The media is hyper-focused on the rout in Treasury bonds, touting the rise in the 10-year yield to 1.7%; what’s left unsaid is that yield was first hit nearly a decade ago in the autumn of 2011.

Nearly every day the financial news headlines trumpet the selloff in bonds and the rising yields that go along with it. Some market pundits are convinced a bear market in bonds is underway. It’s easy to get caught up in the hype, but we believe whether or not it’s a bear market is the wrong thing to focus on from a goals-based perspective.

With most planning horizons stretching out 20 or 30 years, Horizon Investments believes the focus should be on whether bond yields and interest rates will ever again be high enough to provide substantial income and capital gains to meet someone’s financial goals.

The recent rout has done little to improve the long-term return picture for bonds. The selloff has pushed up the yield on the 10-year Treasury note to about 1.7%, a level it first reached nearly 10 years ago in the autumn of 2011.

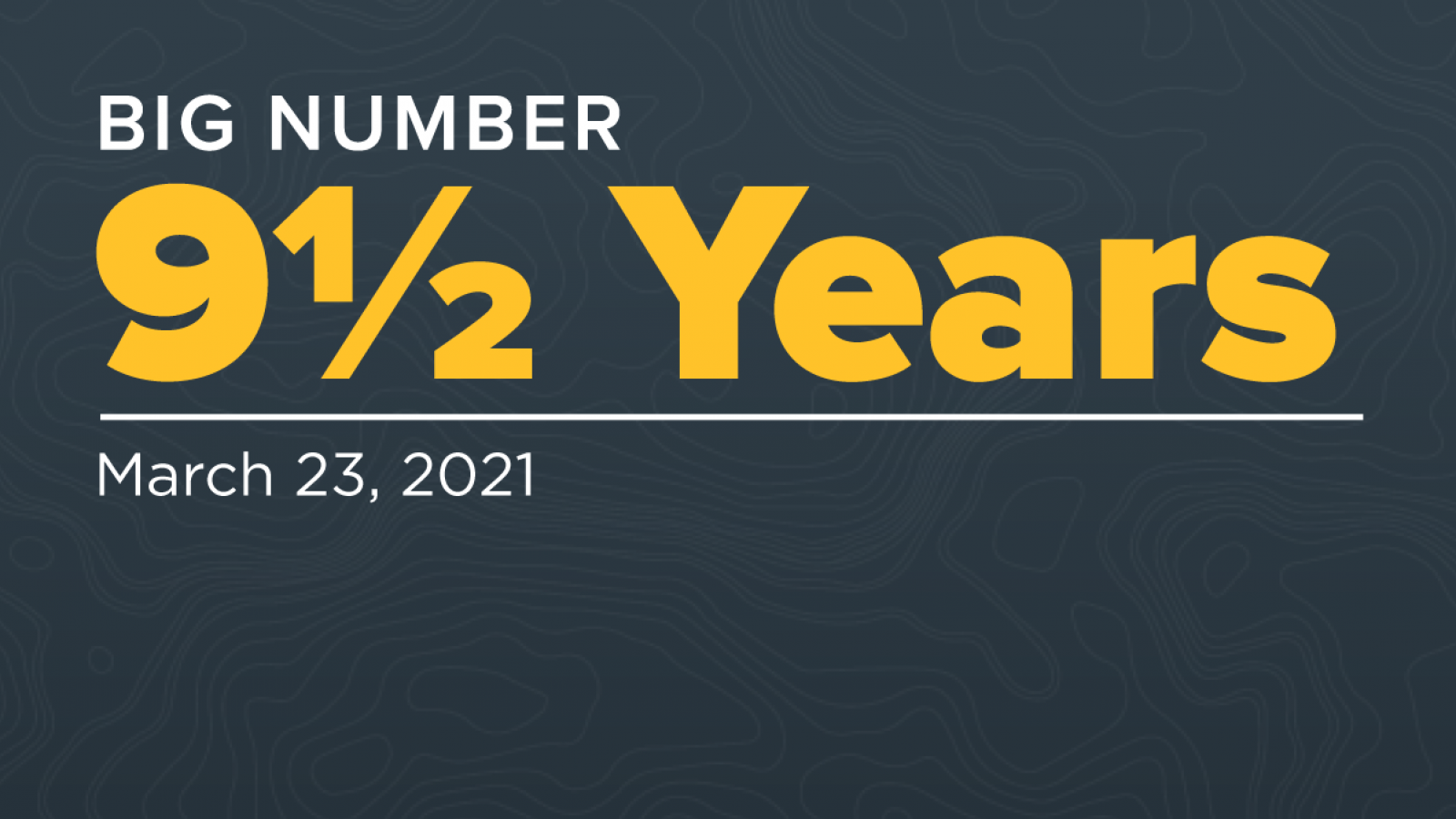

Rallies and routs have come and gone, but low yields remain. Over the last nine and a half years, the 10-year Treasury yield has averaged just 2.1%. Berkshire Hathaway’s Warren Buffett put it starkly in his recent shareholder letter, writing that bonds investors “face a bleak future” with yields at current levels1. We would encourage investors to consider that possibility, even though there could be some eye-catching headlines in the news.

For example, if the month of March ended today, the pullback in Treasury bonds from their peak last year would make history. The drawdown, or peak-to-trough decline, from 2020’s pandemic-fueled high for the Bloomberg Barclays Treasury Total Return Index totals 6.1%; the biggest retreat in U.S. government debt since the bull market in bonds began in September 1981. (Note: Horizon Investments is using monthly data as daily prices are not available for the entire period; Source: Bloomberg.)

The reasons for the drop are well-known: the global economy is reopening, a fresh $1.9 trillion in U.S. stimulus spending has just begun and much-faster U.S. GDP growth being predicted for this year is spurring fears of inflation.

But to change the nearly decade-long, low-rate environment would require a permanent shift to a faster pace of inflation. Horizon doesn’t see that happening, and we take issue with the financial markets pricing in Federal Reserve rate hikes within the next two years.

We believe historically low interest rates are here to stay for the foreseeable future (see our Q1 Focus on the Death of the Business Cycle for a deeper dive). We see the combination of disinflationary forces from technological innovations, the rising dominance of the services sector in the American economy’s make-up and the Fed’s promise to keep rates lower-for-longer all working together to prevent a return to decades past when bonds provided substantial interest income.

The financial planning challenge is to find the right mix of bonds and fixed-income alternatives to keep a client on track to meet their goals while remaining within their risk comfort zone. While this may look different over the next 20 years compared to what we’ve seen over the past two decades, we believe the use of innovative solutions around accumulation, preservation and distribution can help reduce the reliance on traditional fixed income in a time when the market is changing.

1 Letter to Berkshire Hathaway shareholders February 27, 2021, https://www.berkshirehathaway.com/letters/2020ltr.pdf

Further reading:

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

It’s Getting Harder to Fund Retirement Using Bonds

If Inflation Returns, Bond’s Diversification Power May Disappear

Disappearing Junk Bond Yields

Soaring Innovation Companies Go Cold as Interest Rates Rise: Big Number

Inflation Could Be Coming, Are You Ready?

Small-Cap EPS Growth Expected to Be 4x Faster Than S&P 500

Biden, Trump Agree: Make America’s Growth Great Again

Is Now the Time for ESG?

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, please reach out to Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

To download a copy of this commentary, click the button below.

To discuss how we can empower you please contact us at 866.371.2399 ext. 202 or info@horizoninvestments.com.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2021 Horizon Investments LLC