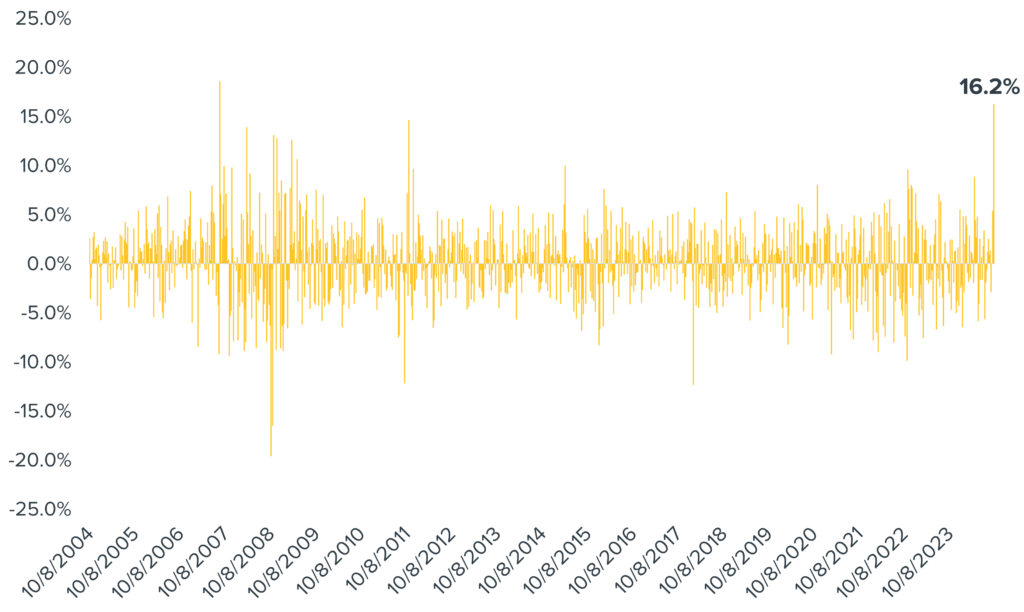

It’s been 17 years since we’ve seen a weekly return this strong

Long-suffering Chinese stocks broke out of their doldrums last week following the announcement of a massive monetary stimulus plan aimed at helping the slumping Chinese economy hit its economic growth target.

The FTSE China 50 soared 16.2% for the week—the index’s biggest weekly return since 2007 (see the chart). Other China stock indices have also posted similar historical gains.

Weekly Return of FTSE China 50 Index

Source: Bloomberg, calculations by Horizon Investments, data as of 09/30/2024. Indices are unmanaged and do not have fees or expense charges, both of which would lower returns. It is not possible to invest directly in an unmanaged index.

The Chinese government made several key decisions that fueled the rally, including:

- A roughly 50-basis-point interest rate cut on existing mortgage loans.

- A reduction in the amount of cash reserves banks must set aside.

- Fewer restrictions on borrowing money to invest in equities.

Given China’s position as the world’s second-largest economy, these and other stimulus measures helped boost international equities in Europe, emerging markets, and in particular, sectors that stand to benefit from financially stronger Chinese consumers (such as luxury goods, metals and mining, and materials).

China’s big gains last week—which have continued into this week thus far—are another reminder of potential opportunities for investors looking beyond U.S. stocks. But while intriguing, the current situation does demand some caution. Chinese stocks have generally declined since peaking in late 2020, and there have been several false starts since then. We will be searching for signals that this most recent stimulus round has truly taken root in market pricing and is being fully appreciated by investors.

The FTSE China 50 index is a real-time tradable index comprising 50 of the largest and most liquid Chinese stocks (H Shares, Red Chips and P Chips) listed and trading on the Stock Exchange of Hong Kong (SEHK). Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. The composition of an index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility, or tracking error targets, all of which are subject to change. It is not possible to invest directly in an index. Information obtained from third party sources is believed reliable but has not been vetted by the firm or its personnel.

Information obtained from third-party sources is believed to be reliable but has not been vetted by the firm or its personnel.

This commentary is written by Horizon Investments’ asset management team. Past performance is not indicative of future results. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves the risk of loss.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. The opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed. Other disclosure information is available at www.horizoninvestments.com.