We have often expressed our view that retirement financial planning should rely less on traditional bonds as historically low yields could mean meager payouts to fund daily living expenses and an increased risk of outliving one’s savings.

Will the Federal Reserve’s imminent rate-hike campaign change our message? We doubt it. Based on what we currently know, the bond market is likely not going to break out of the last decade’s historically low trading range of 0.5% to 3.3%. We believe low yields are here to stay, along with the retirement income planning challenges posed by them.

The current state of market pricing has the Fed announcing about six, quarter-point increases in the Fed Funds Rate this year, based on our calculations as of February 16, 2022. If that occurs, the Fed Funds Rate would rise from 0% currently to 1.50% by New Year’s Eve.

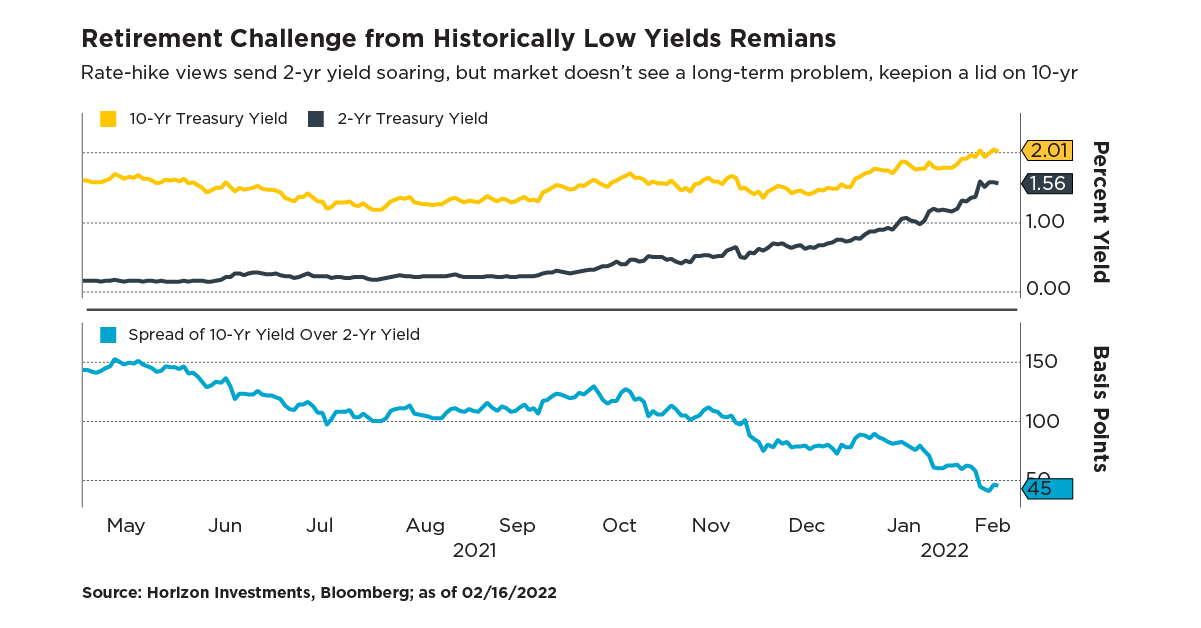

Markets believe the Fed is behind the curve in combating inflation and will have to move aggressively to combat the rising cost of living (see our Special Report: Ripping Off the Easy-Money Band Aid). And that belief explains why the short-end of the Treasury yield curve has been soaring since October.

At the same time, the financial markets are indicating that the Fed will succeed in its inflation fight.

You can see that belief in the more modest rise for 10-year yields, and how much closer its yield is to the two-year yield (lower panel above). In Wall Street parlance, the yield curve is flattening.

But the long-term Treasury yield picture is more complicated than that, and today’s 10-year yield of 2.01% might mark something of a high-water mark.

If the economic growth data softens and inflation pressures ease at the same time the Fed is raising short-term interest rates this year, then it’s possible long-term yields would tumble as traders get a sense of where the rate-hiking cycle will end. That has happened in the past and we would expect that to happen again this time.

The question on our mind is: what will be the peak of the Fed Funds Rate in this hiking cycle? It peaked at successively lower levels over the last three cycles: 6.50% in 2000, 5.25% in 2006 and 2.50% in 2018. Another lower peak now would suggest to us that bond yields will also max out at a lower level than in the past, leaving yields mired at multi-decade lows.

The more things have changed in terms of how the market is thinking about the Fed and rate hikes, the more we think that things have stayed the same in regards to bonds and retirement income: someone’s goal of a dignified and well-funded retirement will likely require investment ideas other than overweighting bonds. Please see our Spend strategies for how a total return approach to retirement income can help address longevity and short-fall risks.

Further reading:

Q4 Focus Magazine: The Good, The Bad and The Ugly of Inflation

2022 Outlook: The Next Unprecedented Year

Disappearing Foreclosures Add to Housing Inflation Pressures

Is Inflation Pressure Easing? Factory Input Costs Tumble Again

Abnormally Low Rates Remain Even If Fed Hikes in 2023

Americans Give Up on Inflation Remaining Tame

If Inflation Returns, Bond’s Diversification Power May Disappear

Essentially Nothing. That’s How Much Bonds May Return Over Next Five Years

It’s Getting Harder to Fund Retirement Using Bonds

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, contact Chief Investment Officer Scott Ladner at 704-919-3602 or sladner@horizoninvestments.com.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2022 Horizon Investments LLC