Successful investing doesn’t have to be a thrill ride.

Anyone who has driven California’s Pacific Coast Highway or North Carolina and Tennessee’s Tail of the Dragon knows the thrill—and the fright—that comes with navigating a winding road complete with hairpin turns and plenty of ups and downs.

Of course, there are times when a smoother path with less excitement may be the preferred route.

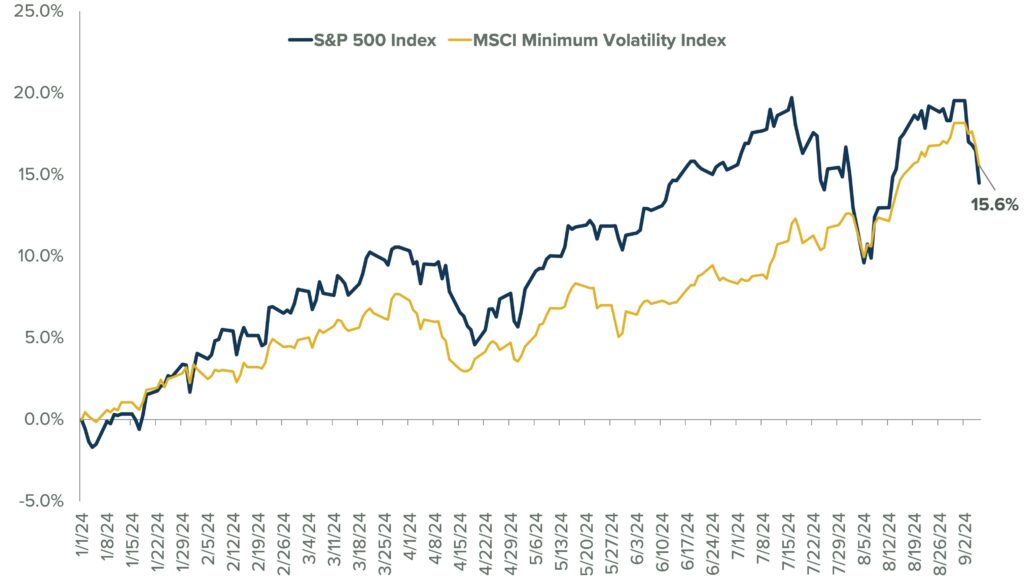

That idea can hold true in the investment world, too. As seen in the chart, the S&P 500 (led by mega-cap tech) was handily beating the MSCI Minimum Volatility Index, which focuses on stocks whose prices have tended to fluctuate very little in the short term, for much of 2024. In early July, for example, the gap between the two indices was roughly 10%.

It’s a different story today: The MSCI Minimum Volatility Index is now up 15.6% for the year—versus 14.5% for the S&P 500.

Low-Volatility Stocks Are Outpacing the S&P 500 So Far This Year

Source: Bloomberg, calculations by Horizon Investments, data as of September 6, 2024. Indices are unmanaged and do not have fees or expense charges, both of which would lower returns. It is not possible to invest directly in an unmanaged index.

The takeaway: There are opportunities in the market beyond the handful of names capturing the headlines (and they seem to frequently swing wildly). We think artificial intelligence’s promise remains attractive, but a slight overweight of those stocks can often be adequate to capture significant upside potential.

A well-diversified approach that includes more low-volatility stocks may add an important level of stability that can help smooth out returns over time. Such allocations are key components of portfolios that balance the trade-off between risk and returns over a goals-based investment journey.

The MSCI Minimum Volatility Indexes are designed to serve as transparent benchmarks for minimum variance (or managed volatility) equity strategies. The S&P 500 or Standard & Poor’s 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. The composition of an index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility, or tracking error targets, all of which are subject to change. It is not possible to invest directly in an index. Information obtained from third party sources is believed reliable but has not been vetted by the firm or its personnel.

This commentary is written by Horizon Investments’ asset management team. Past performance is not indicative of future results. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves the risk of loss.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. The opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed. Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2024 Horizon Investments, LLC.