Is the fast-moving market moving too fast?

Technology stocks generally hate higher interest rates. Tech companies often need ongoing access to lots of capital to fund their operations—and higher rates mean higher borrowing costs for those businesses, of course.

Then there’s the oft-repeated advice that investors shouldn’t “fight the Fed”—meaning the time to pile into risk assets isn’t when the Fed tightens monetary policy.

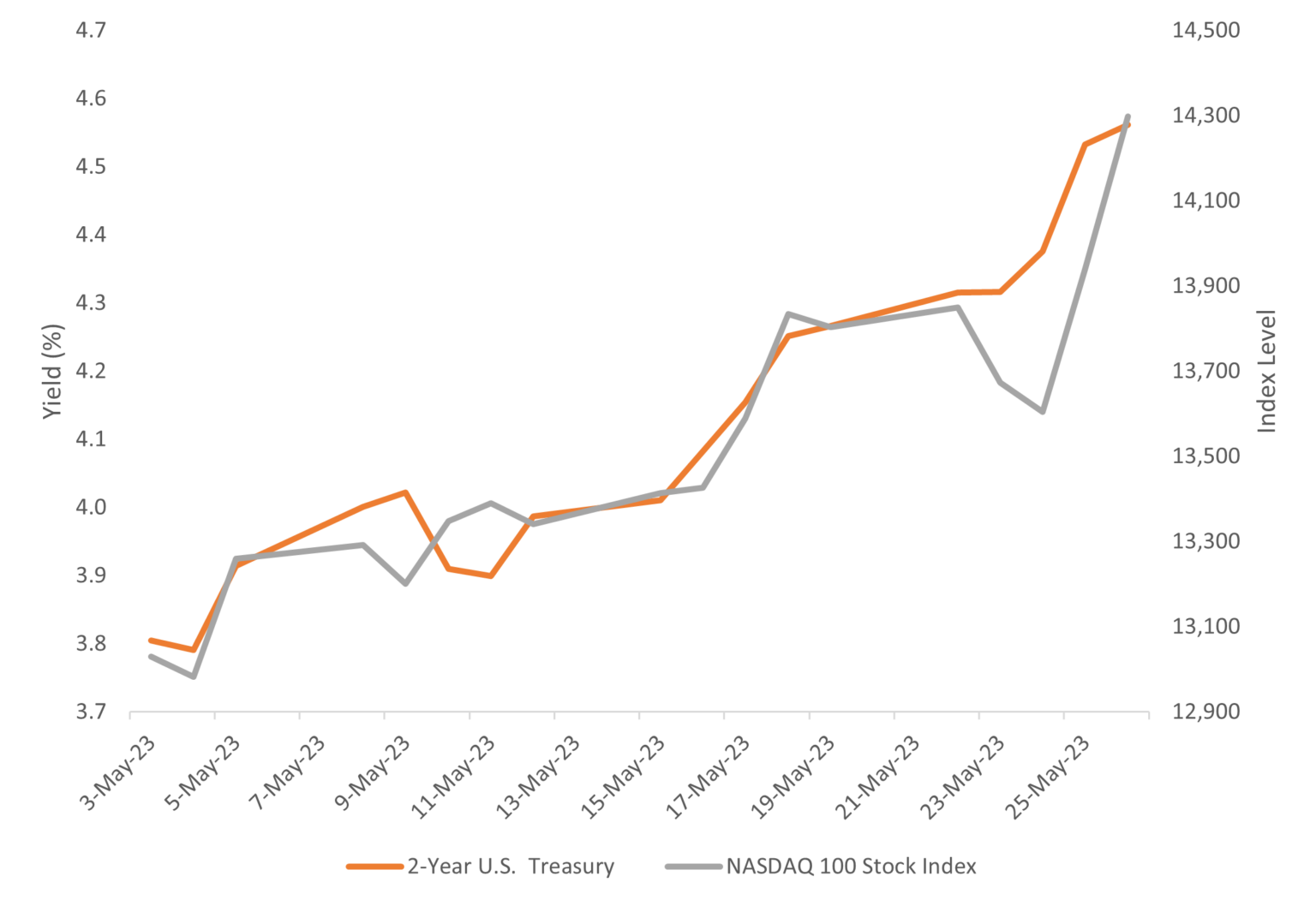

So how to explain the Nasdaq 100 Index’s 9.7% gain since the Fed’s last meeting in early May (see the chart) when Chair Powell and company once again hiked the federal funds rate—a period that’s seen the yield on the 2-year Treasury note subsequently rise by 76 basis points?

Start with rates. Hotter-than-expected inflation data of late has pushed rates higher in recent weeks. Oddly, so has a more positive development: stability in the banking sector. The lack of further bank failures putting downward pressure on growth means the job of cooling the economy once again falls primarily on the Fed’s shoulders. And indeed, messaging from the Fed on interest rates has taken on a more hawkish tone.

Meanwhile, the artificial intelligence (AI) craze has investors pouring into tech stocks in hopes of capitalizing on this fast-paced trend. Case in point: Nvidia, whose chips are used in AI programs, saw its stock rocket 24% higher in a single day last week and currently has a market cap of more than $1 trillion.

Horizon’s portfolios have adjusted according to our current market views. That said, the dizzying speed of the tech sector’s recent ascent—and the narrowness of the current market—merits some caution in our view. Consider, for example:

- Nvidia’s performance alone represents 26% of the Nasdaq 100’s total return in May—and 78% of the S&P 500’s 1.0% return over the month.

- Just six stocks in the Nasdaq 100 (Nvidia, Microsoft, Alphabet (Google), Amazon, Apple, and Tesla) account for 79% of the index’s recent gains.

Healthy markets experiencing growth tend not to be as concentrated as this. Moreover, stocks ignored higher rates and moved higher back in February, only to reverse course in March.

The upshot: It’s possible that higher rates may eventually put the brakes on the recent intense-yet-narrow rally. We will look for signs that major market indices may have come too far or fast.

Disclosures

This commentary is written by Horizon Investments’ asset management team.

Past performance is not indicative of future results.

The Dow Jones U.S. Select Dividend Index represents the U.S.’s leading stocks by dividend yield. The Nasdaq 100 Index represents 100-plus of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

The investment strategy or strategies discussed may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives and financial circumstances. There are advantages and risks to both strategic and active allocation approaches. All investing involves risk.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money.

Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves risk of loss, and in periods of market growth, risk mitigation strategies can be expected to lag in performance behind equity strategies that do not focus on risk mitigation.

This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed.

Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. An index’s composition may not reflect how a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Individuals cannot invest directly in any index.