They’re very different Presidents, but what Joe Biden and Donald Trump have in common is their drive to make America’s economic growth rate great again. Each in their own way is committed to running the economic engine as fast as possible to revive employment, seemingly without worrying about inflation or other potential problems.

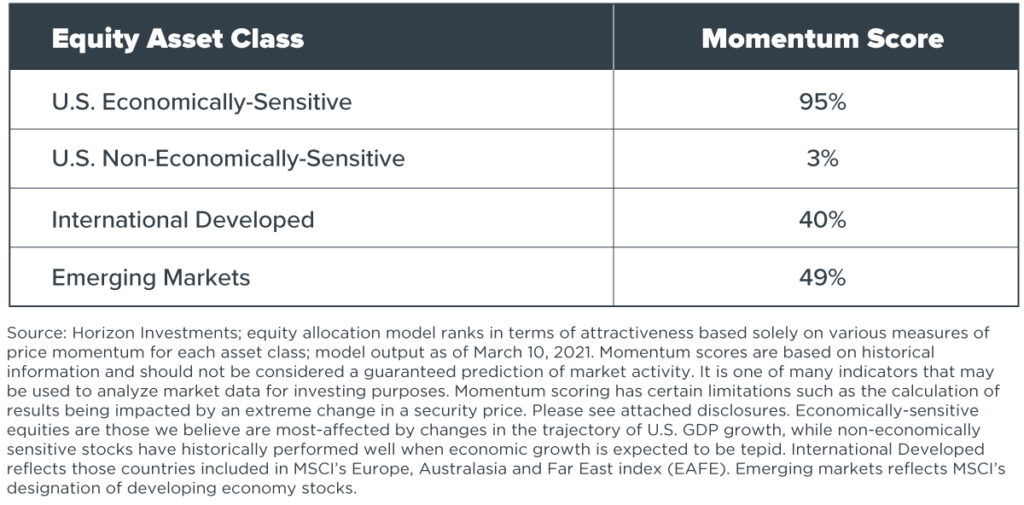

The U.S. risk-on mood in markets in the early days of the Biden Administration – with its successful push for a $1.9 trillion stimulus package – mirrors the days after the surprise election of Trump, who aimed to unleash U.S. growth through fiscal and infrastructure spending, cutting taxes and pruning regulations. Our research is signaling economically-sensitive parts of the U.S. equity market are as attractive – from a price-momentum perspective – as they have been since late 2016. The price action indicates investors believe the newest push will successfully ignite American GDP growth.

The positive backdrop in 2016 for America’s economically-sensitive companies didn’t last long-term as Trump increased trade frictions. For the moment, it remains to be seen what might shift the scales back to a more balanced picture.

Red hot is just fine

How hot is too hot in terms of GDP growth? Equity markets realize the answer no longer seems to matter to either politicians or central bankers as they commit themselves to post-pandemic growth at almost any cost. Investors are applauding because quicker growth could mean surprisingly big profits for companies of all shapes and sizes in all sorts of industries – which may be more alluring than the predictable nature of richly-valued, large-cap technology companies.

Reinforcing that bullish view is the Organization for Economic Cooperation and Development (OECD). Its 2021U.S. GDP forecast is now 6.5% versus 3.2% in December. And it raised its global projection by over 1% saying the Biden stimulus provides a “major boost” to the U.S., which will have a positive knock-on effect on global growth1.

Central bankers embrace turbo-charged GDP

Central bankers are playing a big role, too. Normally an overheating economy is a risk central bankers would be on guard against. But not now. Fed Chairman Powell reiterated two weeks ago that he and his colleagues would wait to see too-hot inflation and full employment before raising interest rates. Horizon expects the Fed meeting and press conference on Wednesday to show once again that it expects to keep rates pinned near zero, even as the central bank upgrades its growth forecasts and acknowledges that the economy is showing signs of recovering.

A rising tide lifts more boats

Plenty of market commentators are saying rising interest rates are a major threat to equities; the 10-year Treasury yield is up 71 bps this year, as of Friday’s close. Horizon Investments doesn’t think that’s right.

First of all, the 10-year Treasury yield is sitting where it was in February last year, just before it became clear that the economic lockdowns were likely to be instituted. Second, the recent jump in rates is not at restrictive levels. In fact, it hasn’t had any discernible effect on the easy financial conditions seen in the U.S. or around the world.

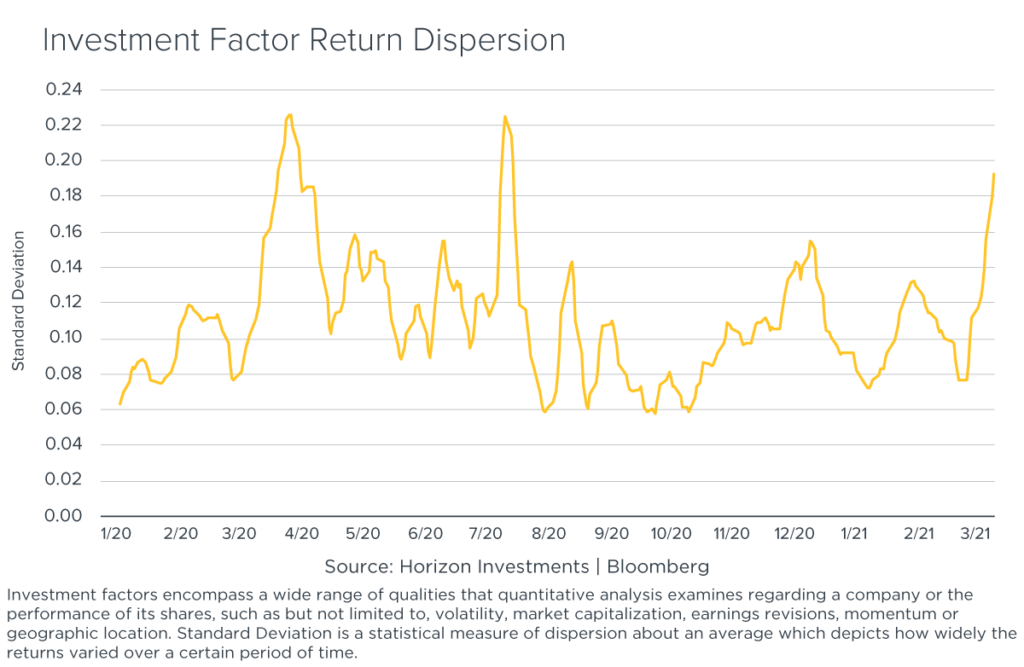

That said, the move up in yields could help drive a change in stock market leadership. A way we see if that shift is happening is through our measurement of the standard deviation of the dispersion of returns among investment factors – such as market capitalization, balance sheet quality or dividends. Typically, the standard deviation of returns is small, however when the gap between the best- and the worst-performing factors widens sharply, that can indicate a change in leadership is underway. The prior two weeks’ move is more extreme than it was during the height of the reopening optimism in November.

Sharp changes in dispersion have often happened during a rotation in equities or during heightened market volatility. It looks to us like it may be the former as America’s growth this year appears to be fast enough to power a global rebound. That could benefit the wide range of industries that suffered during both the pandemic and the uncertainty surrounding the Trump Administration’s trade battles. However, it could come at the expense of the companies that dominated the stock market when the outlook was bleak and unsettled.

1 OECD Economic Outlook, Interim Report March 2021, March 9, 2021, https://www.oecd-ilibrary.org

Related stories:

Soaring Innovation Companies Go Cold as Interest Rates Rise: Big Number

You May Need a Bigger Down Payment for a New Home: Big Number

Emerging Markets Are Surging – And Evolving: Market Notes

Inflation Could Be Coming, Are You Ready?

Disappearing Junk Bond Yields

Do Bonds Really Offset Stock Market Declines?

If Inflation Returns, Bond’s Diversification Power May Disappear

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

Only Two Words Matter to Markets: Stimulus Spending

PIIGS Fly and Other Stories of Investors Reaching for Risky Bets

Momentum’s No Longer the Stock Market King, Vaccine Will Raise New Leadership

It’s Getting Harder to Fund Retirement Using Bonds

7.9 Trillion Reasons Not to Fight the Fed, ECB, BOJ or BOE

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, contact Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

To download a copy of this commentary and the chart of the week, click the button below.

To discuss how we can empower you please contact us at 866.371.2399 ext. 202 or info@horizoninvestments.com.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index. The visuals shown above are for illustrative purposes only and should not be considered a guarantee of success or a certain level of performance. Horizon Investments’ models are not intended as investment advice. Both the asset allocation and dispersion models analyze the performance of exchange traded funds that we believe are representative examples of either a stock market segment, a measure of an investment factor utilized by quantitative analysts or a geographic segment.

Momentum scores and factor calculations by Horizon Investments. More information about the calculations of the data mentioned herein is available from Horizon. The investment factors used are: market capitalization (SPYG, IJR, RSP, QQQ), dividends (DVY), quality (QUAL), momentum (MTUM), volatility (USMV). Standard Deviation is a statistical measure of dispersion about an average which depicts how widely the returns varied over a certain period of time.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2021 Horizon Investments LLC