Bonds are usually thought of as a safe haven for investors due to their lower risk/ lower return profile. For investors preparing for retirement, or those already in retirement, a common rule of thumb has been to shift away from equities into bonds. The ole ‘own your age in bonds’ rule, however, may need to be reconsidered in today’s market environment.

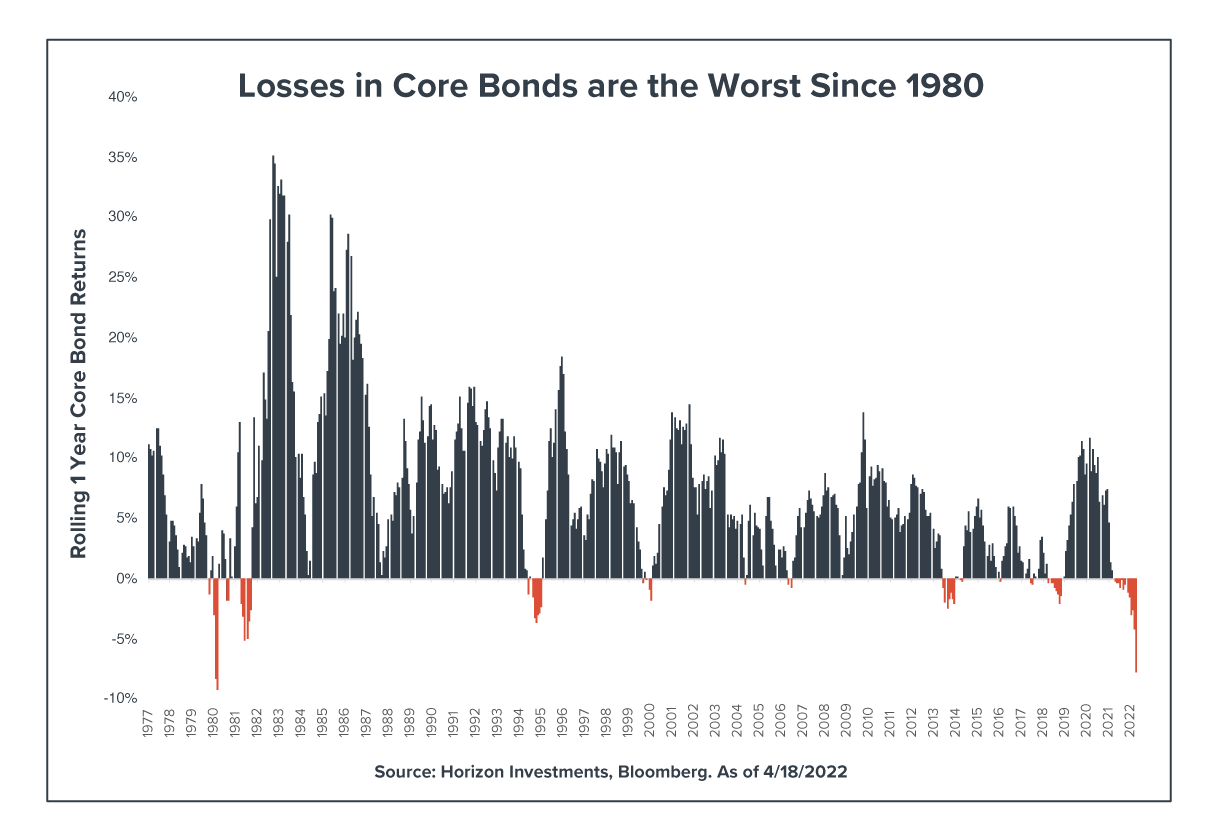

Investors, financial advisors, and investment managers are all experiencing a bond anomaly and wake up call that bonds are not always low risk; that in the short term they can sometimes lose a lot of money. So, what does the data tell us about this anomaly? And what are some takeaways? The below graphic illustrates rolling one year returns for core bonds, as represented by the Bloomberg U.S. Aggregate Bond Total Return Index, since the index’s inception in the late 1970s.

A few noteworthy things to highlight from the graph (monthly data as of 4/18/22):

● Historically, bonds have earned a negative 1 year return about 11% of the time

● Conversely, core bonds have been positive approximately 89% of rolling one year periods

● When bond returns were negative, their average 1 year return was -1.9%

● Bonds have returned -7.8% over the last 1 year and -8.8% so far in 2022

● The worst rolling 1 year period for bonds was -9.2% (year ended March 1980)

The recent performance that we have seen in core bonds is some of the worst in the last 50 years. Recent bond performance has obviously been disappointing when viewing fixed income as a historically low risk asset that typically provides stability. With this in mind, how can we think about the potential future role of bonds in a portfolio context?

One factor that is often overlooked when assessing the role of fixed income in a diversified portfolio is the impact of prevailing level of inflation. Since 1976, the average year over year inflation rate during down quarters for both stocks and bonds was 6.1%. However, the average inflation rate when bonds provided a diversification benefit to a stock portfolio, i.e. bond returns were positive when stocks were down, was substantially lower at 3.3%. So, history indicates that if inflation remains elevated, the diversification benefit of bonds may be challenged.

While bonds have historically been a good addition to reduce portfolio risk and diversify against portfolio volatility and loss, today’s inflationary environment is likely to substantially decrease the diversification benefits of bonds. It may be a good time for investors to add more equity to their portfolio to offset the negative effects of both bonds and high inflation.

In a recent article we wrote, Using an 80 /20 Portfolio with Risk Mitigation to Replace a 60/40, we introduce three potential solutions advisors may want to consider to implement these insights into practice.

DISCLOSURES

Nothing contained herein should be construed investment advice or a recommendation to buy or sell any security or to adopt a particular investment strategy. This document does not take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments.

Past performance is not a guide to future performance. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. We do not intend to and will not endeavor to update the information discussed in this document. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. Individuals cannot invest directly in any index.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC.

© 2022 Horizon Investments, LLC. HIM042022