Other market sectors are showing signs of life.

The S&P 500 continued its winning streak in July and is up more than 20% in 2023. That’s the index’s best performance through the first seven months of a calendar year since 1997—and a far cry from its -12.6% return during the first seven months of last year.

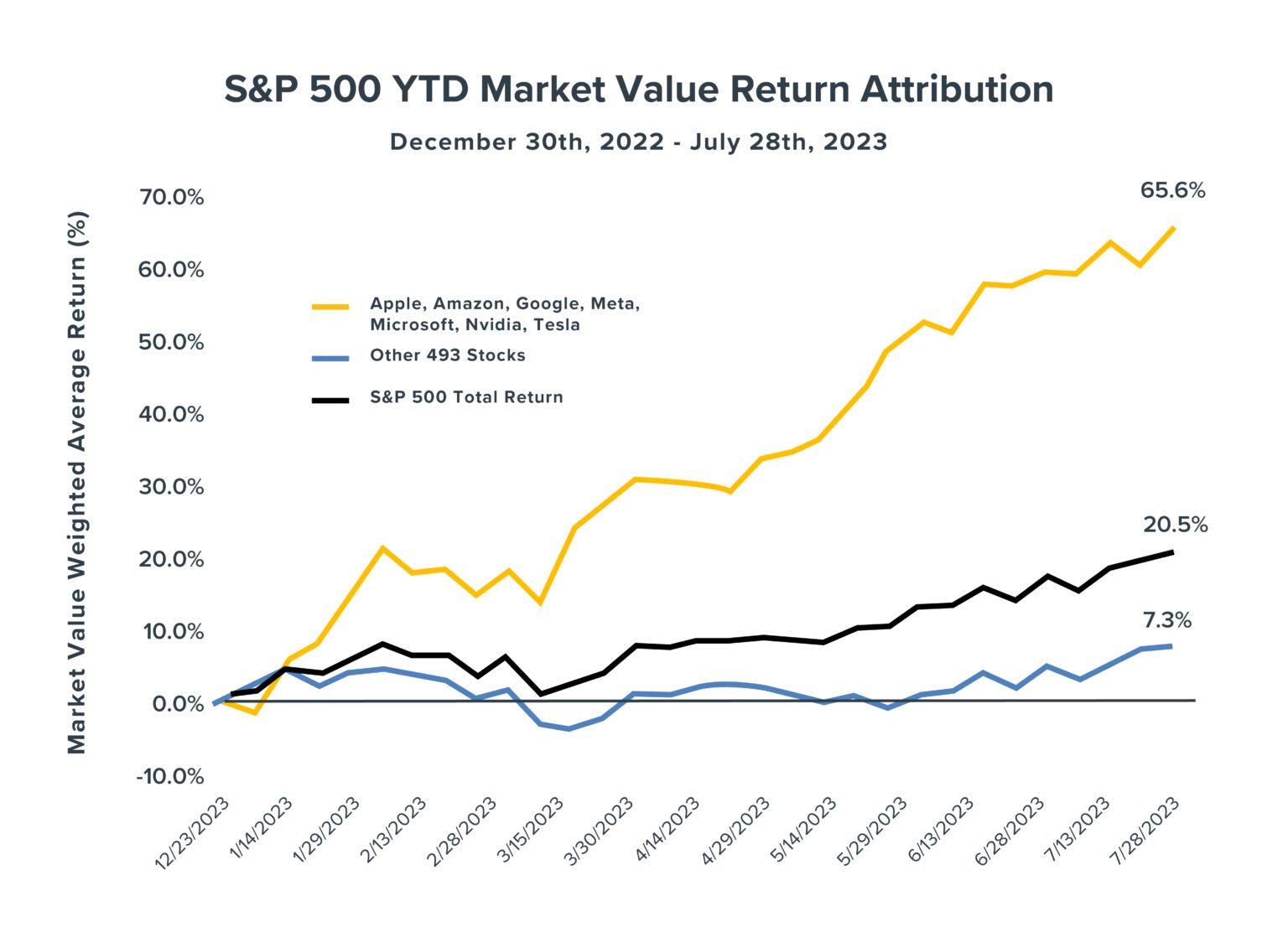

If investors’ excitement about this strong overall showing sometimes seems a bit muted, perhaps blame the S&P 500’s so-called “Magnificent 7” stocks. These 7 names—Tesla, Apple, Nvidia, Microsoft, Amazon, Meta and Alphabet—have soared by a whopping 62.9% as a group so far this year, leaving the vast majority of their index brothers and sisters in the dust (see the chart).

Indeed, the remaining 493 stocks in the S&P 500 have gained a mere 7.3% as a group, year-to-date. That means:

- The Magnificent 7 together have gained more than three times the market as a whole, and more than 8.5 times the other 493 stocks.

- Those 7 stocks account for $4.5 trillion (or nearly 70%) of the S&P 500’s $6.5 trillion in market growth so far this year.

But before you build a portfolio of nothing but a handful of stocks, consider this: The highly concentrated, 10-stock NYSE FANG+ Index (which includes the 7 companies above) only recently regained its high point from all the way back in November 2021. From November 2021 until November 2022, the index plummeted 49%—something to weigh if you’re salivating over the Magnificent 7’s returns this year. In contrast, the S&P 500 lost far less (-20%) during that time period.

What’s more, there are signs that the rest of the S&P 500 is waking up and getting in the game. Example: Nearly all of that 7.3% year-to-date return from the other 493 stocks has occurred since the end of May—and we’re seeing strong relative returns from sectors such as financials, energy, and retail.

The upshot: While the Magnificent 7 can’t be ignored, it may be a good idea to consider looking at the rest of the market.

Disclosures

This commentary is written by Horizon Investments’ asset management team.

Past performance is not indicative of future results.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments.

The S&P 500 or Standard & Poor’s 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The NYSE FANG+ Index is an equal-dollar weighted index designed to represent a segment of the technology and consumer discretionary sectors consisting of highly-traded growth stocks of technology and tech-enabled companies such as Facebook, Apple, Amazon, Netflix, and Alphabet’s Google. Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. An index’s composition may not reflect how a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Individuals cannot invest directly in any index. Indices are unmanaged and do not have fees or expense charges, which would lower returns.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money.

Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves risk of loss, and in periods of market growth, risk mitigation strategies can be expected to lag in performance behind equity strategies that do not focus on risk mitigation.

This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2023 Horizon Investments LLC