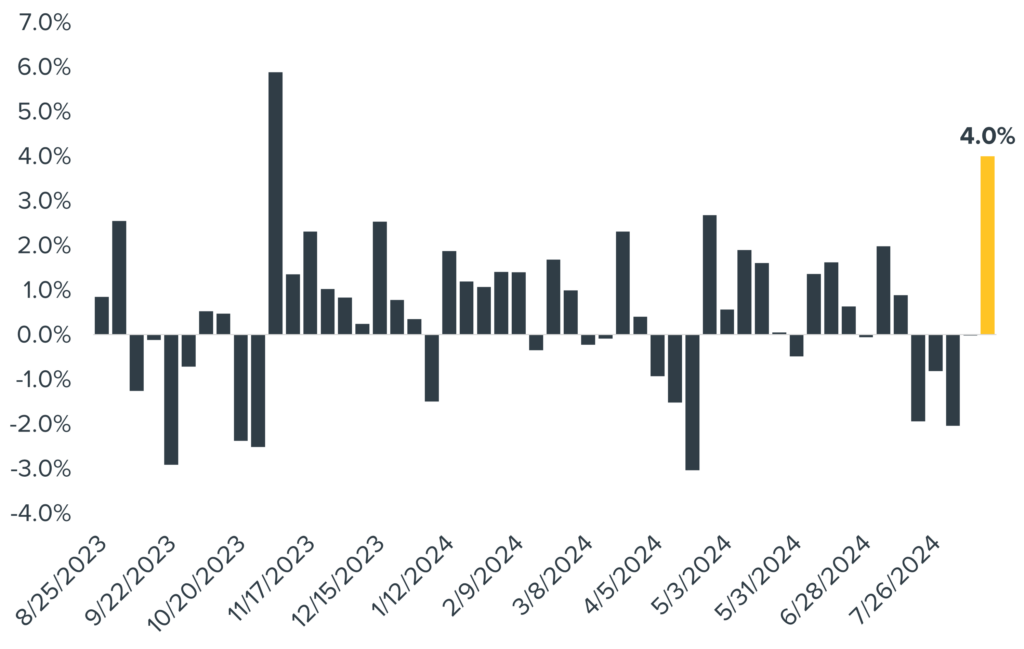

Best week of 2024 for the S&P 500

After a brief summer slump and a short-lived overreaction, stocks enjoyed their best week since November, up 4% last week.

S&P 500 Weekly Returns

Source: Source: Bloomberg, calculations by Horizon Investments, as of August 19, 2024.

Market sell-offs preceded both of these big moves. Back in November 2023, bad news, such as weaker-than-expected job growth, got investors excited about the possibility of a Fed rate cut and boosted stock prices. Last week, in contrast, good economic news helped stocks rally:

- Consumer inflation (CPI) was lower than expected and fell below 3% for the first time since March 2021. Additionally, wholesale inflation (PPI), the average price changes seen by producers and manufacturers, came in lower than anticipated.

- Initial jobless claims fell by 7,000 during the week ending August 10th, the lowest level since early July and far better than the expected increase of 3,000.

- Retail sales rose more than expected, tamping down fears from earlier this month that consumer spending is running out of steam.

The upshot: With inflation firmly headed toward the Fed’s goal of 2%, many investors anticipate an economic soft landing and expect the Fed to cut rates at its September meeting. The Fed’s main focus going forward is the labor market. All eyes will be on Jackson Hole, Wyoming, this week, where Fed Chair Powell will provide his latest thoughts on the economy and the future of interest rates.

The S&P 500 is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. References to indices, or other measures of relative market performance over a specified period of time are provided for informational purposes only. Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. The composition of an index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility, or tracking error targets, all of which are subject to change. It is not possible to invest directly in an index. Information obtained from third party sources is believed reliable but has not been vetted by the firm or its personnel. This commentary is written by Horizon Investments’ asset management team.

Past performance is not indicative of future results. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves the risk of loss. The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. The opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed. Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2024 Horizon Investments, LLC.