Did We Just Reach Peak Inflation Pain?

The blaring stories about high inflation are inescapable after last week’s shockingly strong inflation report. We wrote aboutsurging prices spreading to more and more everyday products, which undercuts the “transitory” narrative. Still, we recognize that the pandemic re-opening period has no historic parallel to help guide forecasts. And there are forces afoot that may yet tame inflation, and reduce pressure on the Federal Reserve to raise interest rates in 2022.

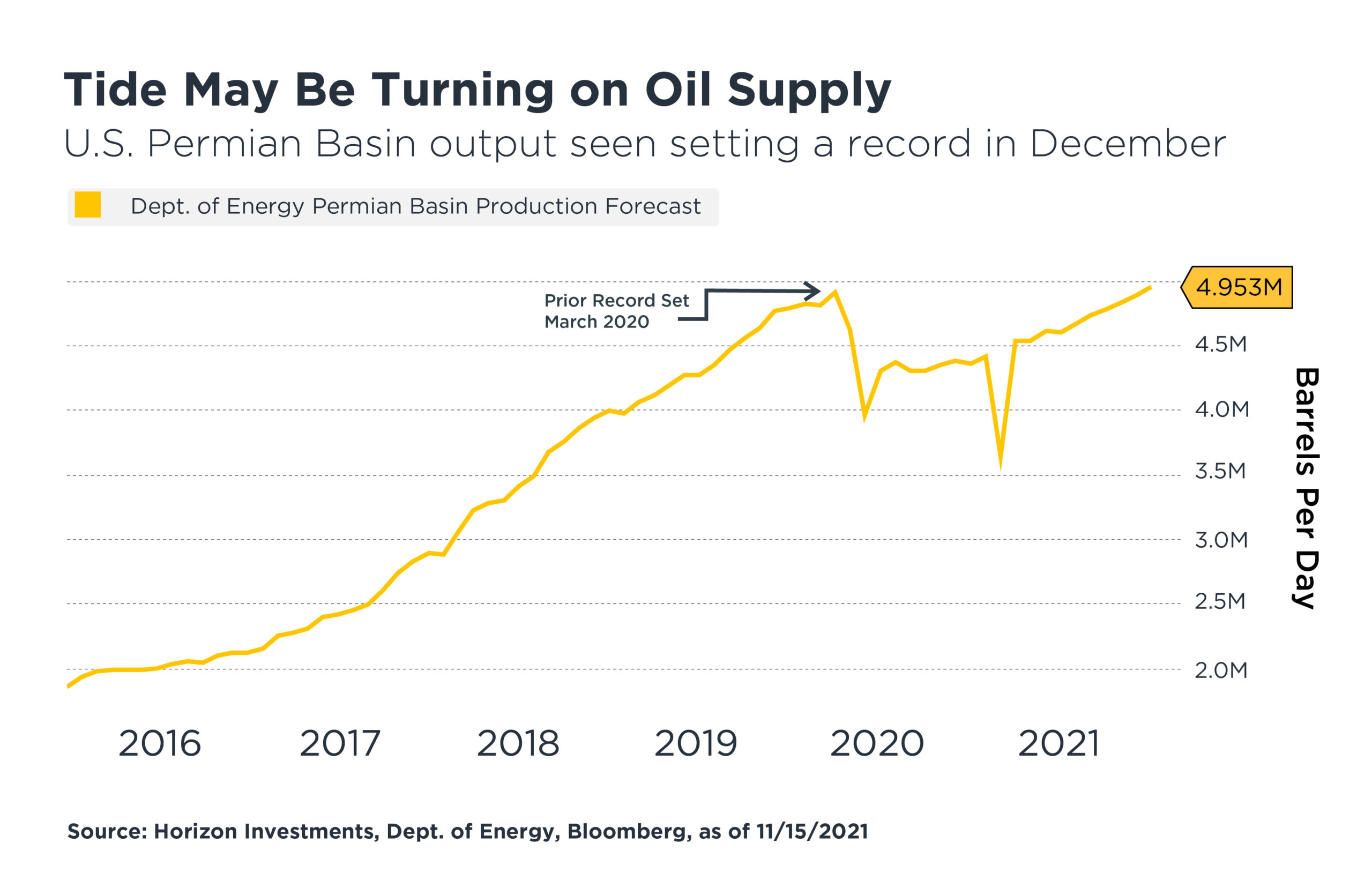

Take energy. U.S. oil output continues to recover from both the pandemic and this summer’s storms. Output in the Permian Basin, the largest shale-oil patch, is projected by the Department of Energy to reach a record 4.95 million barrels per day in December, surpassing the current record set in March 2020.[1] And that’s occurring as global oil output recovers as well.

The Permian Basin is an important part of the global oil market. Its output exceeds that of every OPEC member except for Saudi Arabia, making it an important swing producer. Its growth is part of the reason why oil market watchers, including the International Energy Agency, are beginning to talk about oil supply surpassing demand next year.[2]

OPEC is even more aggressive in its supply/demand forecast. Secretary-General Mohammad Barkindo said crude output could exceed demand starting in December.[3] Rallies for oil and gasoline futures stalled weeks ago, though prices have not fallen enough to provide relief at the gas pump. Meanwhile, as of today, natural gas futures prices are down 23% from a high reached in early October, a time when news reports were touting painfully expensive winter heating bills.

There are other signs that suggest some measure of relief may be near:

- New car production is ramping up. General Motors had no manufacturing downtime related to the computer chip shortage in the last week of October.[4]

- Toyota boosted its December vehicle production to 800,000 units to refill car-dealer lots. That’s a 21% production increase compared to December 2019 before the pandemic.[5]

- The cost of sending a 40-foot container from Shanghai to Los Angeles is down 20% since late September.

- The Port of Los Angeles said this week that it has cleared out 29% of the containers that were clogging the port’s storage space, which was slowing ship unloading.[6]

- The CEO of GXO Logistics, the world’s largest contract logistics company, said more goods are arriving at its facilities and that the company is “through the worst of it.’’[7]

- American companies are on pace to add the most robots ever this year as a way of alleviating the labor crunch at restaurants, warehouses and factories.[8]

Of course, there are plenty of other anecdotes that point to long-lasting inflation strains. To take just one example, Americans are still spending heavily on goods and appliances rather than services, which exacerbates the logistics challenges and contributes to higher prices.

How soon inflation cools from these elevated levels is an important question for markets. Quick cooling should keep the Fed on hold for longer, while elevated readings like last week’s risk forcing the Fed into action.

While our bias is still for the former, the lingering nature of this inflation surge, as well as the interconnectedness of today’s inflation woes, have weakened our conviction in that call. We continue to analyze the details of this unprecedented economic recovery, and stand ready to adjust our portfolio positioning should we see transitory lasting a lot longer than many – including us – would have predicted.

(Read our 2022 Outlook pieces on inflation and the economy for the full details)

Further reading:

Inflation Sticker Shock Is Spreading to More and More Products

Skyrocketing Energy Prices Bring Back Bad 1970s Memories

Powell Still Sees Transitory Inflation, Ship Orders Offer Another Clue

If Inflation Returns, Bond’s Diversification Power May Disappear

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

[2] International Energy Agency, “Oil Market Report – November 2021,’’ 11/16/2021

[3] Bloomberg News, “OPEC Sees Oil Market Switching to a Surplus as Early as December,” 11/16/2021

[4] Automotive News, “Detroit 3 Learning to How to Live With Chip Shortage,” 10/31/2021

[5] Bloomberg News, “Toyota December Production Outlook Shows Easing Supply Woes,” 11/12/2021

[6] Bloomberg News, “Container Logjam Eases as L.A. Port Threatens Penalties,’’ 11/16/2021

[7] Bloomberg News, “Warehouse Operator Says Supply-Chain Snags Are Starting to Ease,’’ 11/02/2021

[8] Wall Street Journal, “Companies Order Record Number of Robots Amid Labor Shortage,’’ 11/11/2021

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2021 Horizon Investments LLC