Falling bond market volatility could support equity prices.

Investors looking for signs of what stocks may do next often turn to the bond market for clues: these days, those investors probably like what they see.

Fixed income market conditions can give clues for future stock market behavior. One example: Historically, equity markets have tended to have stronger rallies when interest rate volatility was low.

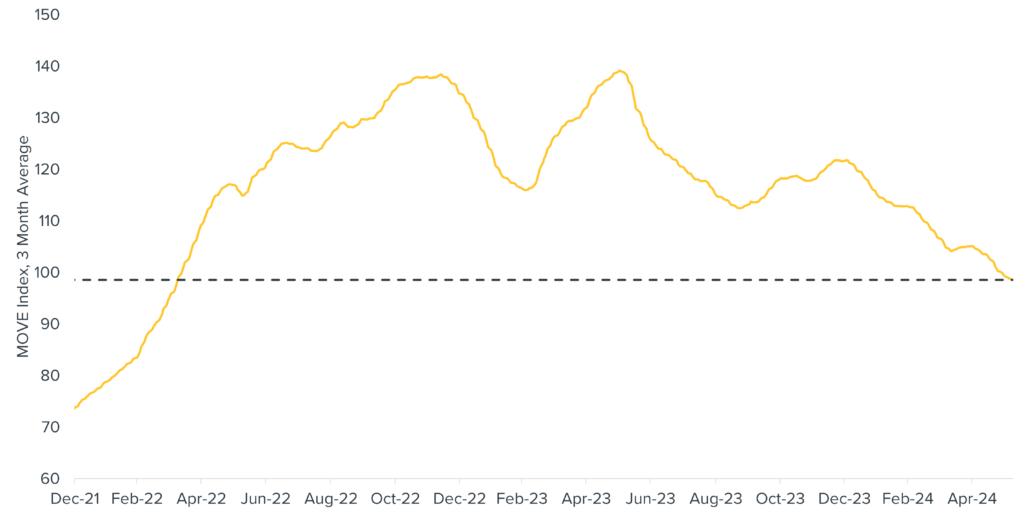

The good news: The overall trend for bond market volatility in 2024 has been relatively low. As the chart shows, the three-month average for the Merrill Lynch Option Volatility Estimate (MOVE) index—which essentially measures expected future rate volatility among U.S. Treasuries—currently sits at around 98. That’s the index’s lowest level on a three-month basis since early 2022, just before the Fed began its rate-hike campaign.

Despite the Chop, Trends in Bond Market Volatility are Improving

Source: Bloomberg, calculations by Horizon Investments, as of June 10, 2024. It is not possible to invest directly in an index.

Additionally, the MOVE index at this level is just slightly higher than its long-term average of 93.6 since 1988.

That said, bond volatility’s path lower hasn’t always been a smooth ride. In fact, the last few times we’ve highlighted lower volatility levels, the MOVE index temporarily rose shortly after.

Ultimately, we believe this overall trend could benefit markets and investors by decreasing uncertainty. What’s more, there’s potentially room for the MOVE index to fall even further over the next few months, given that the Fed is unlikely to alter interest rates until it sees multiple reports providing a clearer inflation picture.

If the index does continue its downward trend, stock investors could be in for a sunny summer.

The Merrill Lynch Option Volatility Estimate (MOVE) Index is calculated from options prices and reflects the level of volatility in U.S. Treasury futures. References to indices or other measures of relative market performance over a specified period of time are provided for informational purposes only. Reference to an index does not imply that any account will achieve returns, volatility or other results similar to that index. The composition of an index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Information obtained from third party sources is believed reliable but has not been vetted by the firm or its personnel.

This commentary is written by Horizon Investments’ asset management team. Past performance is not indicative of future results. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves the risk of loss.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. The opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed. Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2024 Horizon Investments, LLC.