Apple is once again worth more than the entire Russell 2000

In Marvel movies, it’s common for one superhero to be bigger than an entire army. Turns out, that’s also possible in real life in the equity market.

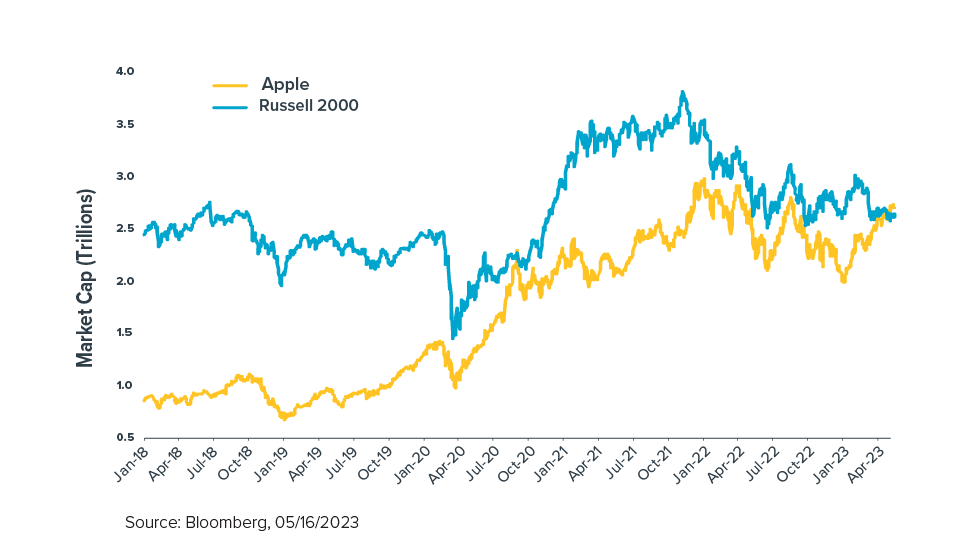

Case in point: The market capitalization of a single company—Apple Inc.—recently surpassed that of the Russell 2000 index of small-company shares. The chart shows that Apple’s roughly $2.7 trillion market cap is now around $100 billion higher than the combined value of all 2,000 stocks that comprise the index.

Apple’s valuation briefly exceeded the Russell 2000’s once before, during the first year of the pandemic, when investors sought safety in shares of the largest companies. These days, Apple’s stock has climbed on better-than-expected financial results and a general shift toward the mega-cap tech sector—while small-company stocks have sputtered in the wake of regional bank failures, concerns about access to much-needed credit, and recession fears.

Our current positioning mainly reflects our views on these recent trends, emphasizing growth and quality and underweighting more cyclical market segments. That said, the rapid pace of Apple’s rise (and of mega-cap tech overall) gives us pause. We believe the situation could suggest that small-company stocks may present an undervalued buying opportunity.

The upshot: Small-cap stocks could snap back if we get good news, such as resolving the debt ceiling issue.

Disclosure

This commentary is written by Horizon Investments’ asset management team.

Past performance is not indicative of future results.

The Russell 2000 Index is a small-cap U.S. stock market index that makes up the smallest 2,000 stocks in the Russell 3000 Index. You cannot invest directly in an index.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money.

Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves risk of loss, and in periods of market growth, risk mitigation strategies can be expected to lag in performance behind equity strategies that do not focus on risk mitigation.

This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed.

Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. An index’s composition may not reflect how a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Individuals cannot invest directly in any index.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2023 Horizon Investments LL