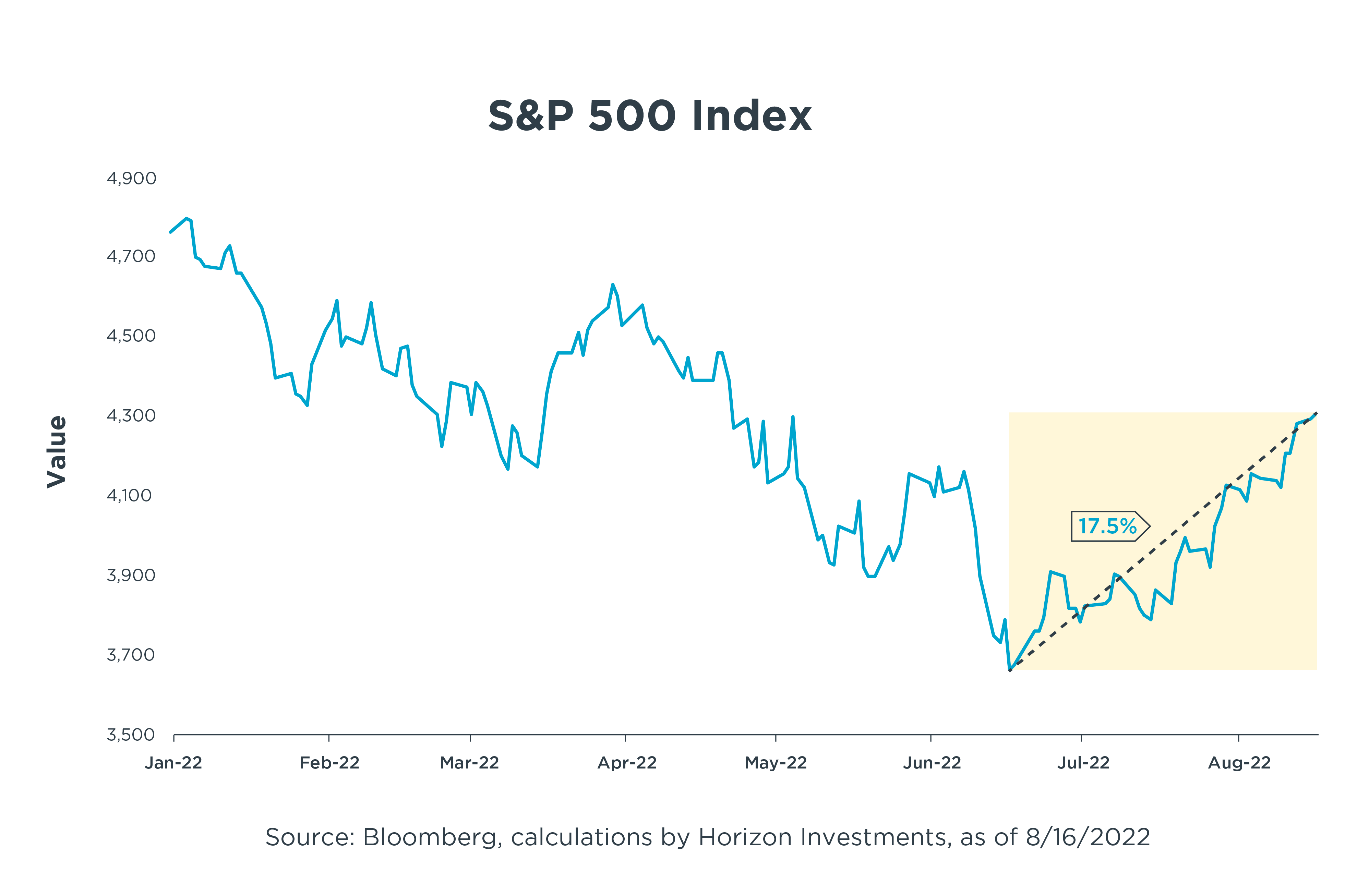

What a difference a couple of months can make.

Since hitting its low point (closing price) for the year on June 16, the S&P 500 Index has rallied nearly 17.5%—buoyed during the past 61 days by solid corporate earnings results for the second quarter and signs that rampant inflation finally may be losing some of its steam. Currently, the index sits at its highest level in three months.

The market’s extraordinary run makes now a good time to revisit the three possible scenarios we outlined in our second-quarter report, Tug of War: Inflation Vs. Growth:

- In a rapidly deteriorating scenario, long-term inflation expectations would likely become de-anchored–increasing wage pressures and likely forcing the Fed to be more aggressive, leading to weaker earnings and economic growth.

- In a slowly improving scenario, pessimism would persist in the near term, but consumer strength driven by lower inflation would eventually win out.

- In a rapidly improving scenario, an exogenous event would likely cause inflation to fall sharply–mitigating current concerns about the economy and enabling the Fed to adopt a more neutral stance as the economy regained momentum.

While some unresolved risks are cause for concern—such as tensions between the U.S. and China and the ongoing Russia-Ukraine war and its possible impact—recent data showing early signs of cooling inflation, a robust labor market, and a resilient earnings picture are viable reasons to expect to see a slowly improving scenario rather than rapid deterioration.

Of course, the question on many investors’ minds is: Are we merely experiencing a bear market rally that will end with stock prices back where they were in mid-June, or even lower? Retrenching after such a run-up would be jarring, to be sure, but it’s happened before. In the depths of the 2008 financial crisis, for example, there were two bear market rallies of 18% and 24% in late October and early December, respectively—but the market didn’t bottom until March 2009.

The next few rounds of data measuring inflation and consumer confidence should give investors more clarity as to whether the recent rally has legs. In this environment, we believe systematically re-investing back into the market through a strategy such as Risk Assist® may help investors feel more comfortable participating in the markets to capture potential gains. But if it turns out that we are not out of the woods yet, the rules-based de-risking behavior of Risk Assist® may also offer some mitigation from a market reversal.

This commentary is written by Horizon Investments’ asset management team.

The S&P 500 Index represents the stock performance of the 500 largest companies listed on exchanges in the United States.

The Risk Assist® algorithm uses a disciplined, automated process to dynamically “de-risk” a portfolio during times of severe market stress. In doing so, it seeks to curb the behavioral investing impulses that can derail financial plans. Risk Assist® is also designed to address the question of when to “re-invest” the portfolio. As market conditions improve, the strategy is restored to its intended portfolio mix using the same disciplined and automated process, with the aim of keeping clients on track to achieve their goals. RiskAssist® is NOT A GUARANTEE against loss or declines in the value of a portfolio; it is an investment strategy that supplements a more traditional strategy by periodically modifying exposure to fixed income securities based on Horizon’s view of market conditions. While Risk Assist was designed with the goal of limiting drawdown, Horizon is not able to predict all market conditions and ensure that Risk Assist will always limit drawdown as designed. Accounts with Risk Assist® are not fully protected against all loss. Furthermore, when Risk Assist® is deployed (whether partially or entirely) to mitigate risk for an account, the account will not be fully invested in its original strategy, and accordingly during periods of strong market growth the account may underperform accounts that do not have the Risk Assist® feature. Clients may lose money.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. The opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2022 Horizon Investments LLC.5