OVERVIEW

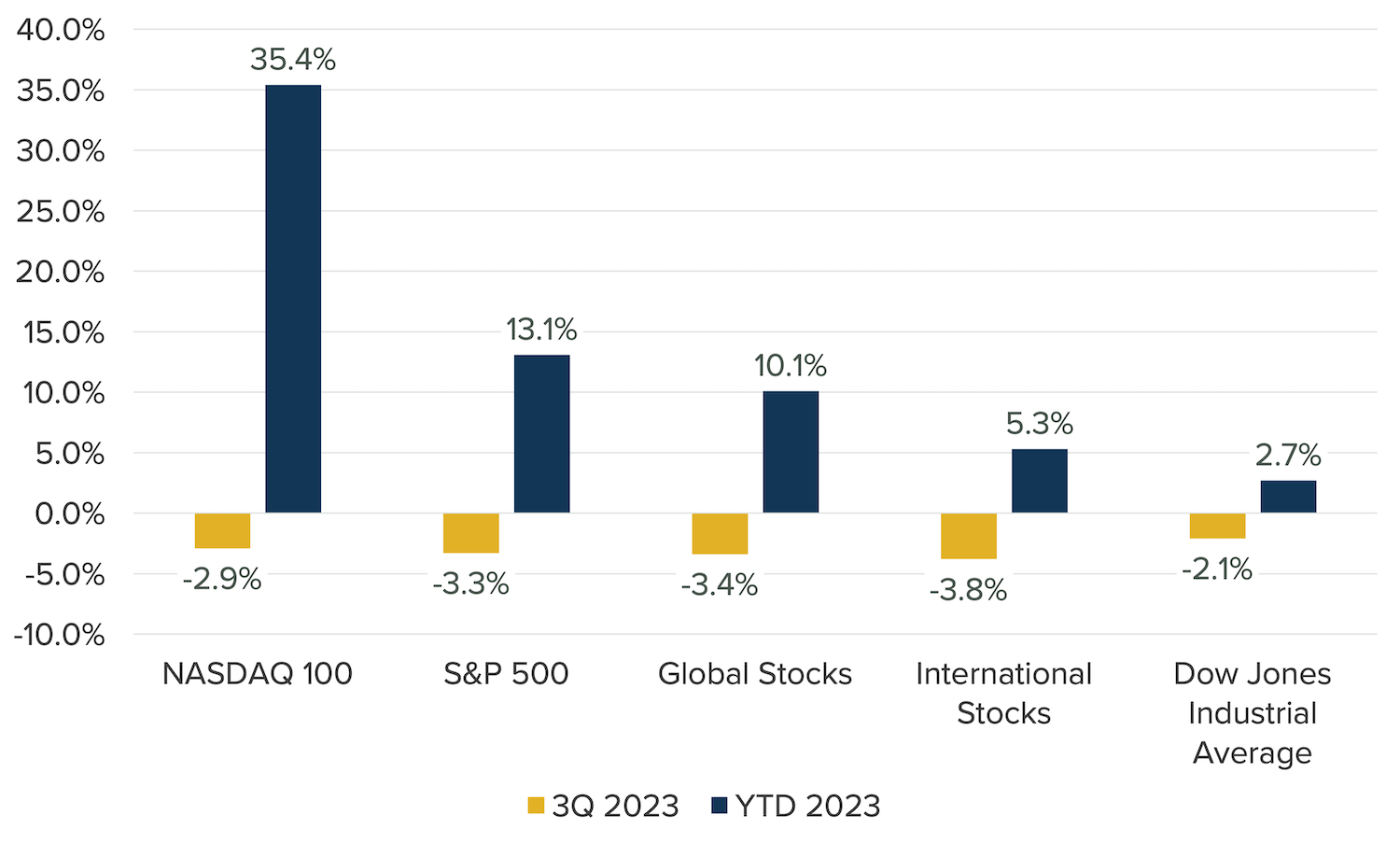

During the third quarter of 2023, investors hit “pause” on the rally that had lifted stocks higher for much of the year. The major equity market indices were down over the three months; although, they remain in positive territory year-to-date (see Exhibit 1).

Exhibit 1: Performance of Major Equity Market Indices, 3Q 2023 and YTD

Total Returns Across Major Equity Indices

For the quarter:

- The S&P 500 fell -3.3%.

- The Nasdaq 100 returned -2.9%.

- The Dow was down -2.1%.

- It was the first negative quarter of 2023 for all three indices.

Stocks fell as it became clear throughout the quarter that interest rates—rising as part of the Federal Reserve Board’s rate hikes aimed at taming inflation—will likely stay elevated longer than investors had anticipated or hoped for due to strong economic conditions. The Fed raised rates once during the quarter, in July, but opted to hold rates steady in September.

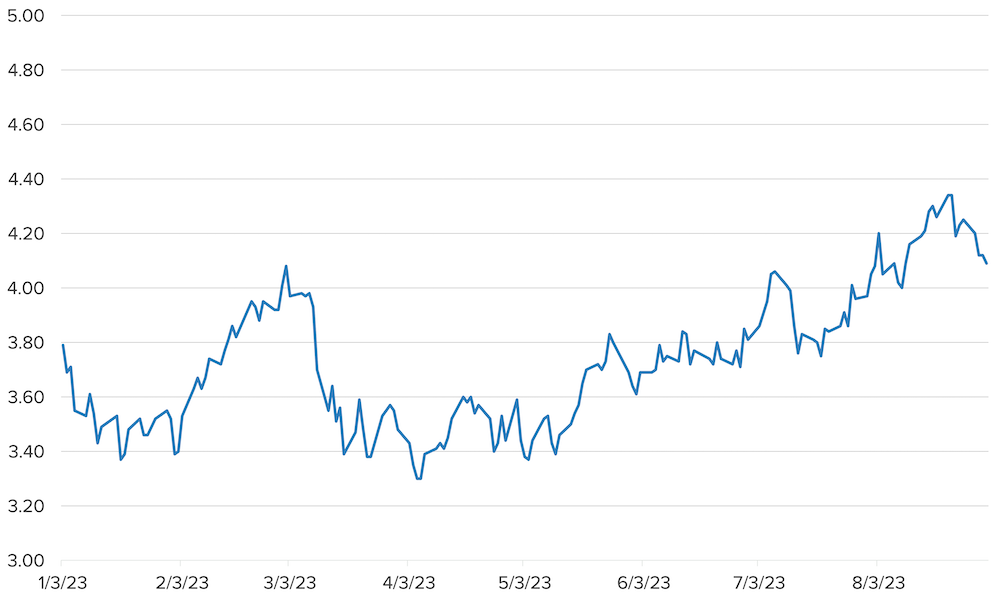

In that environment, the benchmark 10-year U.S. Treasury note yield rose to its highest level of 2023 (see Exhibit 2) and its highest level since 2007. Since bond prices fall as bond yields rise, the Bloomberg U.S. Aggregate bond index declined -3.2% for the quarter—the index’s third consecutive quarterly loss.

Overseas stocks also suffered during the quarter, with the MSCI All Country World Index down -3.4% and the MSCI All Country World ex US Index (which excludes U.S. stocks) down -3.8%. European stocks, represented by the MSCI Europe Index, returned -7.2%, while the MSCI Japan Index returned -1.6%.

Exhibit 2: Yield on 10-Year Treasury, 2023 YTD

A VIEW FROM THE TOP?

As the third quarter ended, investors, by and large, agreed that the Federal Reserve Board was either finished or nearly finished with its campaign of raising short-term interest rates to bring down high inflation. Since March 2022, the Fed has increased a key short-term rate, the federal funds rate (FFR), 11 times—bringing the FFR target range to 5.25% to 5.50%. Now, the thinking goes, we’ve reached the top of that cycle.

During that time, inflation fell from 9.1% in June 2022 to 3.7% in August. After the Fed chose to hold rates steady at its last meeting in September, Fed Chair Powell stated that Fed officials didn’t yet need to decide whether to raise rates again, that they would “proceed carefully,” and that they expect to keep rates around their current levels for longer into next year than they had previously predicted.

Opinions about how the economy and financial markets will behave in this “higher for longer” environment are decidedly mixed—primarily influenced by the perspective from which various investors view current conditions.

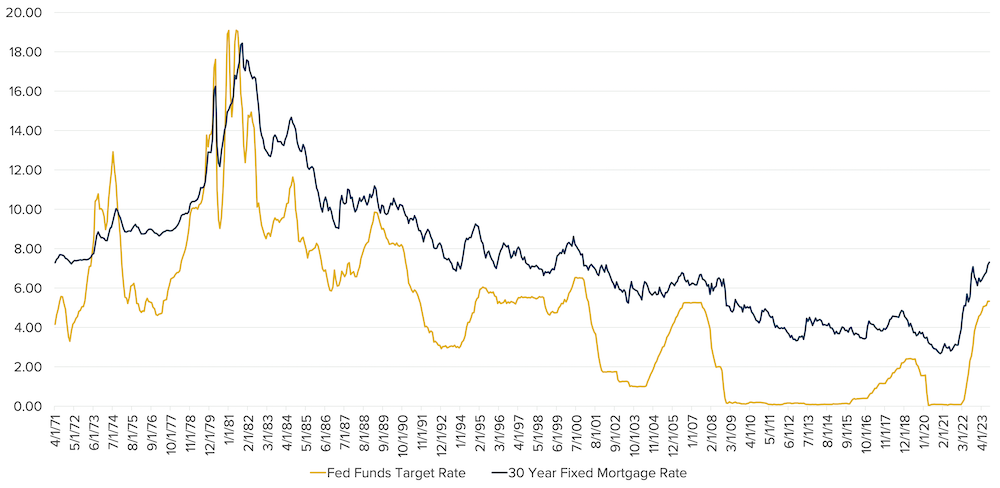

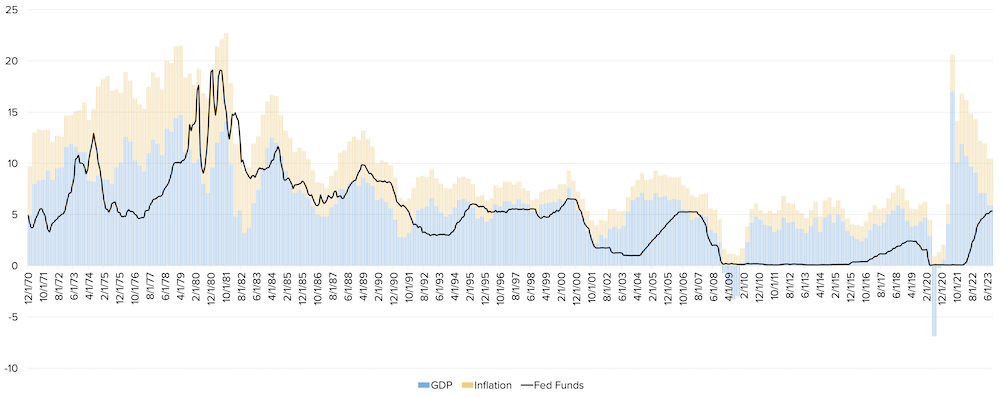

- An investor looking back over roughly the past 15 years—from 2008 to today—might reasonably conclude that today’s interest rates have reached abnormal heights and worry that these high rates could hurt spending and corporate profits enough to cause a recession.

- An investor looking back over the past 40 years or so would notice that today’s interest rates largely match those seen in the mid-2000s and much of the 1990s—periods of strong economic growth and stock market returns—and that current rates are far, far lower than those experienced during much of the 1970s and 1980s.

Exhibit 3: A History of the Federal Funds Rate and 30-Year Fixed Mortgage Rates

Clearly, the perspective from which investors view the environment impacts how they think and feel about where we are today and where we may be headed. With that in mind, consider various perspectives on the state of the economy, the health of the consumer, the prospects for corporate profits, and the direction of the markets.

THE ECONOMY

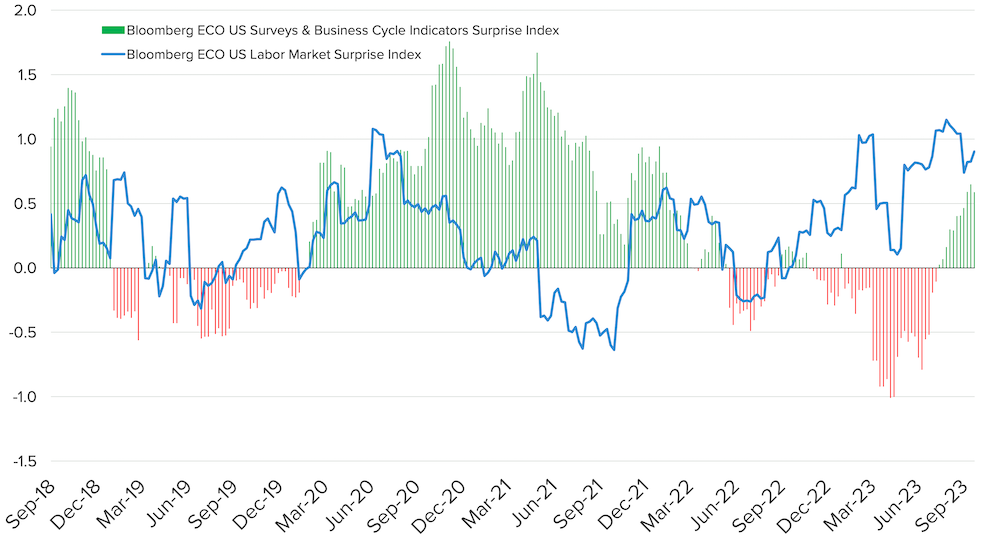

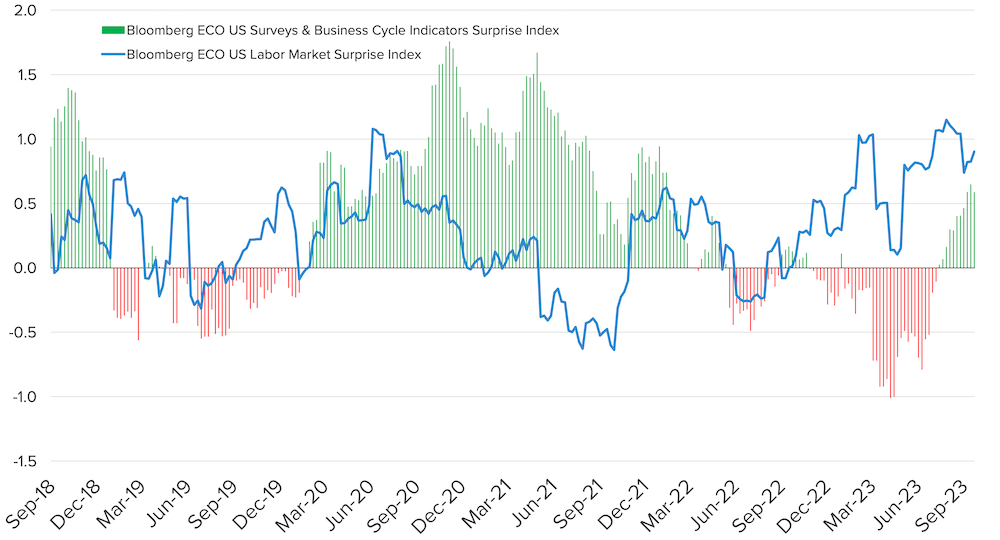

The U.S. economy has shown remarkable resilience in the face of rising interest rates, posting annualized growth in the second quarter of 2.1% with expectations of nearly 5% growth in the third quarter (according to the Federal Reserve Bank of Atlanta). As seen in Exhibit 4, labor market data has come in better than expected for an extended period now (the blue line), while the negative business cycle surprises we had seen for some time have turned a corner and are now in positive territory (the red and green bars).

Exhibit 4: Labor Market and Business Cycle Surprises Turn Positive

A VIEW FROM THE TOP?

As the third quarter ended, investors, by and large, agreed that the Federal Reserve Board was either finished or nearly finished with its campaign of raising short-term interest rates to bring down high inflation. Since March 2022, the Fed has increased a key short-term rate, the federal funds rate (FFR), 11 times—bringing the FFR target range to 5.25% to 5.50%. Now, the thinking goes, we’ve reached the top of that cycle.

During that time, inflation fell from 9.1% in June 2022 to 3.7% in August. After the Fed chose to hold rates steady at its last meeting in September, Fed Chair Powell stated that Fed officials didn’t yet need to decide whether to raise rates again, that they would “proceed carefully,” and that they expect to keep rates around their current levels for longer into next year than they had previously predicted.

Opinions about how the economy and financial markets will behave in this “higher for longer” environment are decidedly mixed—primarily influenced by the perspective from which various investors view current conditions.

- An investor looking back over roughly the past 15 years—from 2008 to today—might reasonably conclude that today’s interest rates have reached abnormal heights and worry that these high rates could hurt spending and corporate profits enough to cause a recession.

- An investor looking back over the past 40 years or so would notice that today’s interest rates largely match those seen in the mid-2000s and much of the 1990s—periods of strong economic growth and stock market returns—and that current rates are far, far lower than those experienced during much of the 1970s and 1980s.

Exhibit 3: A History of the Federal Funds Rate and 30-Year Fixed Mortgage Rates

Clearly, the perspective from which investors view the environment impacts how they think and feel about where we are today and where we may be headed. With that in mind, consider various perspectives on the state of the economy, the health of the consumer, the prospects for corporate profits, and the direction of the markets.

THE ECONOMY

The U.S. economy has shown remarkable resilience in the face of rising interest rates, posting annualized growth in the second quarter of 2.1% with expectations of nearly 5% growth in the third quarter (according to the Federal Reserve Bank of Atlanta). As seen in Exhibit 4, labor market data has come in better than expected for an extended period now (the blue line), while the negative business cycle surprises we had seen for some time have turned a corner and are now in positive territory (the red and green bars).

Exhibit 4: Labor Market and Business Cycle Surprises Turn Positive

THE CONSUMER

Consumers’ spending habits have largely been the driving force behind this resilient economy. Not surprisingly, investors are watching consumer attitudes and behaviors closely as they seek to determine whether consumers can continue to keep their foot on the economic gas pedal.

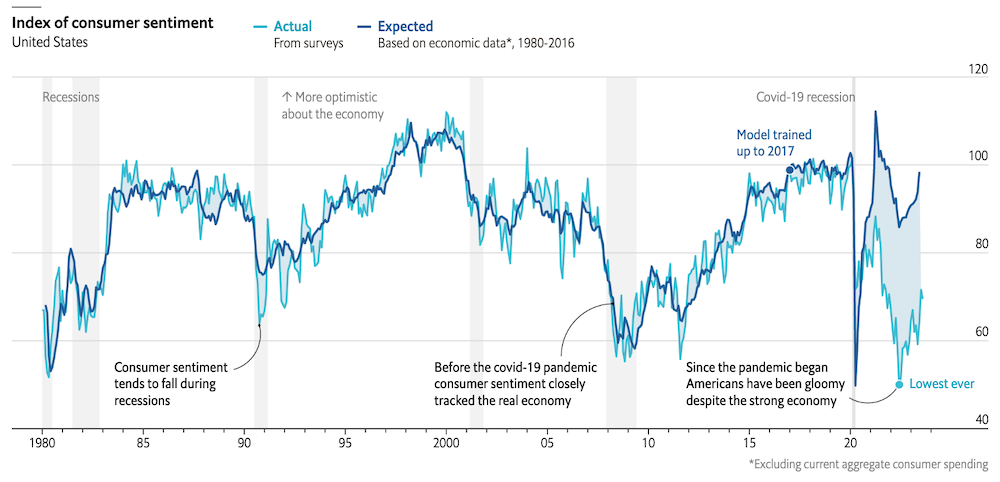

From one perspective, there is reason for concern. Consumer sentiment about the overall economy and people’s personal financial situations (shown in Exhibit 5) is hovering near the all-time low it hit in 2022—and right around the level it was at in the midst of the 2008-2009 global financial crisis that erased some $17 trillion of household wealth. Clearly, consumers are feeling very bad about current and expected future economic conditions—even though the economy remains healthy overall, as noted above.

Exhibit 5: Consumers Feel Horrible

Indeed, by several objective measures, there is little reason for consumers to have such negative sentiment. A perspective that looks beyond these self-reported feelings reveals a decidedly more positive picture of a strong consumer, willing and able to spend. For example:

- Consumer debt is at reasonable levels. Consumers’ nominal interest payments on their debt, as a percentage of their overall compensation from wages, is just 7.1%—near the lowest level since 1978 and on par with where it was pre-Covid. This low debt-to-compensation percentage strongly suggests U.S. consumers are very underlevered and can easily support their current interest payments.

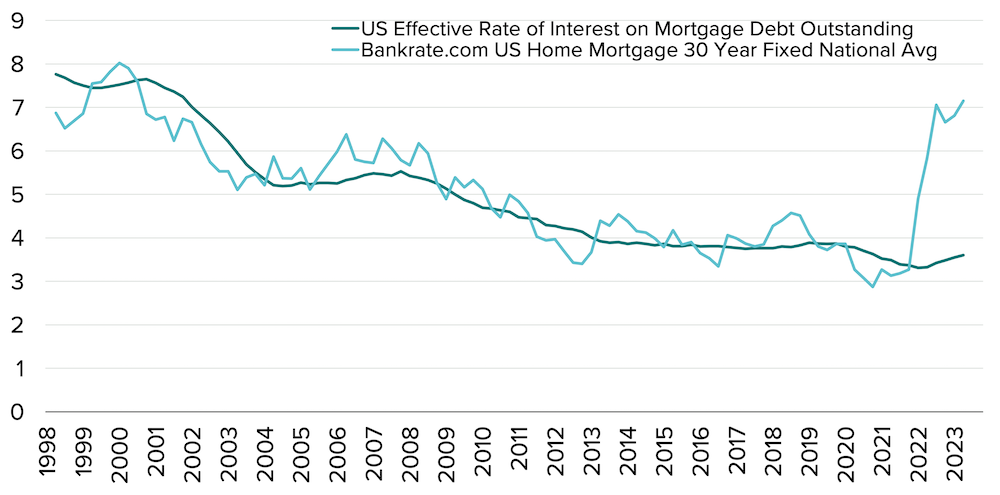

- Most homeowners have locked-in low mortgage rates. A key reason interest payments are manageable for so many consumers is that by and large, homeowners are paying between 3% and 4% on their mortgages (see Exhibit 6). While the Fed’s rate hikes have pushed the average 30-year fixed-rate mortgage above 7%, most homeowners today find their finances largely insulated from the impact of that spike.

Exhibit 6: Today’s Mortgage Rates vs Rates Most Homeowners are Paying

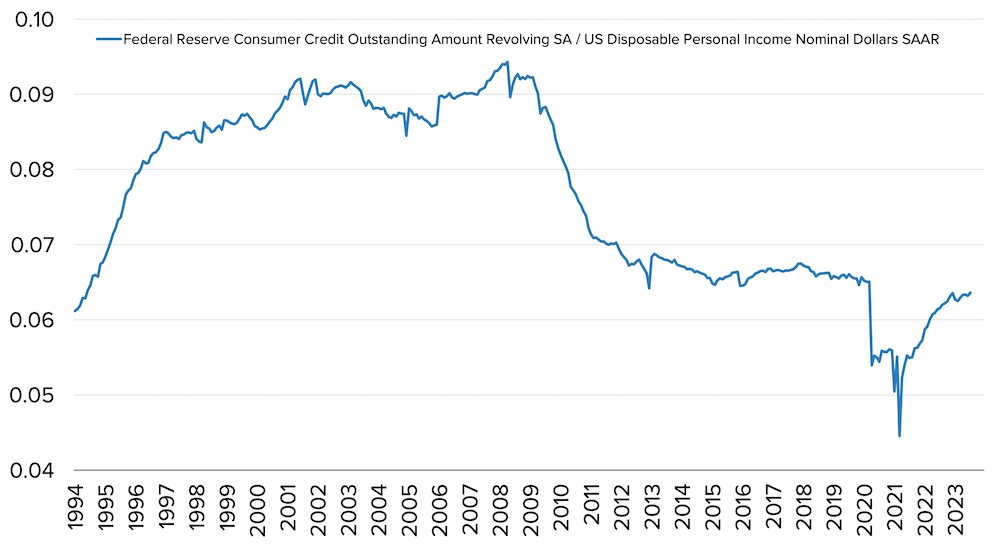

- Credit card debt remains under control—despite the headlines. Americans’ rising credit card balances have captured much attention this year. And, indeed, balances are up substantially: Consumer credit card debt topped $1 trillion for the first time ever earlier this year. From another perspective, however, the situation looks quite different. Exhibit 7 shows that outstanding revolving (credit card) debt relative to consumers’ disposable personal income is lower than before the pandemic—and far from the problematic levels seen going into the ’08-’09 financial crisis.

Exhibit 7: Consumers’ Revolving (Credit Card) Debt Relative to Their Disposable Personal Income

Furthermore, delinquency rates on credit card loans are hovering around historically low levels. And “charge-offs” (debt that creditors have essentially written off as a total loss) for U.S. bank-issued credit cards were only 1.73% in August–versus 2.30% in December 2019, 9.88% in December 2009, and 6.64% in January 2004.

- Income growth, rather than personal savings or “free money”, is fueling consumer spending. Massive pandemic stimulus money fueled much of the consumer spending that occurred in 2021 and 2022—a factor that is unsustainable long term, of course. Today, however, spending is financed primarily by workers’ rising wages and incomes According to recent research by Bridgewater Associates.

The upshot: The bad feelings people report about their finances are not supported by the fact that most consumers have strong balance sheets that position them well for continued robust spending, even in the wake of today’s higher rates, as Exhibit 5 showed.

CORPORATE PROFITS

Consumers aren’t the only ones with attractive balance sheets despite higher rates. Over the past several years, businesses have locked in lower rates on their debt, insulating them largely from the worst impacts of Fed’s recent rate hikes. Moreover, companies (and consumers) are benefiting from the higher interest rate payments they’re currently receiving on their cash holdings.

One result: Businesses’ net interest payments as a percentage of their after-tax profits are the lowest they’ve been in more than 50 years.1

Going forward, the outlook for corporate profits remains healthy. Future earnings growth expectations for companies in the S&P 500 recently hit their highest levels in a year and remain much higher than pre-pandemic levels. If we see continued strength from consumers and the overall economy, these estimates could have greater upside.

1Nonfinancial companies only.

THE FED AND INTEREST RATES

Through its words and actions, the Fed has resolutely communicated two key messages to the markets in recent months: It is done or nearly done raising interest rates and is unlikely to cut rates in the near term.

For example, members of the Federal Reserve Board have significantly lowered their 2024 unemployment expectations:

- Most Fed members in June were calling for 2024 unemployment of 4.4% to 4.5%. None predicted an unemployment rate below 4%.

- By September, however, the most common estimate was just 4.0% to 4.1%—with five members now looking for unemployment below 4%.

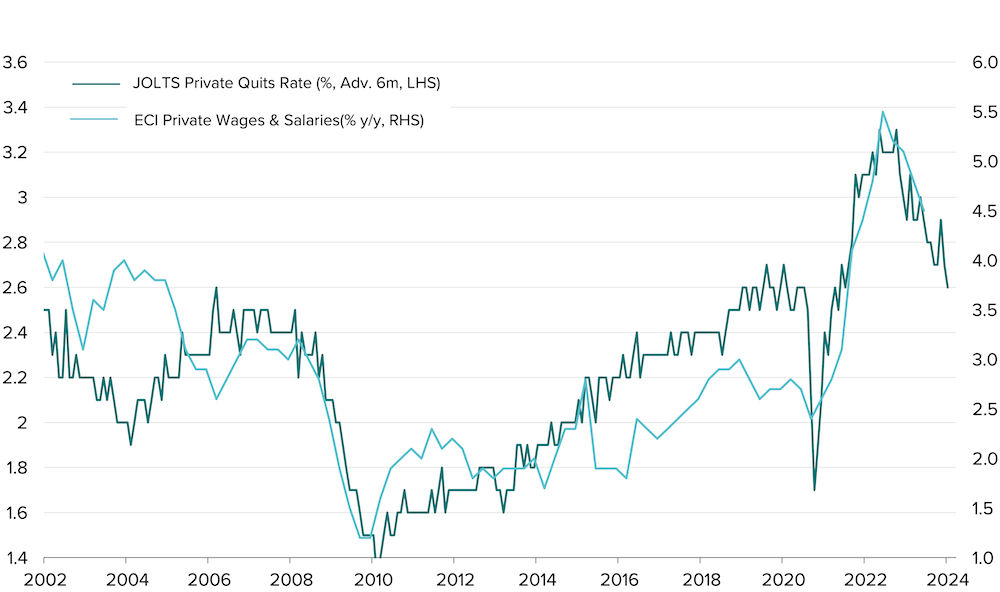

Other measures suggest that the labor market, while softening, remains healthy. The hiring rate, for example, has decelerated considerably—but a longer-term perspective shows that it has merely reverted closer to its historically normal levels (see Exhibit 8). Likewise, wage inflation also continues to normalize following their post-pandemic extremes (see Exhibit 9).

Exhibit 8: Hiring is Slowing – But Isn’t Slow

Exhibit 9: Wage Inflation is Normalizing

The Fed, of course, has made significant progress in its fight against inflation over the past year. Just as important, Americans expect inflation to continue to fall and then stay reasonably well-contained going forward. Example: A survey from the Federal Reserve Bank of New York shows respondents think inflation will stand at 3.7% a year from now and 3.0% in three years.

Given these factors—continued low unemployment, more normalized levels of hiring growth and wage growth, and inflation that’s under control—we believe the Fed sees little need for the type of economic stimulus that rate cuts would aim to generate. Thus, investors have begun to accept that a “higher for longer” rate environment is likely to unfold.

FINANCIAL MARKETS PERSPECTIVE

For investors, the ultimate question is: What do all these developments mean for financial markets in the coming months? The evidence we see suggests the following:

- The backdrop for equities is solid. Today’s combination of interest rates at their current levels, above-trend nominal GDP growth, and disinflation echoes periods such as the mid-1990s and the mid-2000s—both of which saw strong equity market returns (see Exhibit 10).

Exhibit 10: A History of Rates, Inflation and GDP

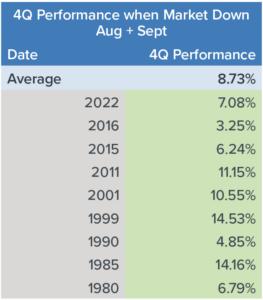

- Seasonal factors may set the stage for gains. Stocks fell in two of the three months during the third quarter—down -1.6% in August and -4.9% in September. It’s worth noting that September is historically the worst month for stocks: The S&P 500 has lost an average of 1.1% in September, dating back to 1928, and has risen less than 45% of the time over that period.

That said, the S&P 500 since 1980 has consistently delivered positive returns in the fourth quarter following those periods when both August and September were negative (see Exhibit 11). The index also tends to see its strongest gains during the fourth quarter—gaining 4.9% on average over the past three decades. (In contrast, third-quarter returns for the S&P 500 averaged just 0.2% over that period.)

Exhibit 11: For Stocks, a Bad August and September Could Mean a Strong Fourth Quarter

- Most stocks have room to run. The so-called Magnificent 7 stocks—Meta, Nvidia, Tesla and other mega-cap tech shares—have accounted for the bulk of the S&P 500’s return this year and make up a large portion of the index. The gap between the return of the average stock in the index (S&P equal-weighted index) and the index itself (S&P 500 Index) is the widest it’s been in approximately 30 years. That means there is an especially large opportunity set of stocks that can grow from current levels.

- There’s a potential for positive earnings surprises. Current corporate earnings growth estimates may be too low because they don’t yet reflect the reduced likelihood of a recession. Therefore, the types of positive earnings surprises we’ve seen throughout 2023 may be set to continue—particularly if strong economic growth (estimated to be 5.1% in the third quarter, according to the Atlanta Fed) acts as a tailwind for earnings.

- “Rate repricing” has largely occurred. We’ve already seen the bulk of any repricing of stocks that occurred because of higher interest rates. Combined with the large increases in longer-term yields not driven by Fed or inflation expectations, this means yields have room to fall without a recalibration of Fed policy. That could potentially put a supportive “floor” under stock prices in the event of signs of economic weakness.

- There are enormous sums of money on the sidelines. Assets in money market funds have hit record highs this year, topping $5 trillion, as interest rates have risen. All that cash “on the sidelines” could spark a stock market rally if positive earnings surprises, continued lower inflation or other economic catalysts prompt investors to put that money to work.

RISKS

As is always the case, some risks could negatively impact these conditions and cause a change in our perspective. Some developments that we are closely watching include:

- Student loan payments. After multiple deferments, student loan payments will restart in October for 28 million borrowers. The average student loan borrower owes around $29,000, with all such debt in the US totaling more than $1.75 trillion. This has some investors worried about the potential impact on consumer spending, which fell significantly in September. One estimate suggests that the disposable income lost due to these loan payments could amount to 0.25% of GDP.

- Auto workers’ strike. As the quarter ended, the United Auto Workers strike was in its third week, and some estimates put the economic damage of the strike at more than $5 billion.

- A gas price spike. Energy goods and services prices shot up by 6.1% in August from July, according to the latest PCE inflation report released just before the end of the quarter. Prices at the pump rose 10.6% from July to August, making gasoline the largest contributor to inflation. Meanwhile, oil prices have marched higher over most of the quarter. If oil and gas prices spike further from here, it could damage consumer spending and corporate profit growth.

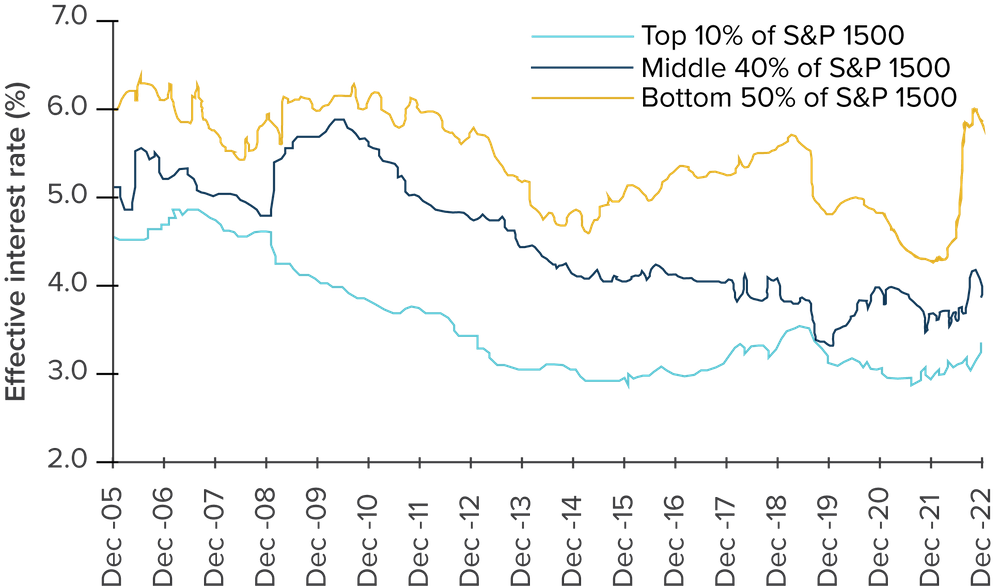

- Impact of higher rates on smaller companies. As noted in Exhibit 12 below, businesses are seeing some of their lowest net interest payments as a percentage of their after-tax profits in decades. But a closer look (see Exhibit 13) reveals that the smallest 50% of those companies are paying significantly higher interest on their debt than their larger peers—at rates close to 6%. That matters because small businesses employ 46% of all U.S. private sector employees. If these firms decide to cut their labor force due to higher costs, it could damage many Americans’ financial health—forcing them to rein in their spending.

Exhibit 12: Smaller Businesses are Paying Higher Interest Rates on Their Debt

The S&P 1500® combines three leading indices, the S&P 500®, the S&P MidCap 400®, and the S&P SmallCap 600®, to cover approximately 90% of U.S. market capitalization. It is not possible to invest directly in an index. Information obtained from third-party sources is believed reliable but has not been vetted by the firm or its personnel.

However, it’s important to note that none of these risks alone appears significant enough to damage the current strength of the economy, the consumer, and corporate America. It would likely take several or all of these risks to occur at once to create a negative impact that would cause alarm.

CONCLUSION

Ultimately, from our perspective, the case for equities going forward is very strong—even in the face of interest rates that are higher than many investors today are used to seeing. In particular, equities’ return potential remains attractive relative to certificates of deposits (CDs) and money market accounts that have caught investors’ attention now that yields have risen along with rates. We believe the returns currently offered by these and other so-called “safe” investments are inadequate for investors looking for the growth necessary to realize their key goals, as well as for those seeking to maintain wealth and purchasing power over the long term.

DISCLOSURE

Global stocks and International Stocks are represented by the MSCI ACWI-ex US Index and the MSCI ACWI Index, respectively.

Past performance is not indicative of future results. The commentary in this report is not a complete analysis of every material fact with respect to any company, industry, or security. The opinions expressed here are not investment recommendations but rather opinions that reflect the judgment of Horizon as of the date of the report and are subject to change without notice. Opinions referenced are as of the date of publication and may not necessarily come to pass. Forward-looking statements cannot be guaranteed.

We do not intend and will not endeavor to provide notice if and when our opinions or actions change. Horizon Investments is not soliciting any action based on this document. This document does not constitute an offer to sell or a solicitation of an offer to buy any security or product and may not be relied upon in connection with the purchase or sale of any security or device. The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money.

The S&P 500 or Standard & Poor’s 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities, and collateralized mortgage-backed securities. The MSCI ACWI Index is designed to represent the performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 24 emerging markets. The Nasdaq 100 Index is a stock index of the 100 largest companies by modified market capitalization trading on Nasdaq exchanges. The S&P Small Cap 600 Index consists of 600 small-cap stocks. A small-cap company is generally defined as a stock with a market capitalization between $300 million and $2 billion. The MSCI ACWI ex-U.S. captures large and mid-cap representation across 22 Developed Markets and 24 Emerging Markets countries and excludes the U.S. The MSCI Japan Index is designed to measure the performance of the large and mid cap segments of the Japanese market. The MSCI Europe Index captures large and mid cap representation across 15 Developed Markets (DM) countries in Europe. The Dow Jones Industrial Average is a stock market index of 30 prominent companies listed on stock exchanges in the United States. References to indices, or other measures of relative market performance over a specified period of time are provided for informational purposes only. Reference to an index does not imply that any account will achieve returns, volatility or other results similar to that index. The composition of an index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Individuals cannot invest directly in any index.

Information has been obtained from sources considered to be reliable, but accuracy and completeness cannot be guaranteed.

Horizon Investments is an investment advisor registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Horizon’s investment advisory services can be found in our Form ADV Part 2, which is available upon request.

Horizon Investments, Gain Protect Spend, and the Horizon H are registered trademarks of Horizon Investments.

© 2023 Horizon Investments, LLC.

NOT A DEPOSIT | NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY