GDP growth over the past three months may have been huuuuuge.

Third-quarter GDP growth could be a monster.

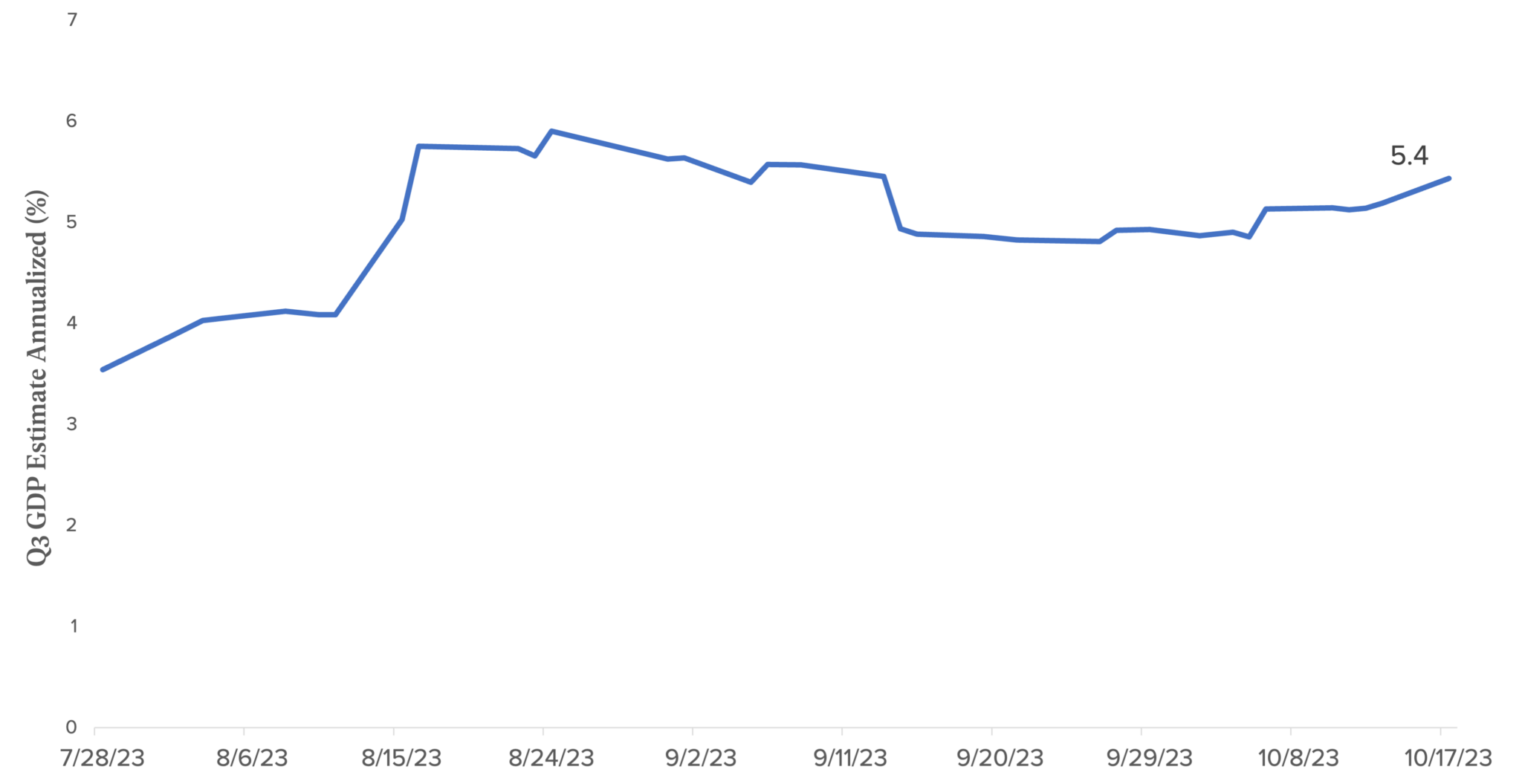

True, it’ll be a few weeks before we get the first official word on how fast the U.S. economy expanded from July through September. But currently, the Federal Reserve Bank of Atlanta’s forecasting model—GDPNow—is calling for a whopping 5.4% surge for the quarter (see the chart).

The Atlanta Fed’s model serves as a running estimate of real GDP growth (seasonally adjusted annual rate) based on available economic data that’s been released. The model is regularly updated as new numbers come out—and as of now, most third-quarter data is public knowledge.

In short, that 5.4% estimate has lots of quantitative support behind it.

If the GDPNow model is accurate, it will represent a remarkable jump from the 2.1% growth rate in the second quarter and the 2.2% rise seen during the first three months of the year. We believe this expected pickup in economic activity may also explain a portion of the sharp increase in longer-term yields leaving the US 10-year at nearly 5%, while providing support at these levels and be constructive for third-quarter earnings.

The driver of this sanguine forecast is, not surprisingly, U.S. consumers—who have shown remarkable resilience and a willingness to keep spending despite rising interest rates. For example, actual personal spending data during the quarter accounts for half of GDPNow’s 5.4% estimate.

- Falling inflation is helping boost economic activity, with the consumer price index coming in at 3.7% in September (year over year), roughly in line with expectations and down from 6.4% back in January.

- Meanwhile, the job market is defying all odds—with employers adding nearly twice as many jobs in September as expected.

It’s important to note that GDPNow isn’t the only game in town and that other models suggest slower growth. For example, the New York Fed’s Nowcast is looking for 2.5% GDP growth for the quarter, while the median consensus of economic forecasters on Bloomberg is 3.0%.

We’ll know soon whether the GDPNow model is on target. But regardless, it’s clear that a strong consumer continues to add fuel to the U.S. economic engine.

Disclosures

This commentary is written by Horizon Investments’ asset management team.

Past performance is not indicative of future results.

The Federal Reserve Bank of Atlanta’s GDPNow forecasting model provides a “nowcast” of the official estimate before its release by estimating GDP growth using a methodology similar to the one used by the U.S. Bureau of Economic Analysis. GDPNow is not an official forecast of the Atlanta Fed. Instead, it is best viewed as a running estimate of real GDP growth based on available economic data for the current measured quarter. There are no subjective adjustments made to GDPNow—the estimate is based solely on the mathematical results of the model. https://www.atlantafed.org/cqer/research/gdpnow.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments.

Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. An index’s composition may not reflect how a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Individuals cannot invest directly in any index. Indices are unmanaged and do not have fees or expense charges, which would lower returns.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money.

Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves risk of loss, and in periods of market growth, risk mitigation strategies can be expected to lag in performance behind equity strategies that do not focus on risk mitigation.

This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed.

Other disclosure information is available at hinubrand.wpengine.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2023 Horizon Investments LLC