whether for a share of a company’s stock, a painting at auction or – in this case – a house.

The pandemic surge in home prices and the sudden emergence of bidding wars in rural and suburban areas has quickly soured public opinion on the idea of buying a home.

For the first time since the high-interest rate period of the early 1980s, the University of Michigan consumer sentiment survey shows most people say it’s not worthwhile to go home shopping. 54% of respondents say it’s a bad time versus 44% who say it’s a good time, for a net negative reading of 10 percentage points

The rapid change in sentiment towards buying a home is another piece of evidence supporting the old Wall Street adage that “the cure for high prices is high prices.” The saying encapsulates a behavioral response to a rapid price increase; buyers experiencing sticker shock step back, while producers get greedy and crank out more supply. Together, the two forces could quickly snuff out a rally.

That’s likely been the case for a key input into the cost of building a home: lumber, a product that has garnered a lot of media coverage on the way up, but scant headlines on the way down.

The price of lumber contracts for July delivery are down 28% since peaking May 7 (data as of June 7). Prices for lumber for delivery in the fall and winter months have plunged even more, a potential sign that traders see supply shortages, demand destruction and the typical winter slowdown in construction bringing the market closer to being in balance. September lumber contract prices are down 35%, while November contracts have plunged 40% since May 7 (data as of June 7).

Horizon Investments’ view is that broad measures of inflation – such as the Consumer Price Index — will likely not spiral higher, so it shouldn’t be a primary concern of goals-based financial plans (see our in-depth Market Notes report on inflation). From our perspective, years of low and stable prices have conditioned consumers and businesses to recoil at the thought of paying much higher prices unless it’s absolutely necessary.

Buying a home may be a priority for many people, but they may also be willing to wait until prices become more reasonable. That may already be playing out. The number of applications for a mortgage to buy a home have fallen 21% from the peak on April 16 through June 4, according to non-seasonally adjusted data reported by the Mortgage Bankers Association1.

Patience, in this case, can be both a virtue and way to slay inflation before it gets out of control.

1 https://www.mba.org/2021-press-releases/june/mortgage-applications-decrease-in-latest-mba-weekly-survey-x280704

To download a copy of this commentary, click the button below.

Further reading:

Pandemic’s Effect Erased in Job Market; Are We Back to Normal?

Does High-Flying Crypto Below Fit Into Goals-Based Financial Plans

Capital Gains Taxes and S&P 500 Returns: Complete Strangers for Over 60 Years

Americans Taking Early Retirement May Benefit from a Goals-Based Solution

Many Investors Tried to Trade the Pandemic Plunge in Stocks

If Inflation Returns, Bond’s Diversification Power May Disappear

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

High & Mighty Stocks; Feeling Inflationary?; Game Stopped: Market Notes

Bond Market Bears Growling as 10-Yr Yield Tops 1%

It’s Getting Harder to Fund Retirement Using Bonds

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, please reach out to Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

To discuss how we can empower you please contact us at 866.371.2399 ext. 202 or info@horizoninvestments.com.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2021 Horizon Investments LLC