Six more months! Six more months!

Investors cheered as stocks ended the second quarter last Friday up 4.3%. . . and 15.3% for the first six months of 2024. That’s the best first-half performance during an election year on record. We also saw the second-largest quarterly outperformance of growth stocks (9.6%) over value shares (-2.1%) in the last 30 years, driven largely by AI-themed mega-caps.

You already know that July is a hot month for stocks, historically. But what might the second half of the year have in store for investors?

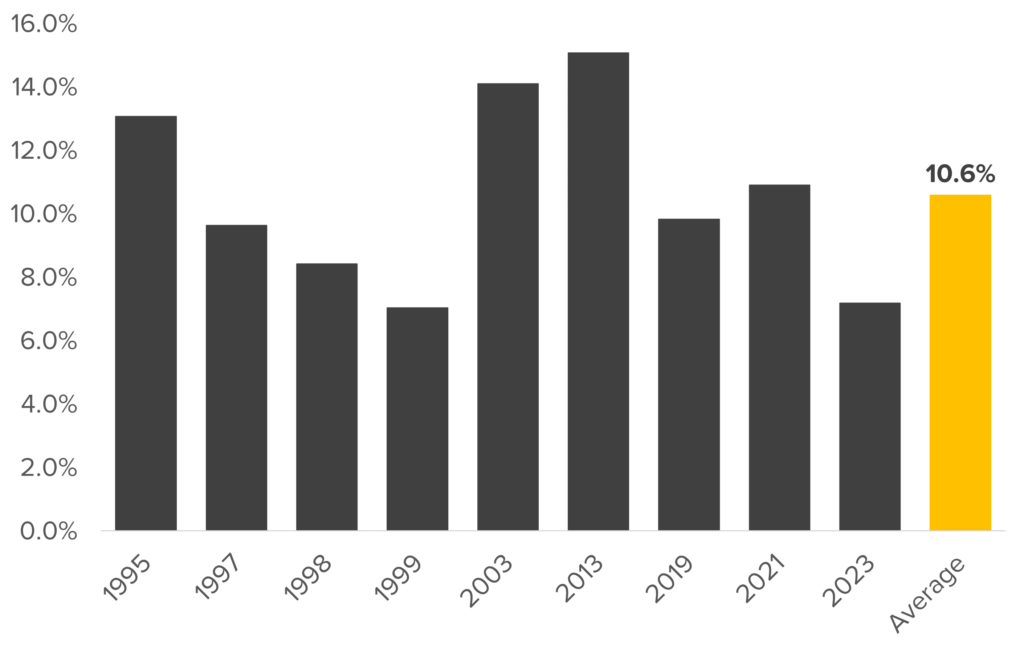

Since 1995, there have been nine instances where the S&P 500 has gained more than 10% during the first half of the year. Here’s what happened next:

- Stocks rose another 10.6% on average from July through December

- Stocks delivered positive second-half returns 100% of the time (9 out of the 9 instances)

Second Half S&P 500 Returns Following a 10% Gain During the First and Second Quarter

Source: Bloomberg, calculations by Horizon Investments, as of June 28, 2024. Indices are unmanaged and do not have fees or expense charges, both of which would lower returns. It is not possible to invest directly in an index.

The upshot: Based on history, there’s a good chance stocks will end 2024 higher than where they stand today. Indeed, over the past 35 years, buying stocks when the market hits a new high has worked out better on average for investors when they’re investing on days picked at random. If the interest rate environment moves lower in the coming months—core PCE inflation slowed to 2.6% in May—it could provide an additional boost to equity prices.

Of course, the future is unknown. But clients with cash on the sidelines may want to consider paying attention to what history has to say about the stock market’s possible path between now and December.

The Standard and Poor’s 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. References to indices, or other measures of relative market performance over a specified period of time are provided for informational purposes only. Reference to an index does not imply that any account will achieve returns, volatility or other results similar to that index. The composition of an index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Information obtained from third party sources is believed reliable but has not been vetted by the firm or its personnel.

This commentary is written by Horizon Investments’ asset management team. Past performance is not indicative of future results. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves the risk of loss.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. The opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed. Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2024 Horizon Investments, LLC.