The end of Fed rate hikes suggests good things for equities.

The stock market’s surge last week—U.S. and global equities soared nearly 6%—may be the start of an extended run.

The reason: peak rates. In the wake of the October jobs report showing a cooling labor market, it appears increasingly likely that the Fed is done raising short-term interest rates. And historically, stocks tend to be in the black after the Federal Reserve Board wraps up a campaign of rate hikes.

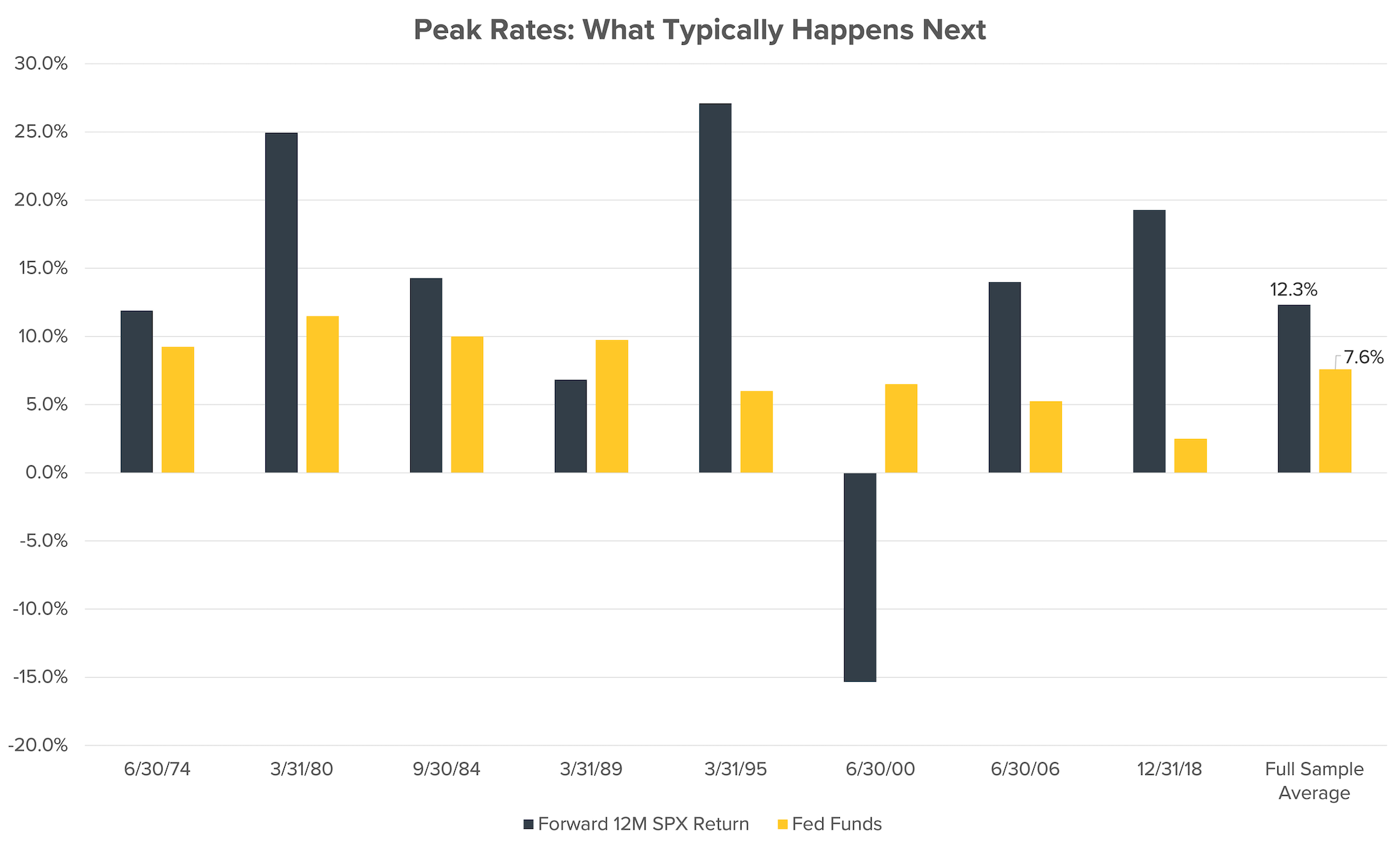

Looking at the last eight conclusions to Fed tightening cycles going back to 1970, the S&P 500’s forward 12-month return was positive in seven of those eight periods.

Even better, the stock market’s returns have historically been robust once rates top out. The chart shows that the S&P 500, on average, has gained 12.3% during the 12 months after the Fed stopped raising rates. That’s 4.7 percentage points higher than the average peak federal funds rate—which influences the interest rates on CDs and other “risk-free” financial instruments—of just 7.6% over that period.

Moreover, the stock market’s 12-month return exceeded the peak federal funds rate 75% of the time after the Fed stopped raising rates.

The upshot: Staying on the sidelines—avoiding equities, loading up on CDs, etc.—after rates have peaked may not work in investors’ favor. And while there will always be uncertainty and concerns over current events and conditions, history suggests that stocks may be positioned to rally in the coming months.

Disclosures

This commentary is written by Horizon Investments’ asset management team.

Past performance is not indicative of future results. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves risk of loss.

The Standard and Poor’s 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. An index’s composition may not reflect how a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Individuals cannot invest directly in any index. Indices are unmanaged and do not have fees or expense charges, which would lower returns.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money.

This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed. Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2023 Horizon Investments LLC