The positive surprises in the labor market just keep on coming.

Job creation in the U.S. continues to defy expectations.

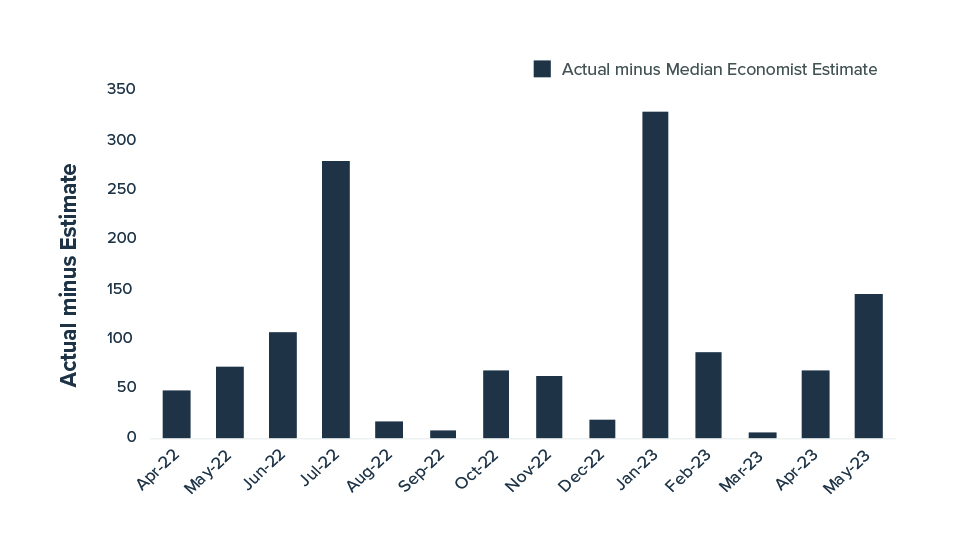

Case in point: last week’s blowout jobs report for May. The chart shows that actual jobs created (non-farm payrolls) have now outpaced economists’ estimates for 14 straight months. That handily beats the previous streak of just five months.

U.S. Non-Farm Payroll

Other noteworthy takeaways on the jobs front:

- Last month’s growth was widespread—with most industries (including health care, hospitality, and construction) adding jobs.

- The workforce’s share of people aged 25-54 has risen to its highest level since 2007.

- The U.S. economy hasn’t experienced a month of job losses since December 2020.

Our view for some time has been that the strength of the consumer—remember that consumer spending represents two-thirds of U.S. economic activity—would largely outweigh both negative economic data elsewhere and the pessimistic tone of media reports about the economy.

That view is being supported by this trend of stronger-than-anticipated job growth, as well as other developments. We believe it supports the case for holding equities and higher-yielding fixed-income securities rather than moving to cash. For example, in our view, the market rally in response to last week’s jobs report suggests that investors are increasingly viewing strong growth positively—rather than as a bad omen of more Fed rate hikes and higher interest rates.

Disclosures

This commentary is written by Horizon Investments’ asset management team.

Past performance is not indicative of future results.

The investment strategy or strategies discussed may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives and financial circumstances. There are advantages and risks to both strategic and active allocation approaches. All investing involves risk.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money.

Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves risk of loss, and in periods of market growth, risk mitigation strategies can be expected to lag in performance behind equity strategies that do not focus on risk mitigation.

This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed.

Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. An index’s composition may not reflect how a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Individuals cannot invest directly in any index.