Can economic growth tailwinds outweigh higher interest rates?

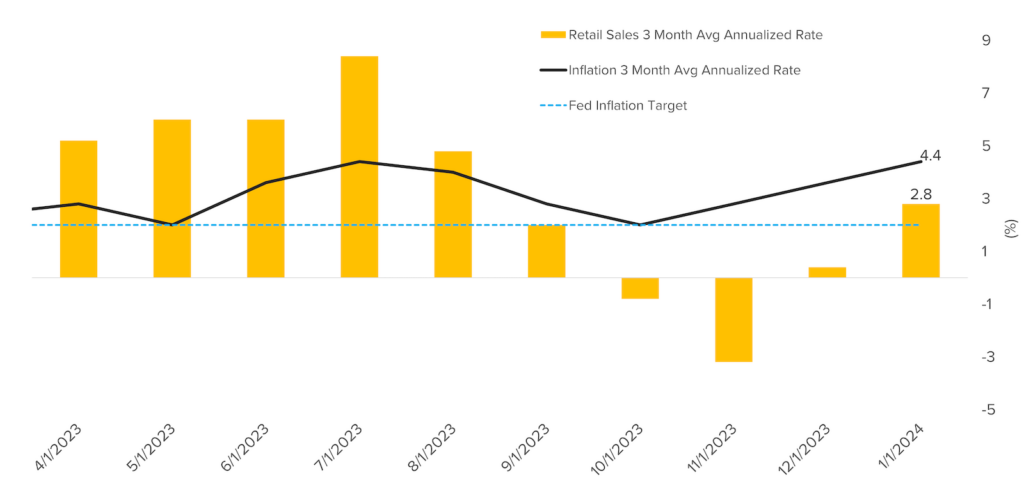

Month-over-month retail sales for March topped economist expectations at 0.7%, with February figures revised higher to 0.9% (they previously sat at 0.6%). This means retail spending has averaged 2.8% annually over the past three months – a sharp trend change as shown in the chart below.

This spending news has important implications for economic growth and inflation alike. If consumers continue to spend money – it can help support economic growth. However, if they spend too much – prices might go up putting more upward pressure on inflation.

With prices going up faster than expected and GDP growth blowing past expectations for six quarters in a row, we would expect this hot consumer spending data to put even more upward pressure on interest rates.

Annualized Month-Over-Month Inflation and Retail Sales

Source: Bloomberg, calculations by Horizon Investments, as of 4/15/2024.

What’s behind the recent rise in rates is relevant to investors as well. Higher rates due to faster economic growth can support equity markets through earnings growth – and we believe this year’s rise in broad equity markets seems well supported through that lens. However, under the hood, rates have mattered for asset allocation decisions recently within equities as large-cap and growth allocations have meaningfully outpaced more rate-sensitive value and small-cap exposures.

As we head into the bulk of earnings season, we expect this split between outperformers and underperformers to grow as investors reprice stocks after the rise in earnings expectations. If the market’s heightened sensitivity to this data continues, we believe an actively managed allocation strategy may seize opportunities a passive, index-based approach might overlook.

This commentary is written by Horizon Investments’ asset management team. Past performance is not indicative of future results. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves the risk of loss.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. The opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed. Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2024 Horizon Investments, LLC.