Could bond investors find the next few months to be “the most wonderful time of the year?”

High-yield (or “junk”) bonds—along with the rest of the fixed-income market—have had a tough 2022. The Bloomberg U.S. Corporate High Yield index is down 10.7% year to date.

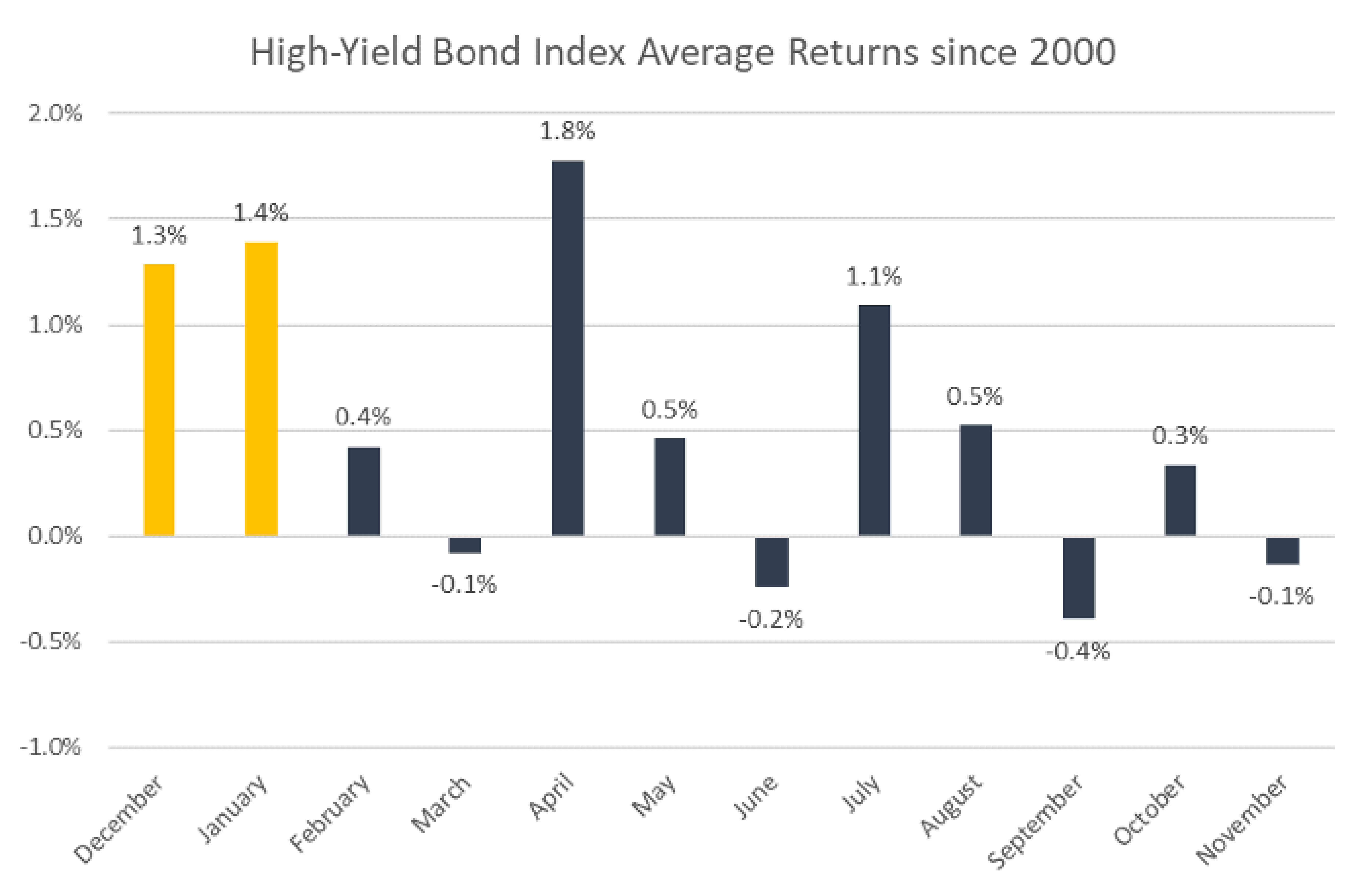

But history suggests that now may be a good time to show this asset class some holiday love. The reason: we are entering what has historically been some of the stronger months for high-yield bond performance. Since 2000, high-yield bonds have posted an average return in December of 1.3%—and 1.4% on average in January (see the chart).

Source: Bloomberg, Bloomberg U.S. Corporate High Yield Bond Index, 2000-2020 average monthly returns

In addition, recent developments may indicate potential emerging tactical opportunities among high-yield bonds. For example:

- Attractive yields. The index’s current average yield of 8.6% (as of 11/28/22) makes high-yield an area that income-focused investors may want to consider.

- Less interest rate risk. High-yield bonds generally have lower durations than many other types of fixed-income securities—so they’re generally less exposed to the volatility that often accompanies rising interest rates.

- Lower default risk. The cost of protection1 against negative events, as measured by credit default swaps (like bond issuers defaulting or going bankrupt), has fallen in recent months, from around 600 basis points to 470—suggesting that financial risk among high-yield bonds has diminished somewhat.

- Supply-demand dynamics. This year, the issuance of new high-yield bonds has been the lowest on record, according to Bloomberg. This lack of supply means it could take only a slight increase in demand for bond prices to move higher into year-end.

Of course, we all know that past performance is not indicative of future results. Seasonal trends and reinvesting signals don’t guarantee positive returns. However, a tactical approach to high-yield bonds may minimize downside risk if these recent positive trends reverse course.

The upshot: Investors may want to consider adding high-yield bonds to their wish lists this season.

1 As measured by the credit default swap index (CDX), a benchmark financial instrument made up of credit default swaps that have been issued by North American or emerging market companies.

Disclosure:

This commentary is written by Horizon Investments’ asset management team.

Past performance is not indicative of future results.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments.

This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed.

References to indices or other measures of relative market performance over a specified period of time are provided for informational purposes only. Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. An index’s composition may not reflect how a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Individuals cannot invest directly in any index.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2022 Horizon Investments LLC