Baby boomers have been approaching retirement for a decade, bringing billions of dollars out of retirement accounts as America’s second-largest generation approaches the IRS’s required minimum distribution age (RMD).

As a fiduciary, helping your clients develop a strategy around their RMD withdrawals, and ensuring they avoid the stiff penalties imposed when an RMD is missed, can be cumbersome and time-consuming. Are you looking for ways to efficiently improve your process and your clients’ RMD experience?

Consider Horizon’s Real Spend® distribution strategy.

Real Spend® is a retirement income strategy available as a managed account. The periodic withdrawal aspect of the strategy aims to slow the exit of assets due to mandatory RMDs.

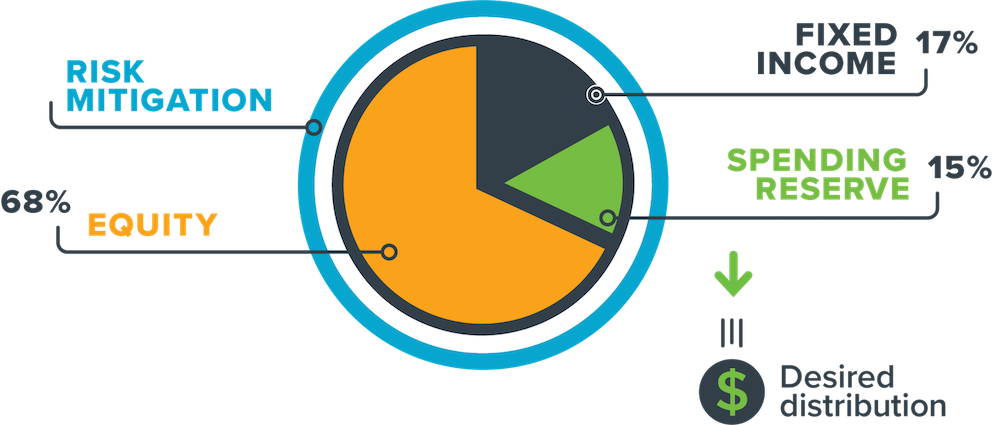

Real Spend® consists of:

Spending Reserve. A multi-year reserve of liquid assets for spending on current and short-term needs and goals.

Investment Portion. An investment portfolio with a tilt toward equities, designed to exceed or keep pace with inflation and generate sufficient returns to replenish withdrawals made from the Spending Reserve.

Risk Mitigation. Includes Risk Assist®, with an active risk management strategy, seeking to protect the investment portfolio during sudden and severe market downturns and help preserve retirement capital.

For illustrative purposes only.

Implementing Real Spend® retirement income strategies to address RMD needs.

Real Spend®’s systematic approach can help create efficiency for advisors and clients in two significant ways:

Ready Liquidity.

Each Real Spend® model features a dedicated spending reserve that aims to hold approximately three years’ worth of income distribution needs in liquid, cash-like holdings. Clients can access these funds whenever necessary – for example, to satisfy their RMDs.

Structure.

The allocation of Horizon’s Real Spend® strategy supports a targeted withdrawal amount each year, eliminating significant time and effort spent preparing to meet clients’ spending requirements, and may help avoid selling retirement holdings at inopportune times to meet withdrawal requirements.

REAL SPEND® 5% Example

Real Spend® is available in five portfolio strategies designed to support distribution rates between 3% and 7% annually through risk-managed exposure to global equity markets.

Real Spend® portfolios are designed to provide:

- Spending reserves replenished by portfolio gains

- Opportunity for portfolio growth through exposure to global equities

- Risk mitigation seeking to avoid catastrophic loss

The investments recommended by Horizon are not guaranteed. The charts represent an approximate percentage of investment choices for each model and should not be considered a guaranteed or fixed percentage.

The Real Spend® retirement income strategy is NOT A GUARANTEE against market loss and there is no guarantee that the Real Spend® strategy chosen by an investor will lead to successful investment outcomes for part of, or for the entirety of an investor’s retirement. This strategy is not an insurance product with payments guaranteed. It is a strategy that invests in marketable securities, any of which will fluctuate in value. Before investing, consider the investment objectives, risks, charges, and expenses of the strategy. Keep in mind investing involves risk. There is a possibility of outliving the assets if market performance is lower than forecasts used in planning, or if longevity is longer than anticipated. Any risk management processes described herein include an effort to monitor and manage risk, but should not be confused with and do not imply low risk or the ability to control risk.

Horizon Investments, the stylized H, Gain Protect Spend, Real Spend and Risk Assist are each registered trademarks of Horizon Investments, LLC.

NOT GUARANTEED | CLIENTS MAY LOSE MONEY | PAST PERFORMANCE NOT INDICATIVE OF FUTURE RESULTS