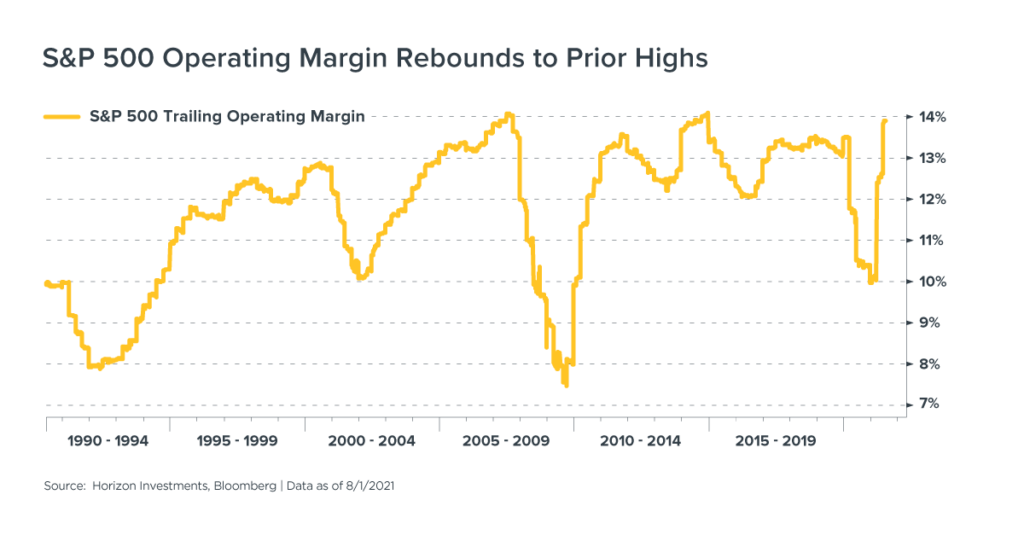

Operating margin for S&P 500 companies rebounds to near all-time highs.

You’ve likely heard that second quarter profits are surging, driven by easy year-over-year comparisons and the reopening of the economy. Lost in the hoopla over blowout earnings is how profitable America’s companies are for every dollar in revenue they take in, or the operating profit margin.

Operating profit margins in the second quarter are running at 13.9% for S&P 500 companies – rebounding to near all-time high levels and exceeding where margins were going into last year’s economic shutdown. If someone is searching for reasons why the S&P 500 continues to make all-time highs, fat profit margins and record profits are likely key parts of the argument. The rebound in operating margins reflects several trends, some related to the economic reopening while others are long-term, including:

The rebound in operating margins reflects several trends, some related to the economic reopening while others are long-term, including:

- Supply and demand imbalances during the economic reopening boosted the fortunes of companies involved in commodities, durable goods, and other products affected by manufacturing bottlenecks

- Cooped up Americans decided to spend their savings and absorbed higher prices for goods and services

- A surge in worker productivity during the shutdown has not been reversed, helping make companies more efficient

- The growing use of data, software, and artificial intelligence helps corporate executives profitably adjust their operations amid ever-changing circumstances

- The S&P 500’s composition is shifting towards higher margin technology companies

The long-term trends listed above – worker productivity, tech innovation and the index’s composition – are reasons to expect the rebound in operating profit margins to last.

As those long-term trends were forming deeper roots across corporate America from 2010 to 2020, the S&P 500’s operating margin held above 12%, the longest stretch ever at such a lofty level.

Past performance is no guarantee that operating margins will remain at today’s levels, of course. Still, Horizon Investments sees the operational flexibility and strong earnings performance of American companies as a reason to tilt its strategies towards U.S. stocks currently.

And while the news media is filled with concerns over the Delta variant and issues in the labor market, corporate America’s ability to navigate such a difficult and volatile environment doesn’t get enough air time. Focusing on what matters for markets, instead of headline grabbing news stories, is what our dynamic, multi-disciplined investment process is designed to do. That’s how Horizon aims to help your clients build wealth through constantly evolving market conditions.

To download a copy of this commentary, click the button below.

Further reading:

Are Glide Path Strategies Still a Good Option for Retirement?

Junk-Bond Yields Don’t Provide Much of a Cushion Against Inflation

Abnormally Low Interest Rates to Remain Even If Fed Hikes in 2023

If Inflation Returns, Bond’s Diversification Power May Disappear

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

Home Prices to the Moon? Americans Say `No Thanks’

It’s Getting Harder to Fund Retirement Using Bonds

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

The charts and visuals are for illustrative purposes only and should not be considered a guarantee of success or a certain level of performance. More information about the calculations used herein are available from Horizon.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2021 Horizon Investments LLC