We all know that last week’s inflation report showed headline inflation continues to surge, with the consumer price index (CPI) accelerating by 8.2% in September from a year earlier.

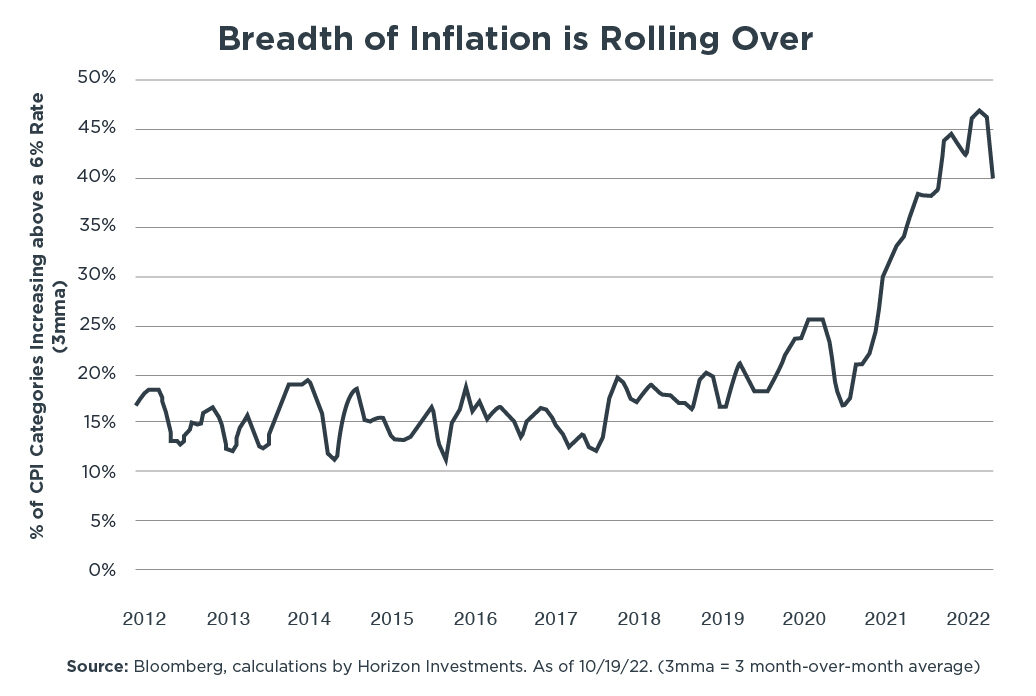

But a closer look at the CPI reveals an encouraging development that most investors have overlooked: The breadth of inflation is showing signs of contracting. The Horizon Inflation Breadth Measure has fallen from its peak of 47% in July to 40% in September. and currently sits at its lowest level since January (see the chart below).

Here’s what that means. Our Inflation Breadth Measure looks at all categories that make up at least 0.25% of the Consumer Price Index (CPI), sums how many of those are rising at an annualized pace of greater than 6%, and averages the results over 3 months to reduce month-to-month “noise.”

The upshot: Prices are either decreasing or increasing at a slower rate in many of the categories that make up the headline inflation numbers investors read about each month. That means lower inflation may be starting to work its way through the system.

In general, the areas seeing price declines are known as flexible price categories. They tend to adjust fastest—many of them led the way when inflation began to rise—and, therefore, may be leading indicators of where prices generally are headed.

Of course, it’s clear that overall inflation is still stuck at historically high levels. Despite these initial signs of hope, it’s far too early to expect the Fed to pivot and take its foot off the brake.

In that environment, investors remain vulnerable to shocks and the risk of further market volatility—especially if the Fed feels compelled to raise rates higher than investors anticipate. Given the continued uncertainty the markets are facing, a risk-mitigation strategy such as Risk Assist® can potentially be highly beneficial in the coming months.

Disclosure

This commentary is written by Horizon Investments’ asset management team.

The Risk Assist® algorithm uses a disciplined, automated process to dynamically “de-risk” a portfolio during times of severe market stress. In doing so, it seeks to curb the behavioral investing impulses that can derail financial plans. Risk Assist® is also designed to address the question of when to “re-invest” the portfolio. As market conditions improve, the strategy is restored to its intended portfolio mix using the same disciplined and automated process, with the aim of keeping clients on track to achieve their goals. Risk Assist® is NOT A GUARANTEE against loss or declines in the value of a portfolio; it is an investment strategy that supplements a more traditional strategy by periodically modifying exposure to fixed-income securities based on Horizon’s view of market conditions. While Risk Assist was designed with the goal of limiting drawdown, Horizon is not able to predict all market conditions and ensure that Risk Assist will always limit drawdown as designed. Accounts with Risk Assist® are not fully protected against all losses. Furthermore, when Risk Assist® is deployed (whether partially or entirely) to mitigate risk for an account, the account will not be fully invested in its original strategy, and accordingly, during periods of strong market growth, the account may underperform accounts that do not have the Risk Assist® feature. Clients may lose money.

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed.

Other disclosure information is available at hinubrand.wpengine.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2022 Horizon Investments LLC